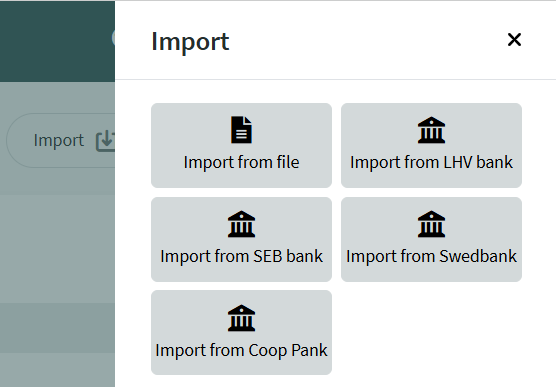

Bank transactions can be imported into SimplBooks in three ways:

SimplBooks includes the option to create an integration with four Estonian banks: Swedbank, SEB Pank, LHV Pank and Coop Pank.

If the bank integration is activated, the system will automatically import the previous day’s bank transactions into the software during the night. If you have enabled automatic transaction processing in the environment settingspoint 9 of the guide, the system will immediately save all transactions for which correct matches are found and will delete any duplicates. Duplicates may occur in situations where you imported transactions from a file on the previous day. In such cases, the automatic bank import will detect the transaction as a duplicate and will not allow it to be saved again.

If necessary, it is also possible to import transactions from earlier periods through the integration, but transactions from the current day cannot be imported.

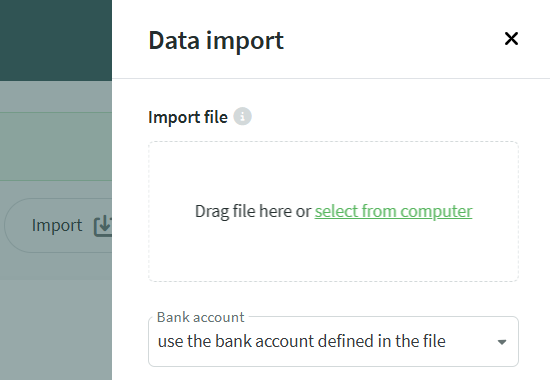

It should be possible to download a bank statement in XML format from all Estonian banks, which can then be imported into SimplBooks. Export the file from the bank for the appropriate period. Please ensure that the file type is XML or ISO XML (the exact wording may vary depending on the bank).

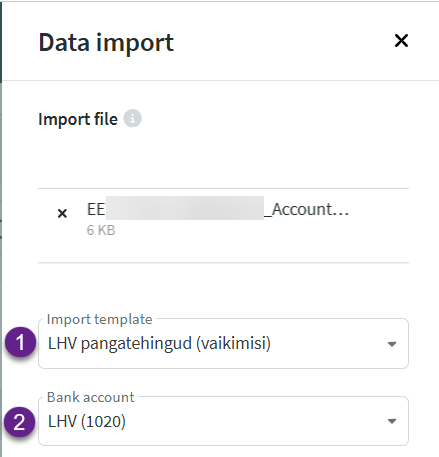

When saving a bank statement in CSV format, you need to map the data fields during import to ensure the information is transferred correctly into SimplBooks. To simplify the process, you can use an import template. In the default settings, import templates are available for SEB, Swedbank, LHV and Wise.

If the transactions have been imported via the integration or from a file, but no suitable match is found automatically, they will remain pending. This means that the transactions do exist in the system, but they have not yet been saved and are not reflected in the accounting data. Regardless of which navigation path you use to access the transactions view, you will always see the same pending transactions.

