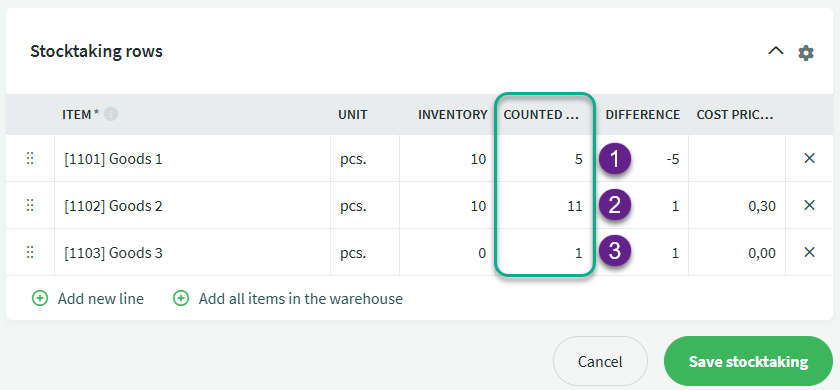

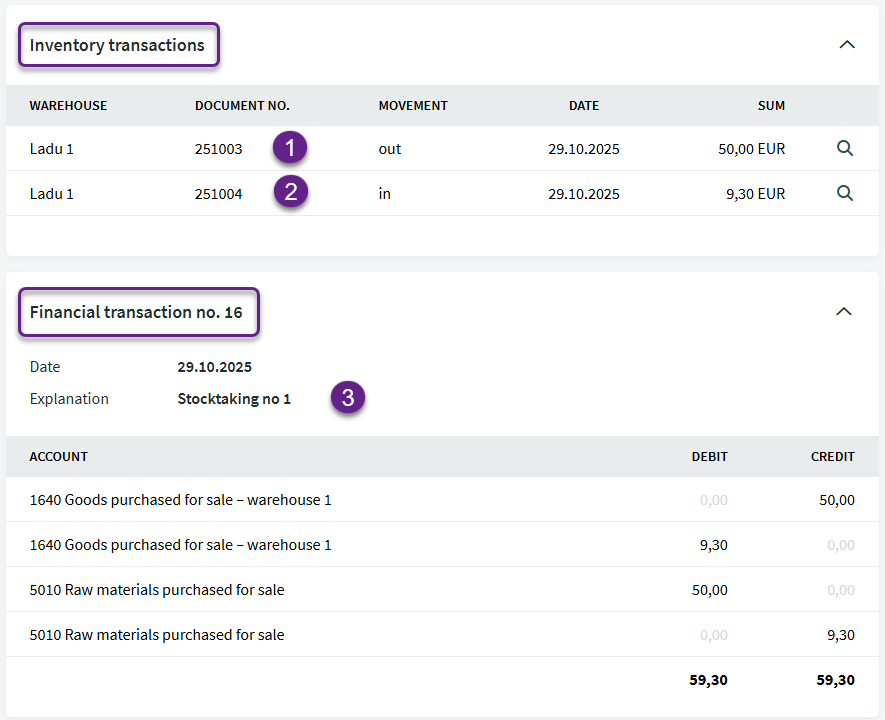

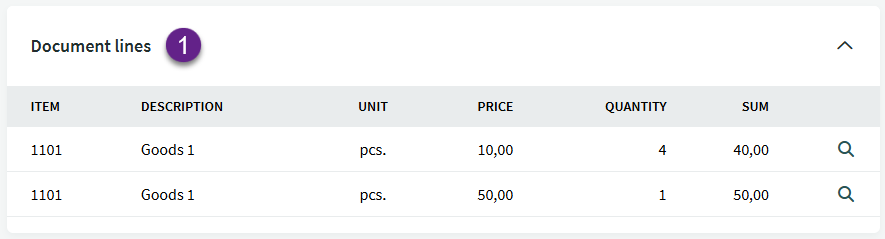

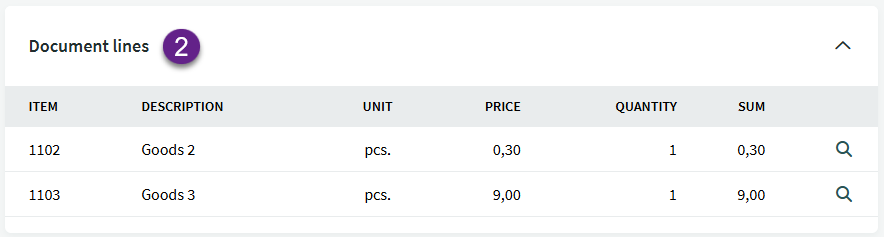

Stocktaking is an important tool to ensure that a company’s inventory is accurately recorded. Over time, data about the goods in stock may become inaccurate due to errors in stock entries, deliveries or sales. Stocktaking helps identify these differences and correct the data so that the recorded stock matches the actual inventory.

According to the Accounting Act § 15 (3), assets and liabilities must be inventoried at least once a year, before the end of the financial year.

