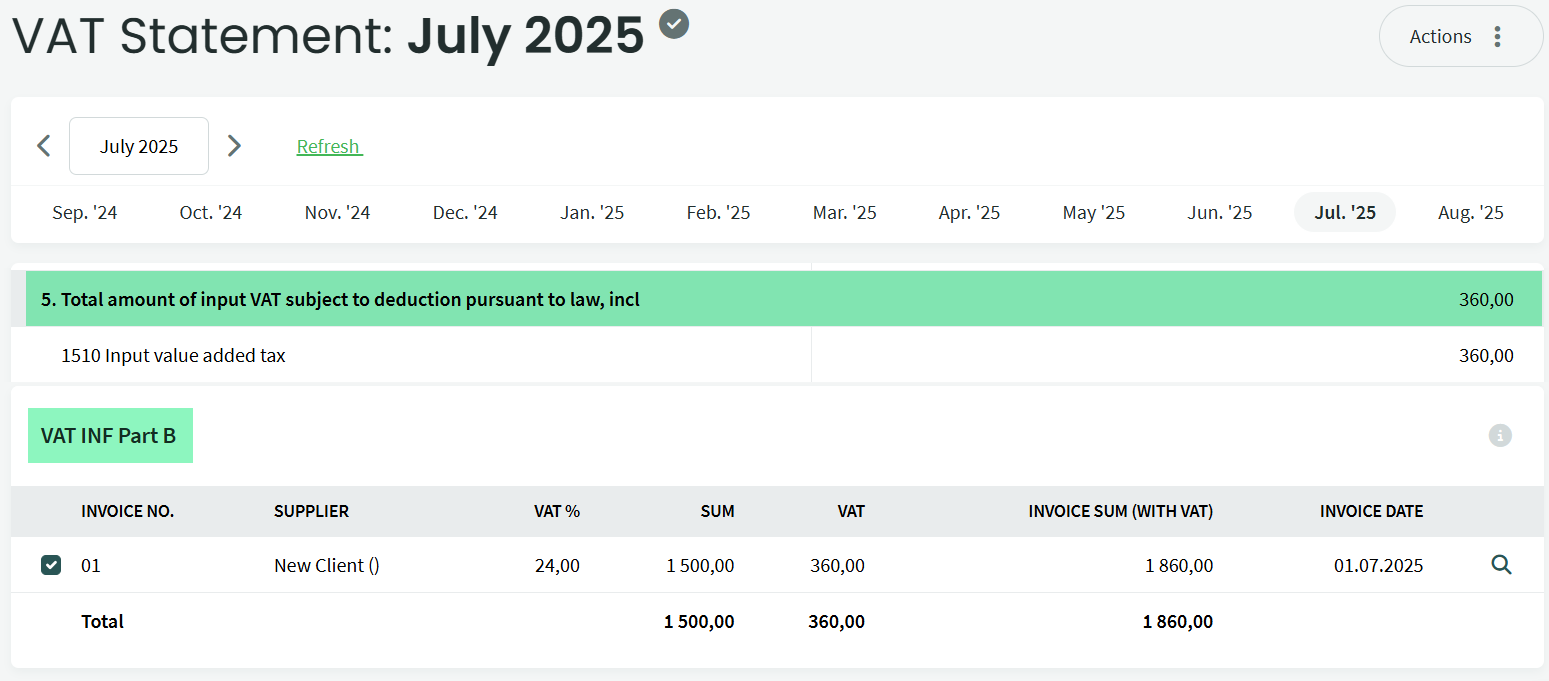

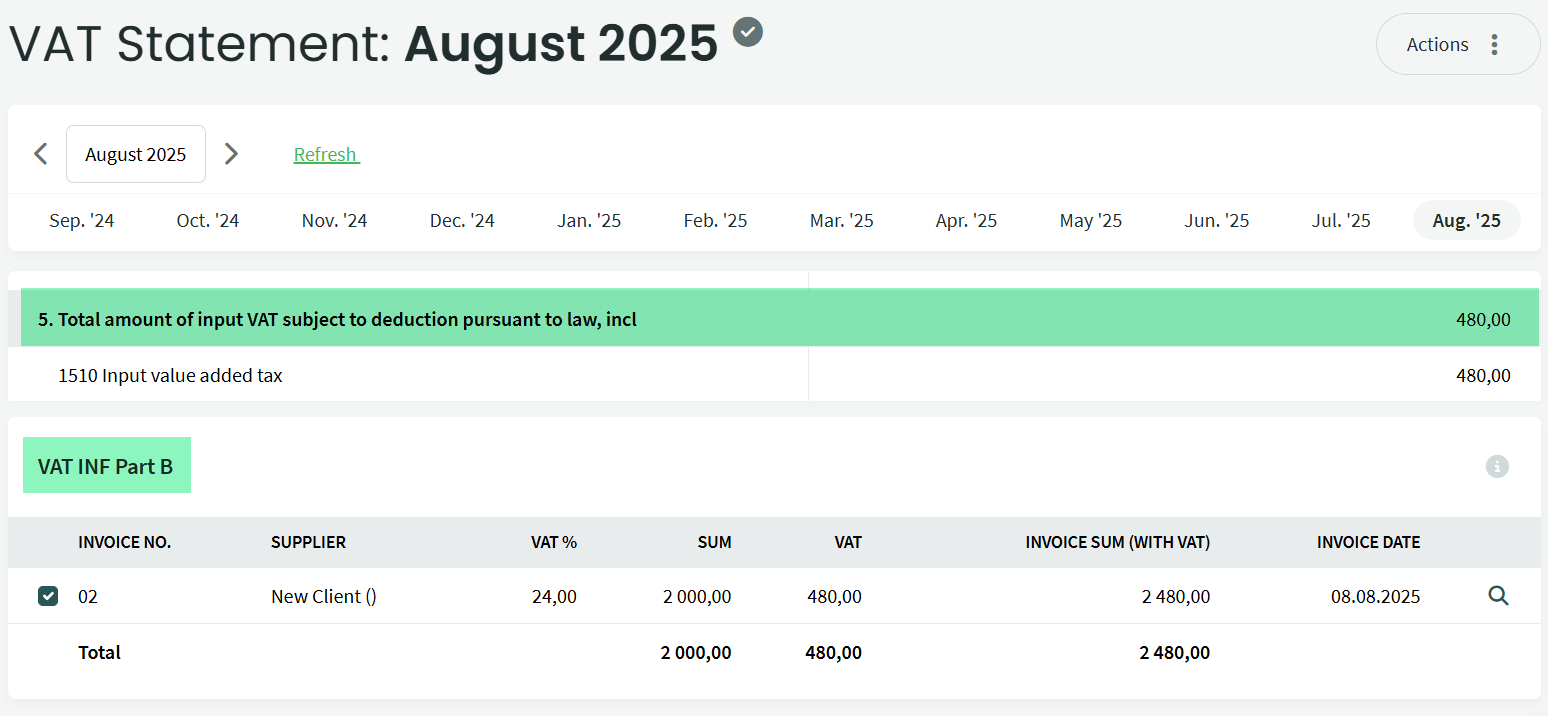

A prepayment invoice has been received from the supplier and paid immediately. The goods or services will be received in the following month. Both parties are VAT-registered, and the input VAT is claimed back in the month the prepayment is made. If the net amount is 1000 euros or more, it must be declared in Annex B of the VAT statement (KMD INF B).