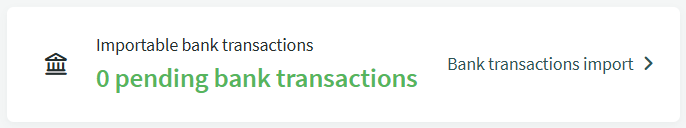

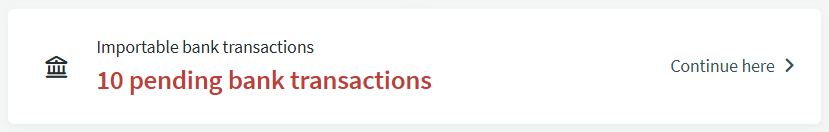

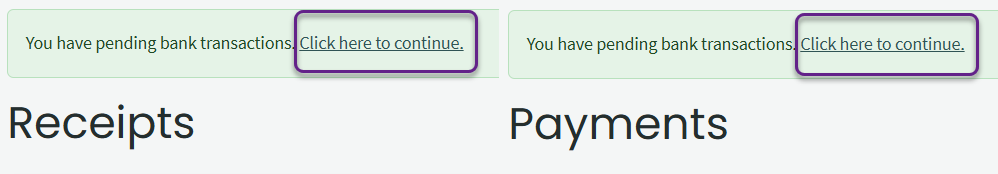

● On the company overview page, there is a panel titled “Importable bank transactions” which displays the number of unprocessed transactions. By clicking “Continue here”, you will be taken to the transaction processing view. ● If you open the Receipts or Payments view from the Operations menu, a notification about pending bank transactions will appear above the list on a green background. The same area also includes a link that will take you to the transaction processing view.You can start importing bank transactions from the company overview page by clicking the “Bank transactions import” link in the “Importable bank transactions” panel.

Alternatively, you can open the Receipts or Payments view from the Operation menu and click “Import”.

When importing from a file, there is no period restriction (the period must be set in the bank). However, when importing directly from the bank, transactions from the current day cannot be imported.

When importing from a file, there is no period restriction (the period must be set in the bank). However, when importing directly from the bank, transactions from the current day cannot be imported.

If you want to import transactions from before the bank integration was activated, note that banks have different limitations on how far back they allow transactions to be imported via the integration.

If no import template has been added, you will be prompted to map the fields in the next view.

What do the statuses on bank transaction rows mean?

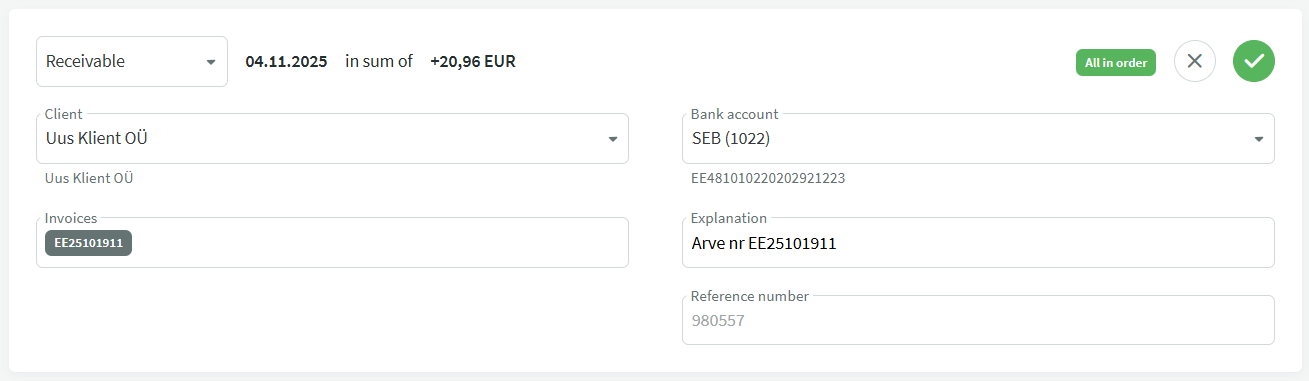

- All in order (green) – a suitable match has been found for the transaction and it is ready to be saved.

- Duplicate (gray) – the transaction has already been saved and cannot be saved again.

