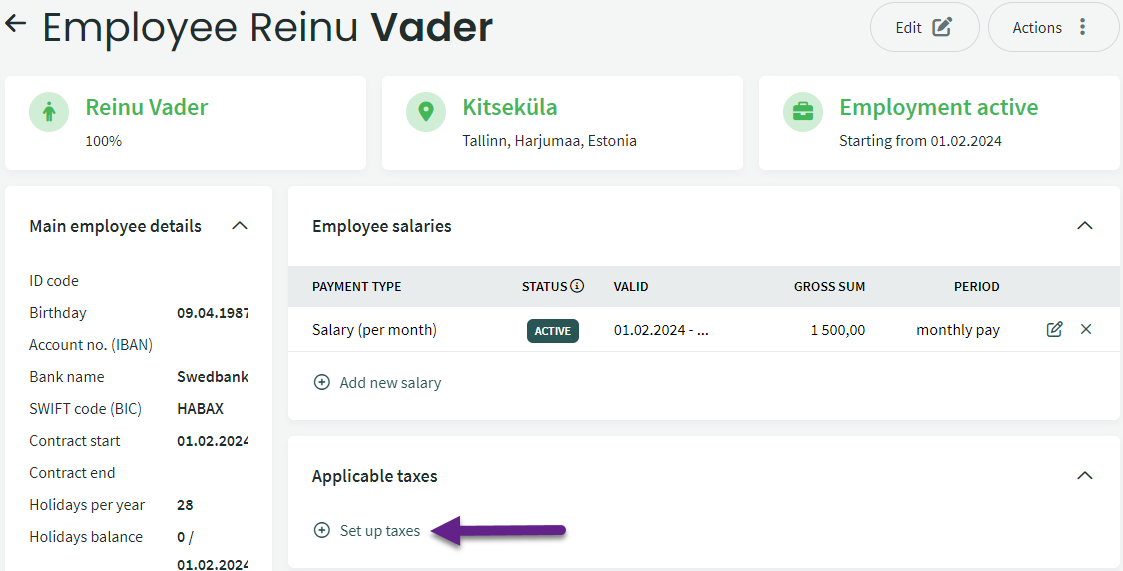

Taxes applied to the employee’s salary are set on the employee card. If left unset here, they must be applied each time during salary calculation.

To avoid mistakes, it is recommended to predefine taxes on the employee card.

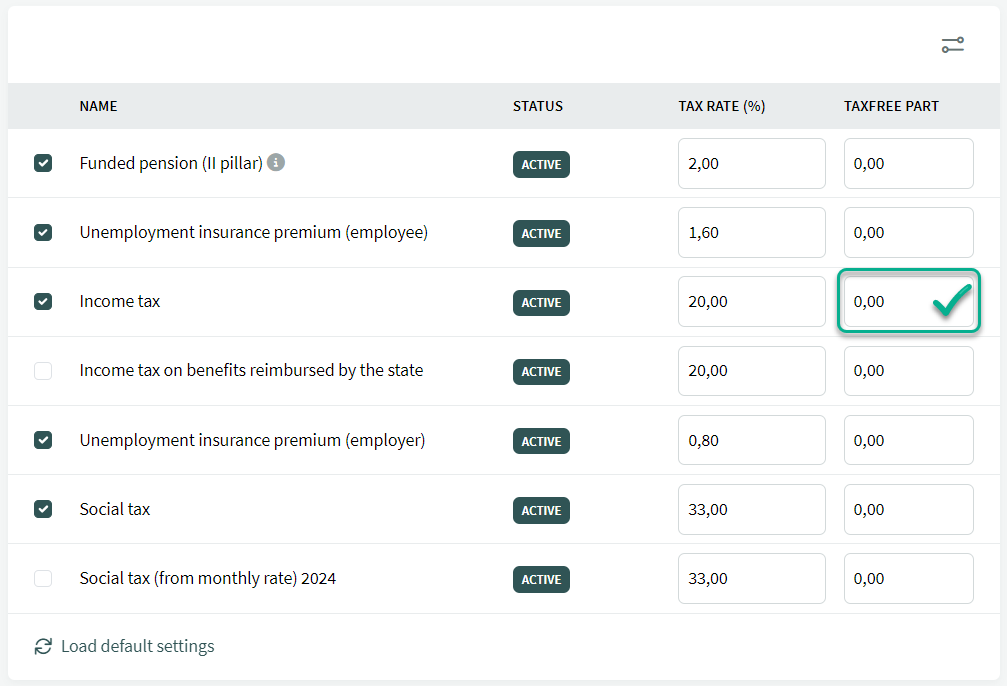

In the settings, you can indicate which taxes apply to the employee by default. For the funded pension, the employee may have a higher tax rate than the usual 2% (4% or 6%, starting from 01.01.2025).

You can also define whether the tax-free allowance is used when calculating income tax, and if so, in what amount.

If the employee wishes to use the tax-free allowance, the amount must be entered in the “Tax-free part” field under the income tax section.

Only one type of social tax may be selected (either social tax or social tax based on the monthly rate).

An employer who hires an employee with reduced work capacity can apply for a social tax discount from the Estonian Unemployment Insurance Fund. How to set this up can be read in detail in the guide .

If necessary, taxes can also be adjusted in the salary calculation view.

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?