Numbers used in the example (VAT 24%):

Total value of goods: 3500 euros + value added tax 840 euros = 4340 euros

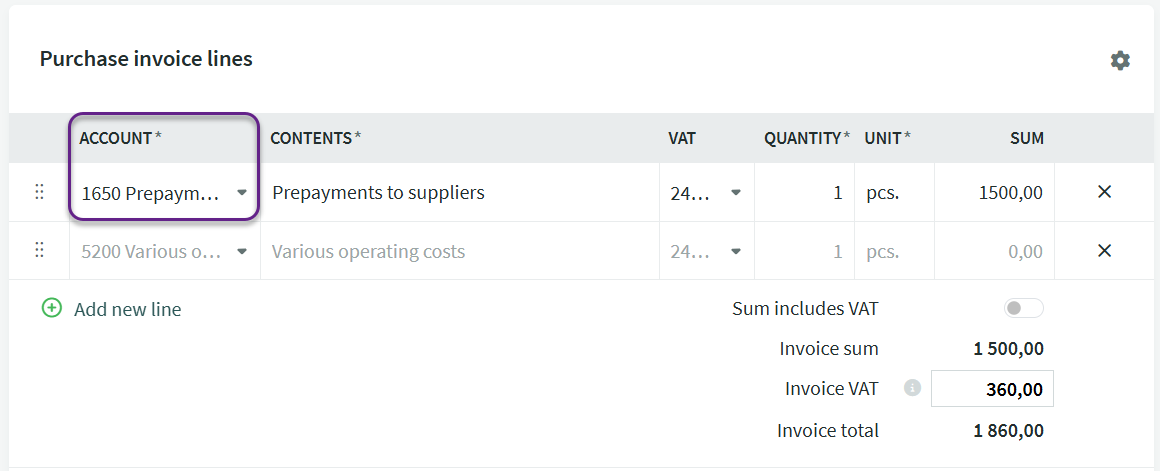

Prepayment: 1500 euros + value added tax 360 euros= 1860 euros (invoice received and paid in July)

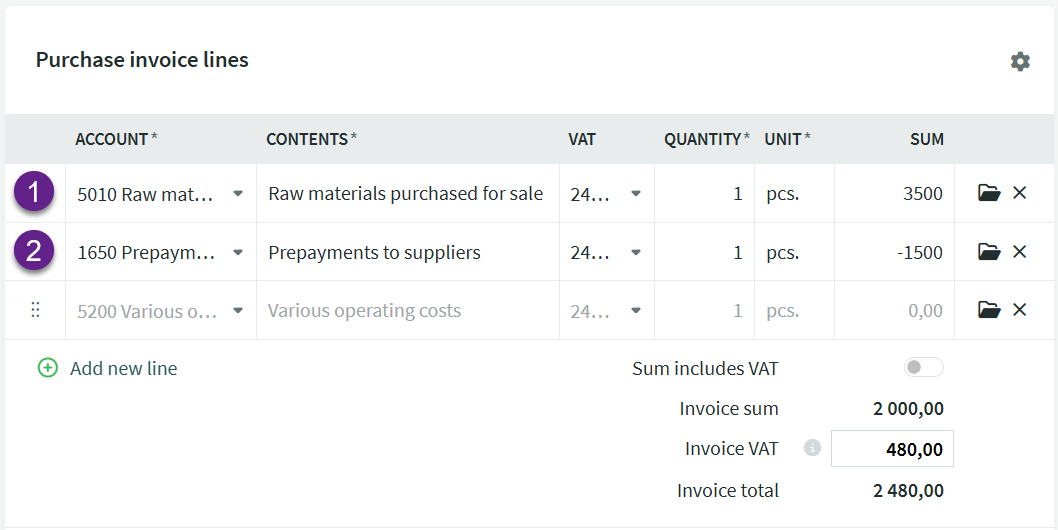

Final invoice: 3500 euros (on the expense line), prepayment 1500 euros (as a negative). The invoice shows value added tax in the amount of 480 euros (goods and invoice received in August).

The result must be that the total input VAT reclaimed from the two purchase invoices (prepayment invoice + final invoice) equals the total VAT calculated from the total amount, i.e., 360+480=840 euros.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?