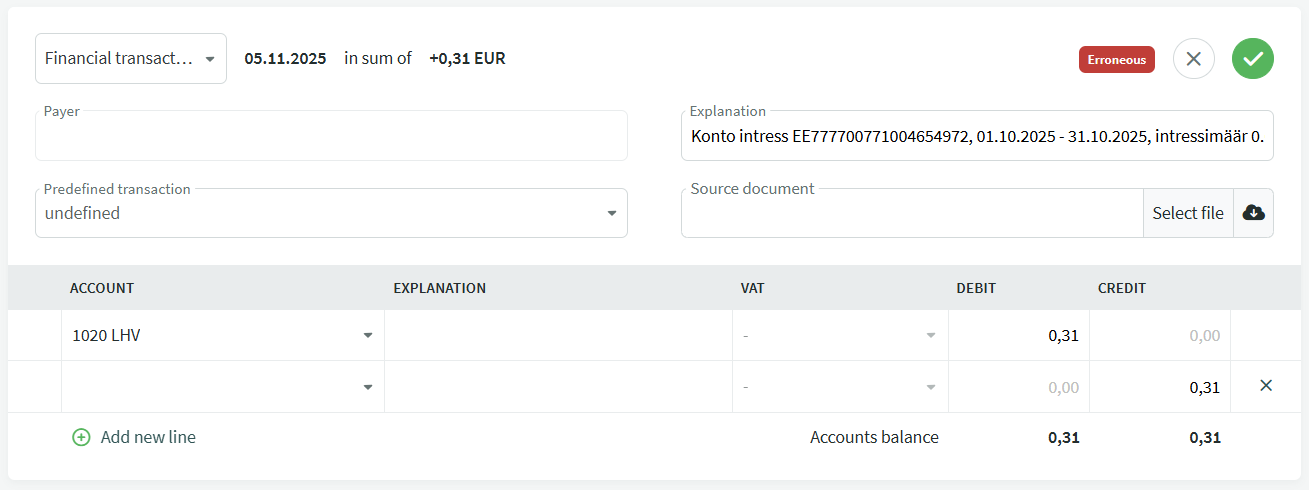

- Erroneous (red) – the transaction row requires additional information. Missing details may include client or supplier information (for receipts or payments) or an account (if the transaction is to be saved as a financial entry).

