Principles for declaring triangular transactions

Source: Estonian Tax and Customs Board, Taxes and payment → Value added tax → Taxation of goods

All parties involved in the transaction must be VAT-registered in different Member States.

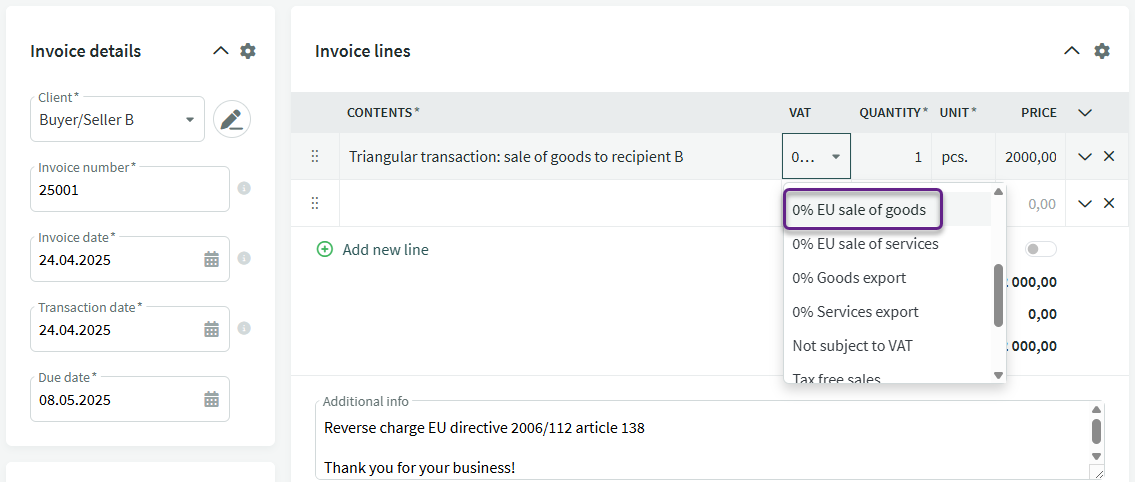

The first seller A declares as follows:

- the sale to B must be declared as intra-Community supply of goods in a VAT statement,

- the value of the sale must be declared in the report on intra-Community supply as regular supply (not triangular).

