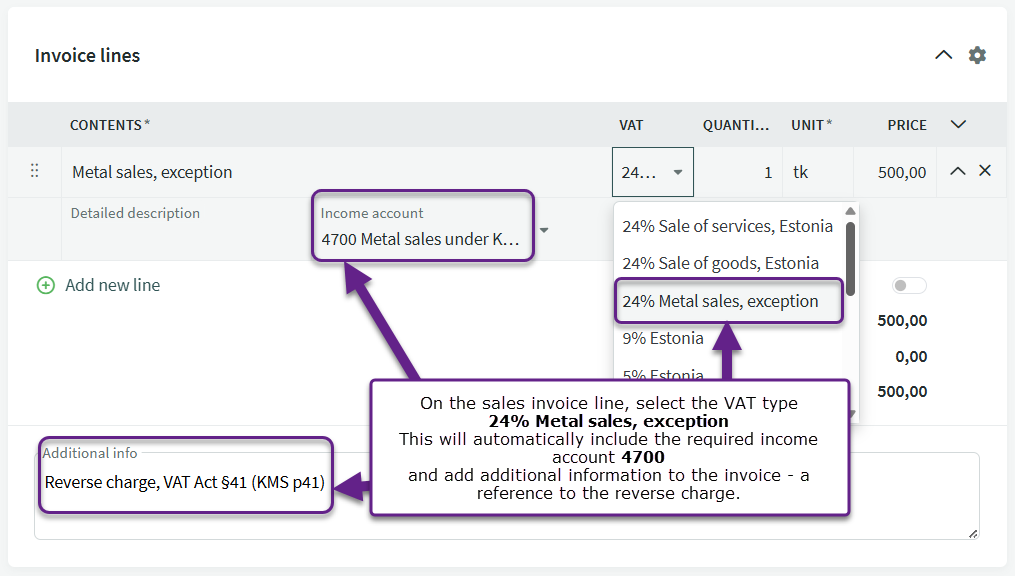

A reference to reverse charge is also added to the additional information of the sales invoice from the VAT type settings.

If you have created a new income account with a different number, you must add it to the VAT type settings and also update the VAT statement settings.

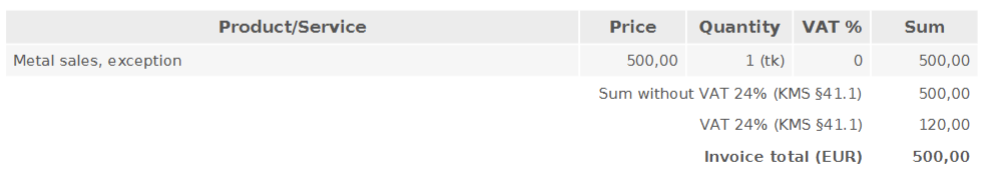

After saving the invoice, you will see the calculated VAT on the sales invoice PDF, but it does not affect the receivable from the customer.