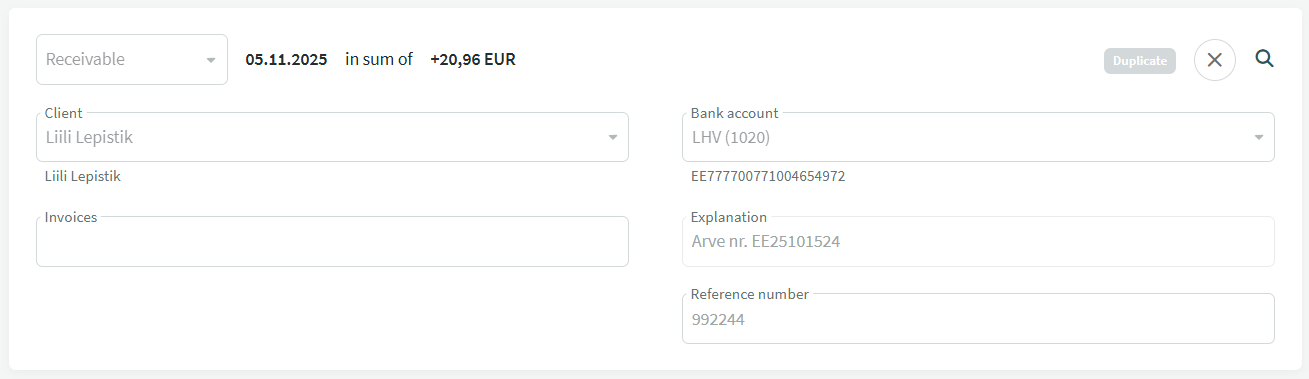

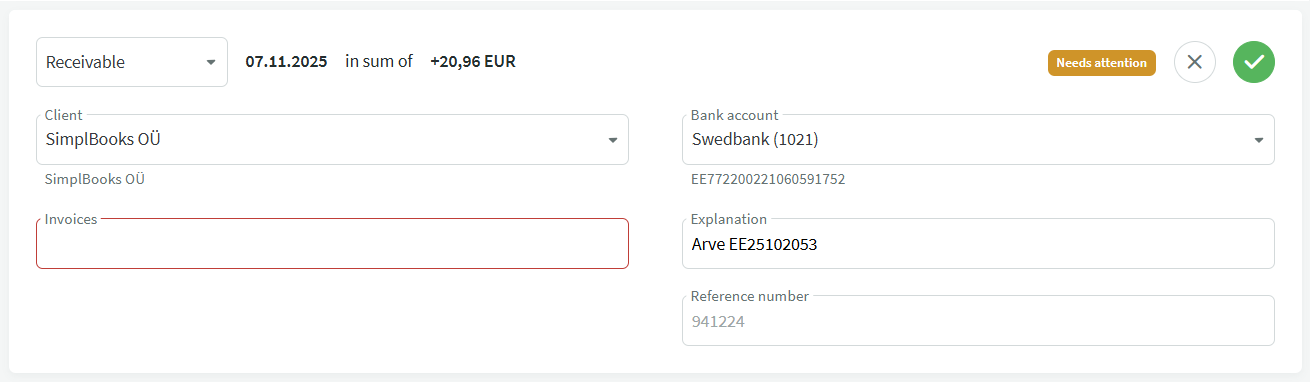

- Needs attention (orange) – the system found a match with a client or supplier, but not with a specific invoice. The payment or receipt can still be saved and the amount will be reflected not only in the bank account movements but also on the prepayment account.

If automatic bank transaction processing is enabled in the environment settingsguide point 9, transactions with the statuses “All in order” and “Duplicate” will not be shown under pending transactions.

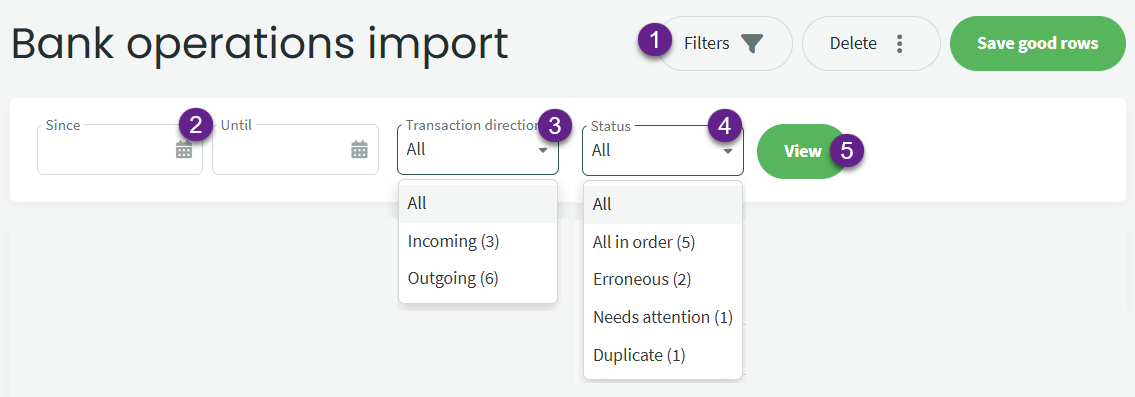

- The Filters button allows you to display transactions based on selected criteria.

- Date range – by filling in both fields, you can define an exact period for displaying transactions.

If you fill in only the “Since” field, transactions from that date onward will be displayed.

If you fill in only the “Until” field, transactions up to and including that date will be displayed. - Transaction direction – incoming or outgoing transactions.

- Status – allows you to display transactions with all statuses or narrow the view to a specific status.

- The View button applies the selected filters and displays the transactions match the chosen criteria.

