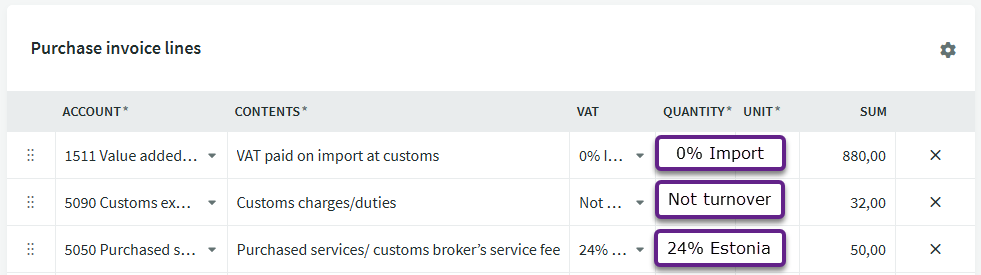

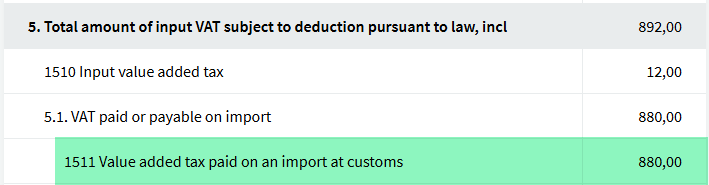

When entering the purchase invoice for imported goods, use the VAT type 0% Import on the expense line.

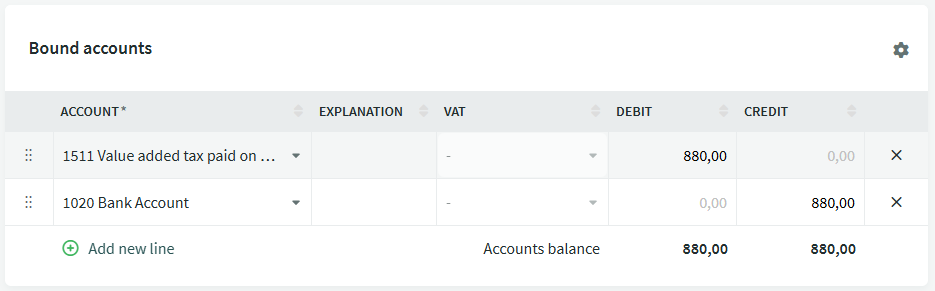

Customs broker services are often used when preparing the import customs declaration and paying VAT. The broker issues an invoice covering VAT and customs charges.

Instructions for recording the customs broker’s invoice are provided below.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?