For an employee with reduced work capacity, a social tax discount may be applied if the employee submits the relevant document for verification and the employer has submitted the corresponding application to the Estonian Unemployment Insurance Fund.

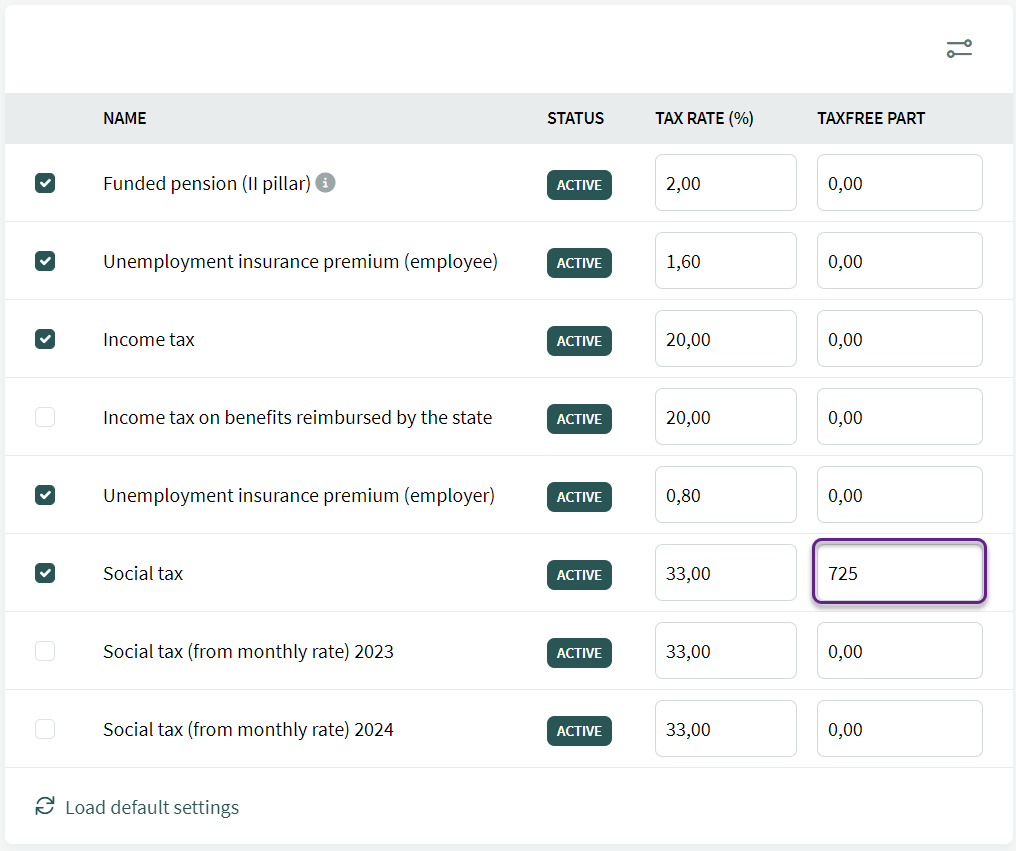

To ensure this functions correctly in payroll, the taxes applicable on the employee card must be adjusted accordingly.

In the “Social tax” row, enter the amount in the taxfree part field that will reduce the basis for calculating the social tax.

In 2024, the applicable base rate is 725 euros, and the employer will pay social tax on amounts exceeding this threshold.

Therefore, “725” should be entered in the “taxfree part” field.

In 2025, the applicable base rate is 820 euros, and the employer will pay social tax on amounts exceeding this threshold.

Therefore, “820” should be entered in the “taxfree part” field.

This setting can be changed or removed as needed during salary calculation—if done, the modification will apply to that specific salary only.

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?