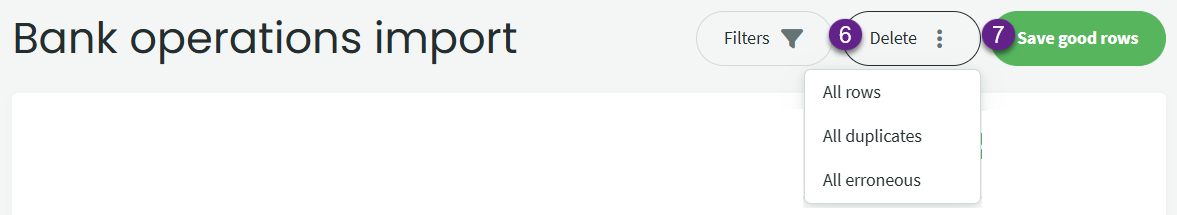

6. The Delete button allows you to select which transactions you want to delete. When deleting, the system does not consider active filters.

Example: if you have added a filter to display only outgoing transactions and select “All erroneous” for deletion, all invalid transactions will be deleted – including incoming transactions.

7. Save good rows – this command allows you to save all reviewed correct transactions at once, without having to save each one individually.

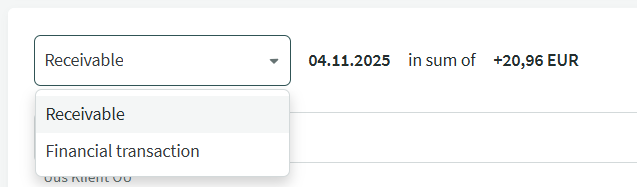

Receipts can be saved as either receipts or financial transactions. The transaction type is displayed in the upper-left corner of the bank transaction, next to the date and amount. If necessary, the type can be changed by clicking on it.