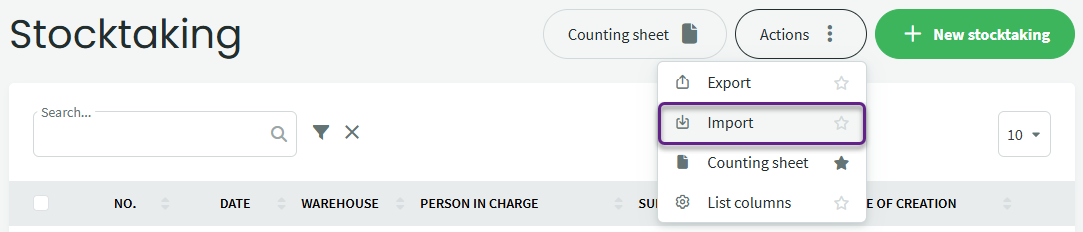

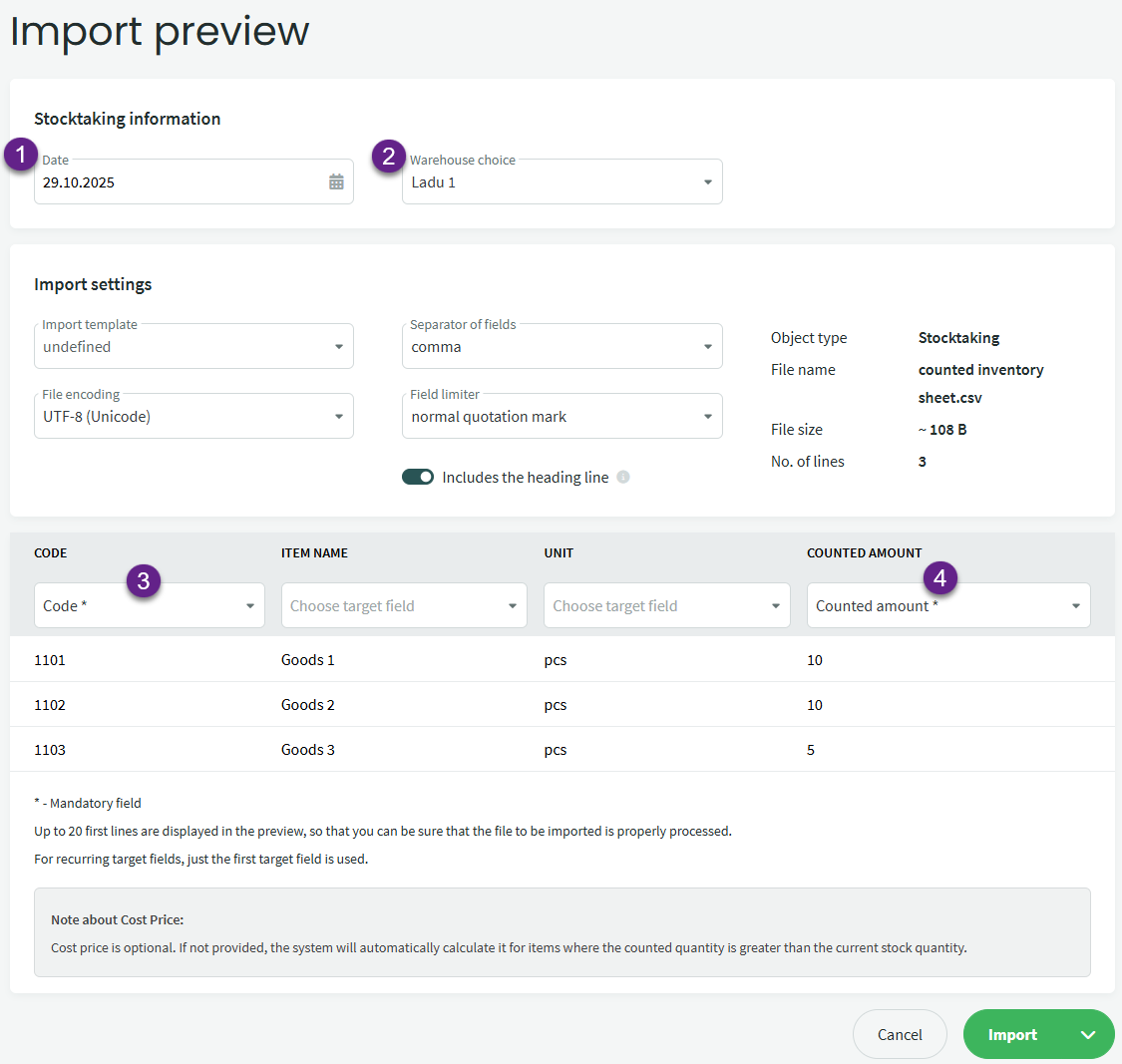

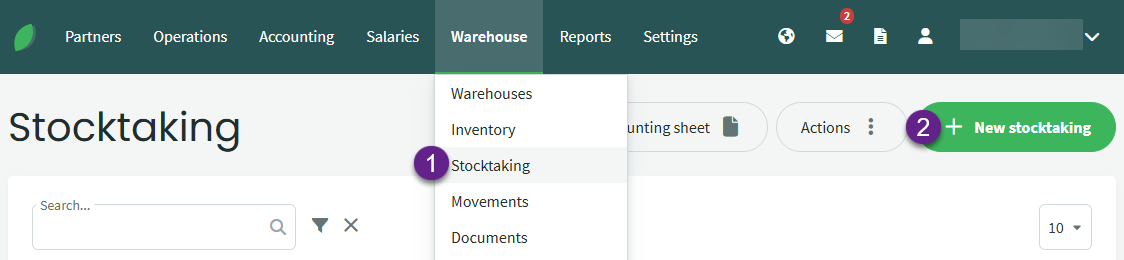

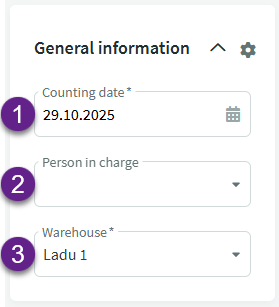

A stocktaking record can be created manually or imported from a file.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?