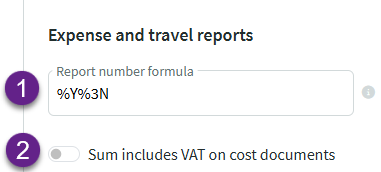

Settings -> Environment settings -> Expense and travel reports settings

● General settings – number formula, amounts with or without VAT- The set up of the expense report number formula works the same way as the

- By default, expense document lines are entered without VAT. If necessary, you can set the default so that the amounts are entered including VAT and the system will automatically calculate the amounts excluding VAT and the VAT amount.

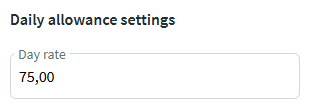

The daily rate is used by default as the . Here you can set which daily rate is primarily used in the company for calculating the daily allowance.

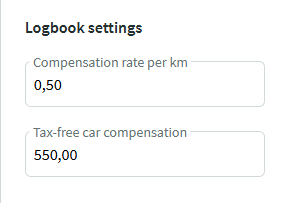

● LogbookAccording to the , you can receive up to 550 euros per month tax-free, with a rate of 0,50 euros per kilometer.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?