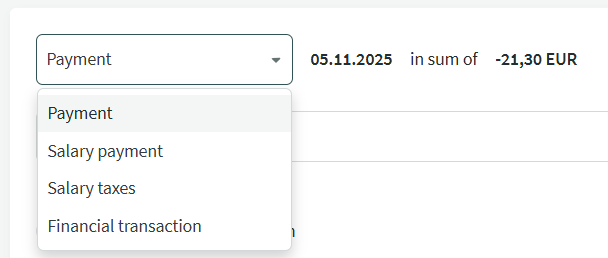

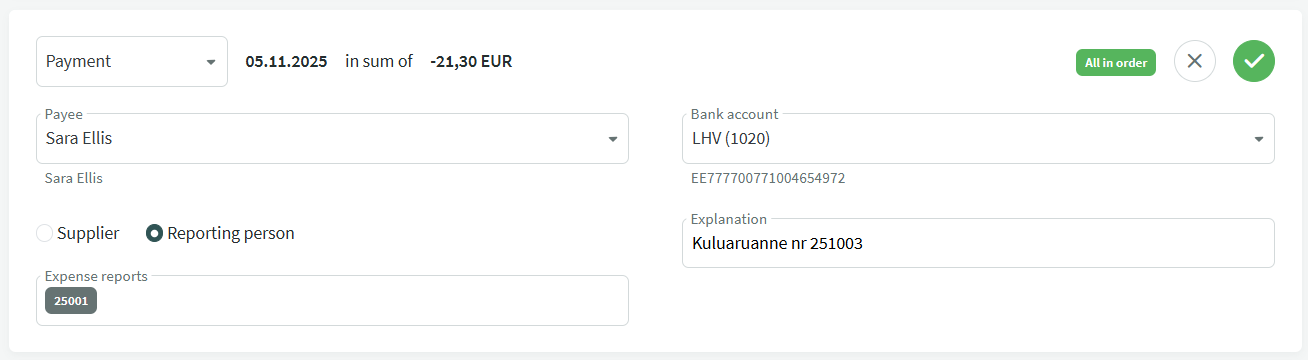

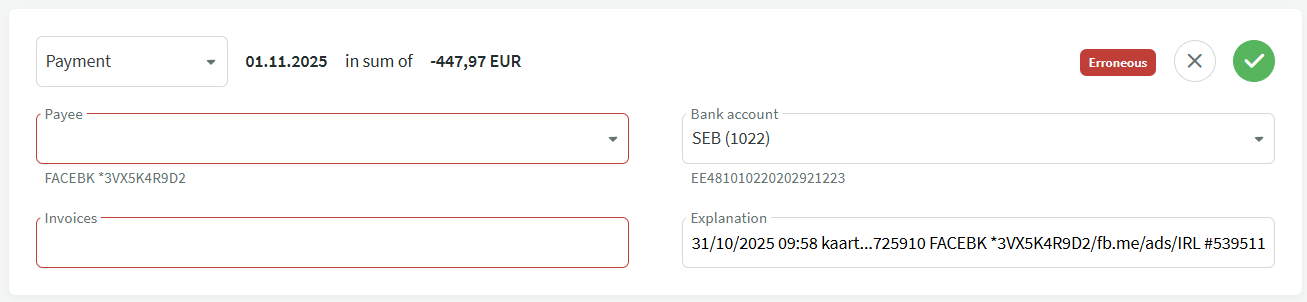

All in order A match has been found with both the client and the invoice. The transaction is correct and can be saved by clicking the green button in the upper-right corner. Erroneous The transaction needs to be saved as a financial transaction. The type is correct, but an account must be assigned to save the transaction. Specify a suitable (income) account and save the transaction. Duplicate This receipt has already been saved and cannot be saved again. Delete the transaction by clicking the cross. You can view the saved receipt by clicking the magnifying glass icon. Needs attention A match with the client has been found, but not with an invoice. The client may have made a duplicate payment by mistake. The transaction can still be saved – it will be recorded in the sales ledger as a prepayment and can later be linked to the next invoice for the same client.Outgoing payments can be saved as payments, salary payments, salary taxes or financial transactions. The transaction type is displayed in the upper-left corner of the bank transaction, next to the date and amount. If necessary, the type can be changed by clicking on it.

PaymentPayment to a reporting person: In this example, the payment is made based on an expense report. The expense report must be added beforehand, and during the bank import it will be linked to the payment automatically.

Card payment transaction: The system does not always find enough information in the description field to determine the correct supplier. The supplier must be selected manually by clicking the “Payee” field and starting to type the name. The invoice must also be selected by clicking the “Invoices” field.

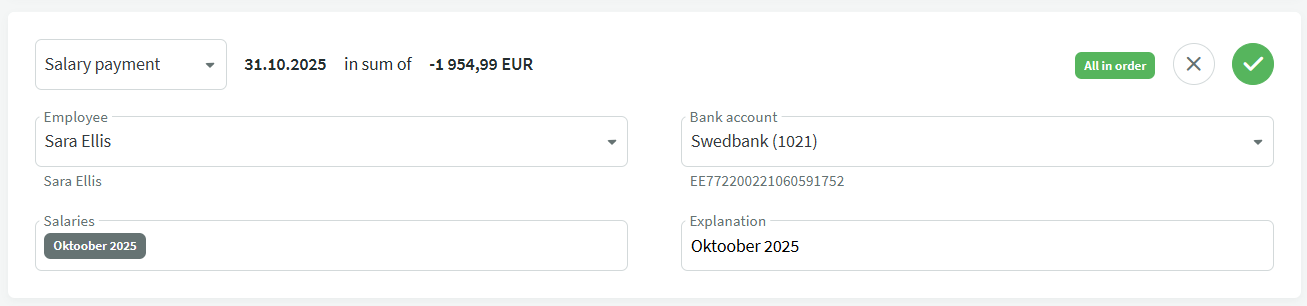

Salary paymentThe salary calculation must be added beforehand. In this case, the system will automatically find the match and mark the salary as paid.