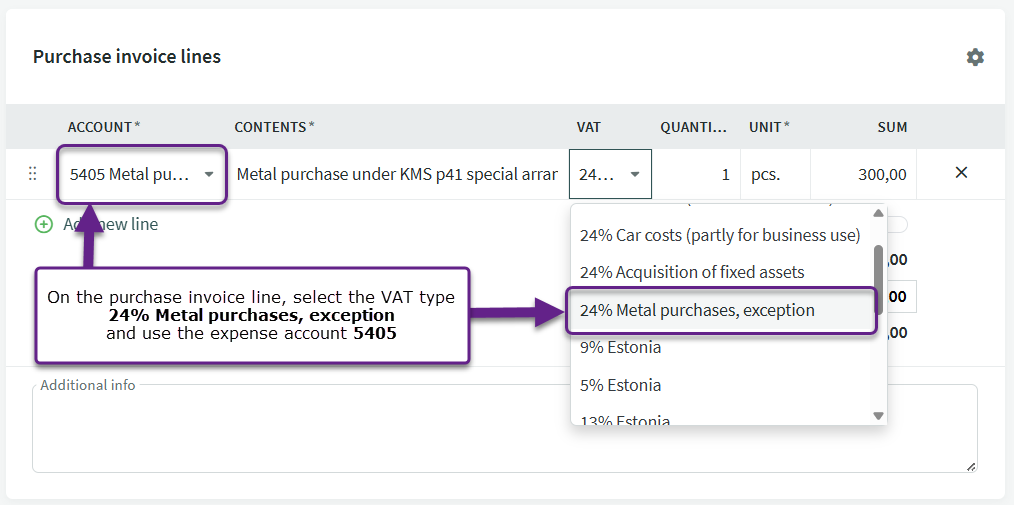

Since VAT statement data is based on the account + VAT type, it is also possible to use other expense accounts for metal purchases. In that case, you must manually add the required expense account in the statement settings.

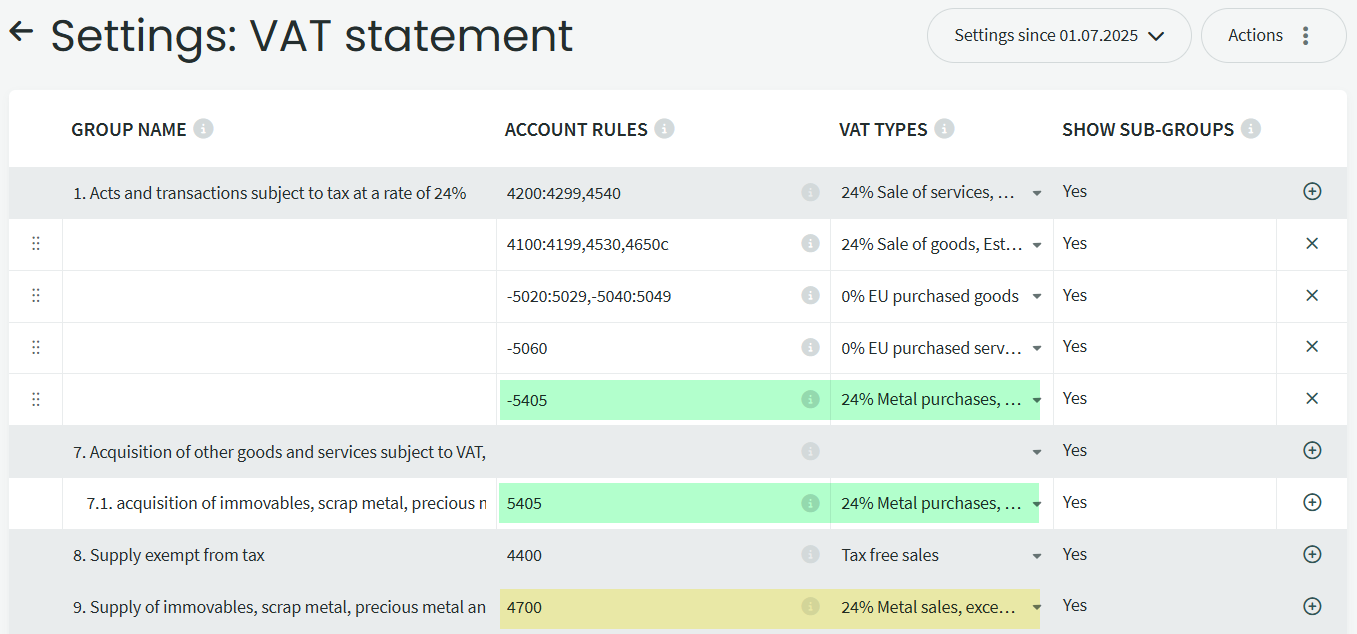

To view or edit the VAT statement settings, go to Accounting -> VAT statement and select “View VAT statement settings” from the Actions menu

For the sales to be recorded correctly, the account must be added in the report settings under line 9 with the VAT type 24% Metal sales, exception.

For the reverse charge on purchases to function correctly, the accounts must be included in the report settings under line 1 (with a minus sign) and line 7.1, with the VAT type 24% Metal purchases, exception.

[/su_note]Invoices for sales and purchases will automatically appear in VAT statement INF sections A and B if they meet the general KMD INF conditions (minimum 1000 euros per transaction partner) and if the correct income and expense accounts have been used as configured in the VAT statement.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?