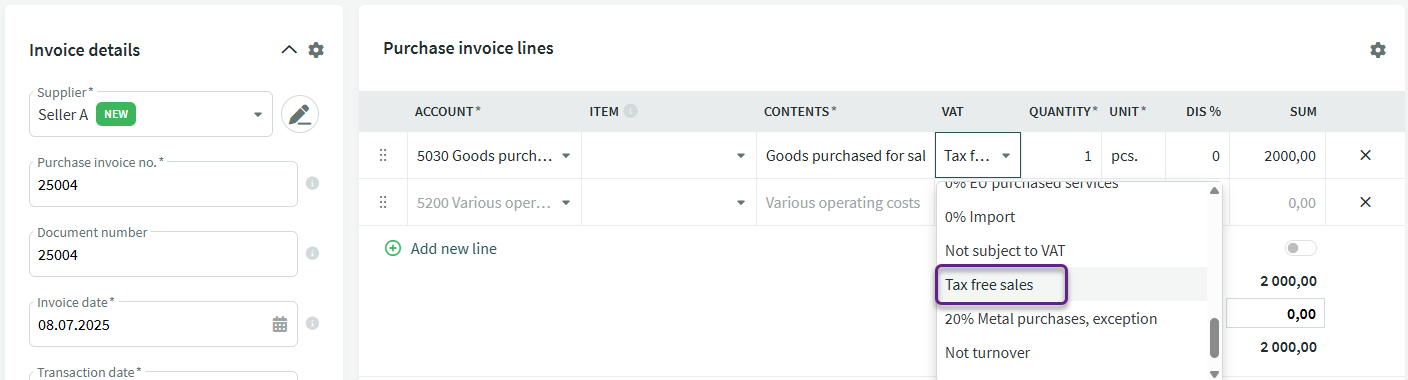

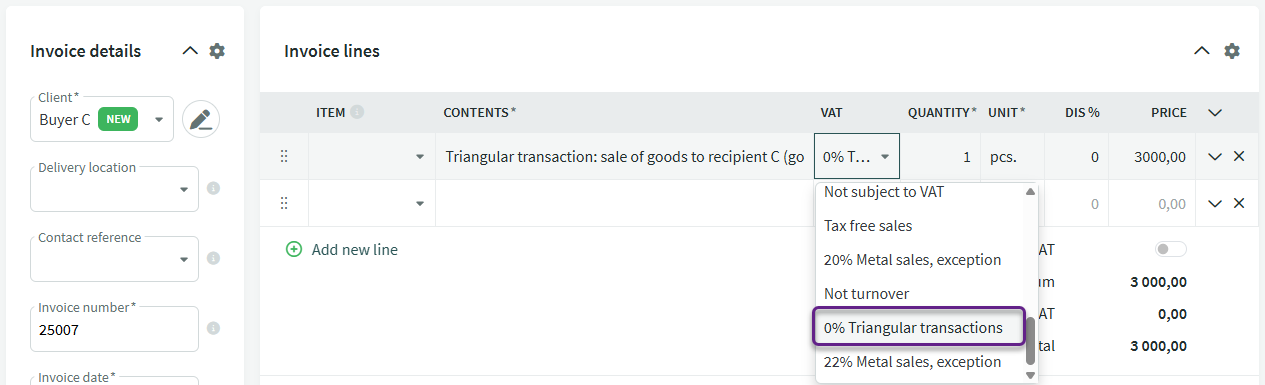

The second seller B declares as follows:

- B declares the goods sold to C in the intra-Community supply report, in the “Triangular transaction” field;

- if B has other intra-Community sales of goods to C, these are declared separately in the intra-Community sales report, apart from the triangular transaction sales.

However, B does not declare the goods purchased from A as an intra-Community acquisition, nor the sale to C as an intra-Community supply of goods in the VAT return.

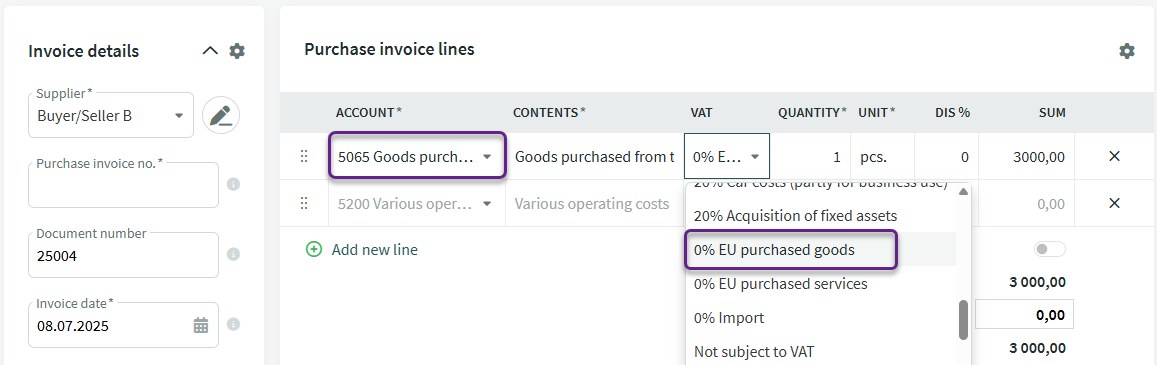

The second buyer C declares as follows:

- the purchase from B is reported in the VAT return in field 1 or 2, depending on the applicable tax rate;

- VAT on the acquisition must be calculated in line 4 of the VAT return, and

- if goods for which the right to deduct input VAT has been acquired, the amount of VAT calculated must also be shown as deductible input VAT in line 5 of the VAT return, and

- in addition, the acquisition must be reported in the informational line 7 of the VAT return.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?