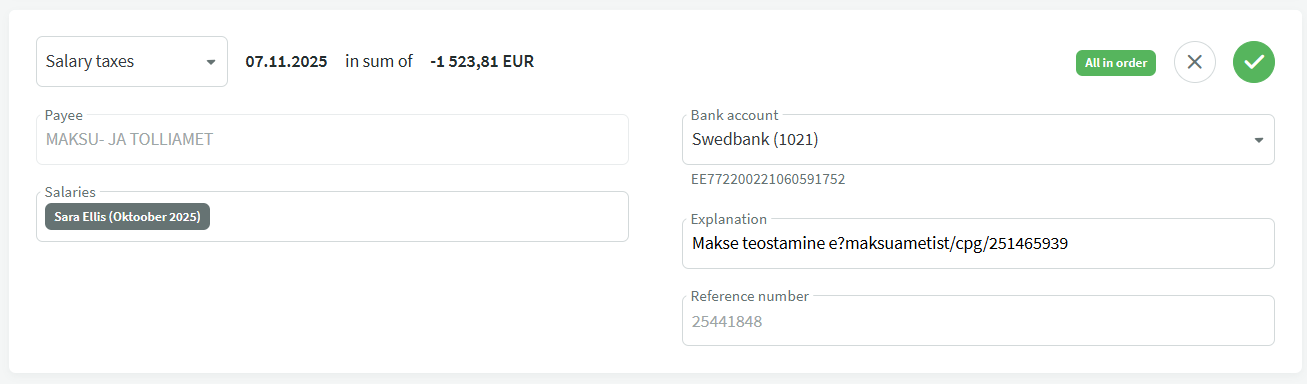

Salary taxesTransfer to the Tax and Customs Board for salary taxes: Select “Salary taxes” as the transaction type.

If the transferred amount also includes other taxes (e.g. income tax on interest, income tax on dividends, etc.), the transaction can still be saved as related to salary taxes.

The transaction will be recorded on the tax prepayment account (1520) and the entry for settling the tax liability will be created separately.

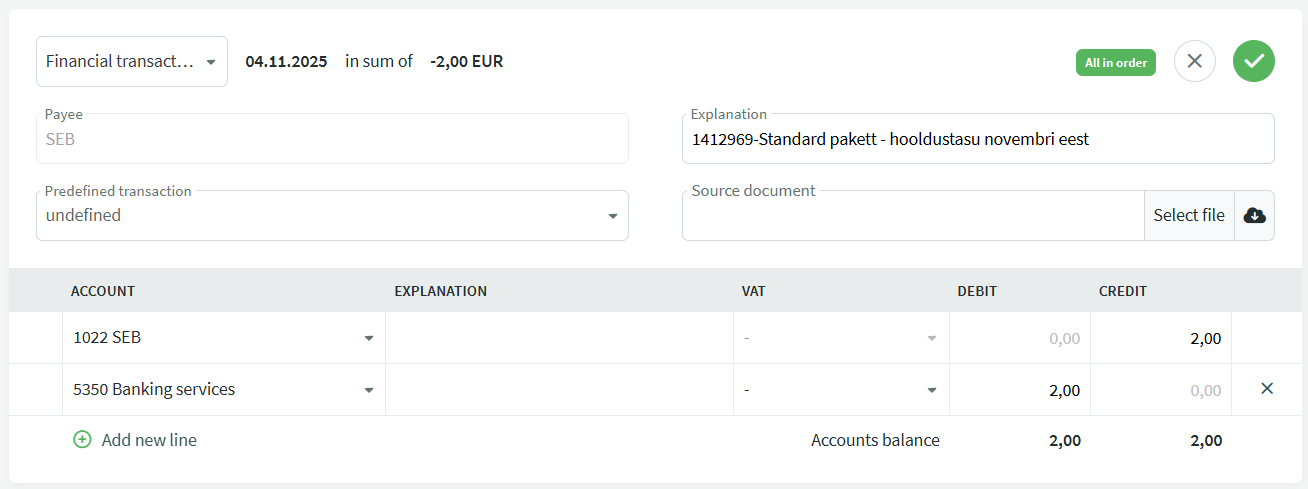

The bank service fee account is defined in the automatic transaction settings, and in most cases the system will correctly prepare and record the transaction. If necessary, the expense account can be adjusted on the transaction line.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?