When implementing SimplBooks accounting software, initial balances must be entered for both a starting company and an existing company. Until at least one account has an initial balance entered, no entries can be made. If the initial balances are unknown or all are zero for any other reason, at least one account must still have an initial balance entered, with the amount marked as zero.

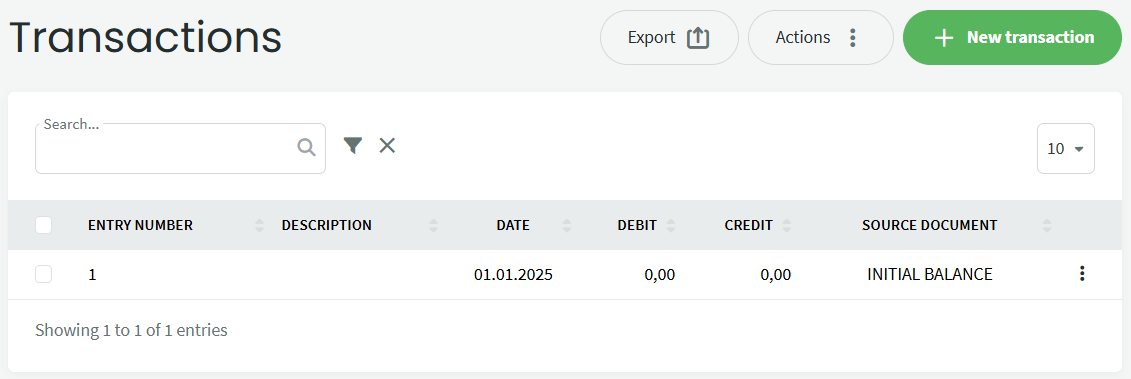

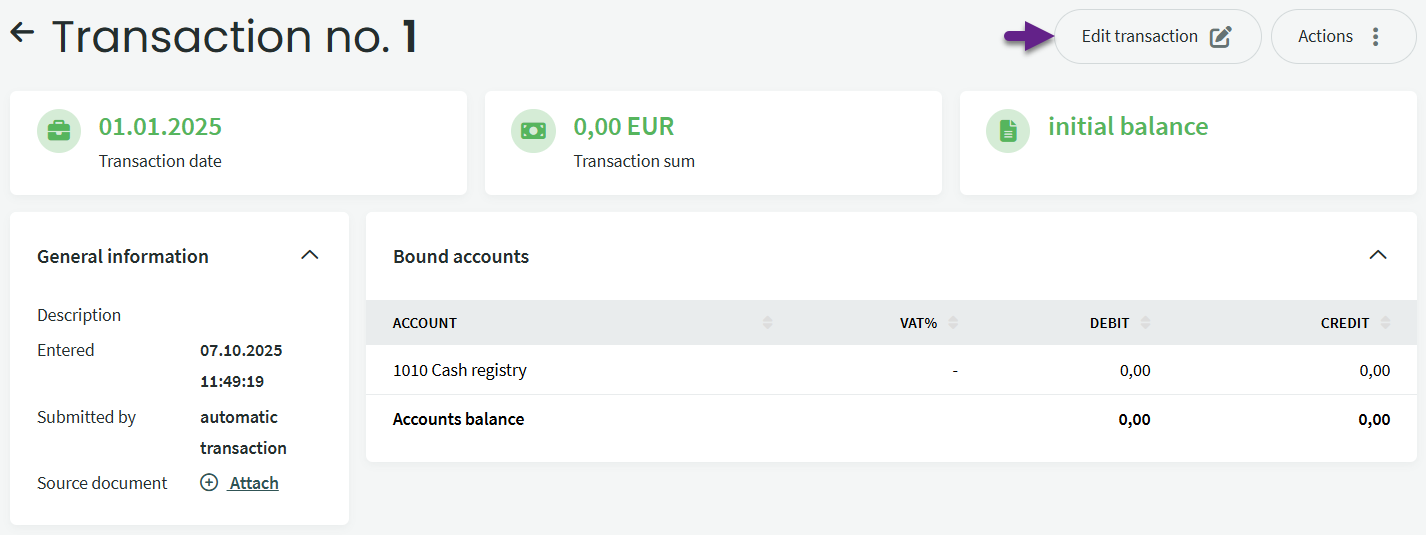

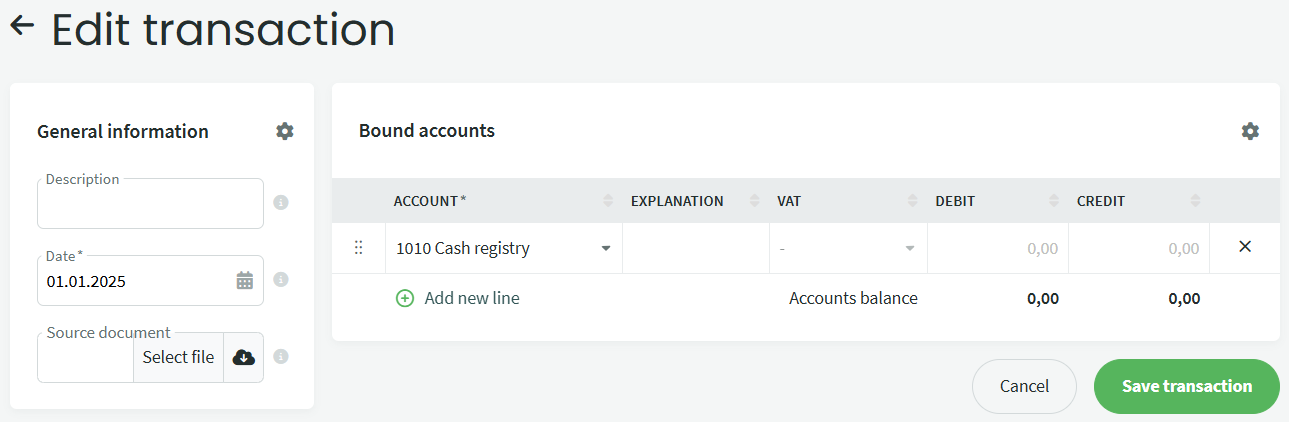

1 When creating a company in the SimplBooks environment, the system automatically adds an initial balance transaction. You can find this entry under Accounting -> Transactions, where the “Source document” column will display “INITIAL BALANCE”. 2 Click on the transaction line, and in the opened view, select “Edit transaction“. 3 For a starting company, the initial balance date is the company’s establishment date. Filling out the description field is not mandatory, but it is recommended to write “initial balance xx.xx.202x” there. 4 For a starting company, the default line (1010 Cash registry) is sufficient and nothing more needs to be added. It is enough to save the transaction (the share capital contribution is not part of the initial balance, it can be added as the next if needed).If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?