Integration with e-MTA provides the possibility to send a VAT return (KMD) with annexes INF A and INF B directly from SimplBooks to e-MTA via machine-to-machine interface. The intra-community turnover (VD) report cannot be sent to e-MTA in a similar way at this time.

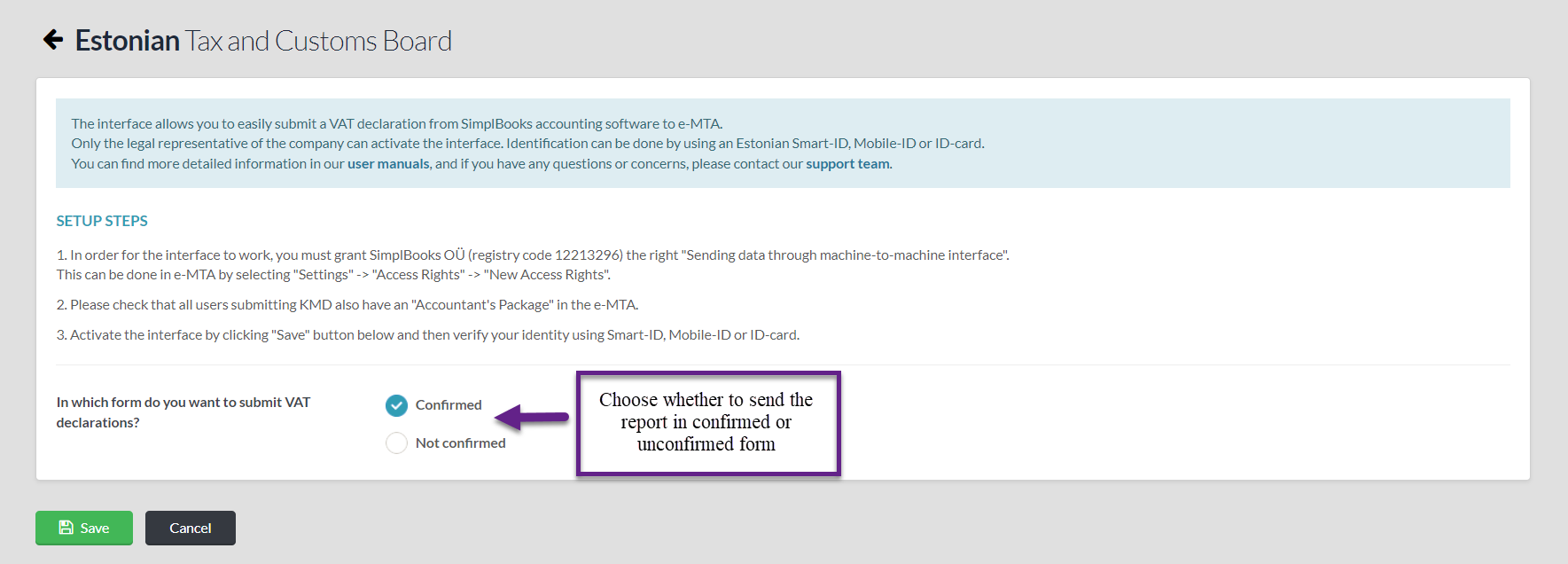

Settings -> Interfaces -> Estonian Tax and Customs Board

The interface can be activated only by the company’s legal representative (management board member) and needs to be confirmed with an ID card or Mobile ID or Smart-ID.

Choose whether you want to send the report in confirmed format (you don’t need to log into e-MTA for confirming) or in an unconfirmed format (you must log into e-MTA and confirm the declaration there).

Save and confirm. The interface is now activated.

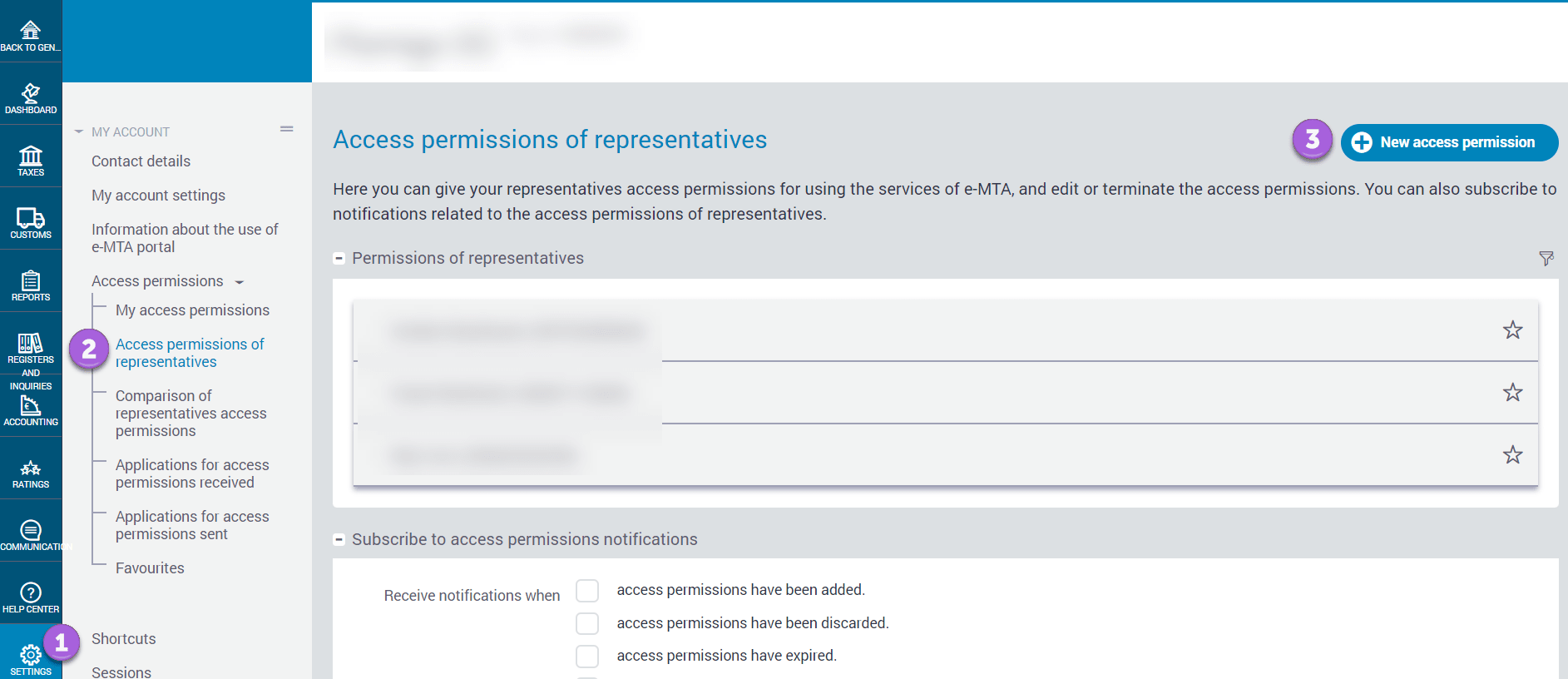

Settings -> Access permissions -> Access permissions of representatives -> New access permission

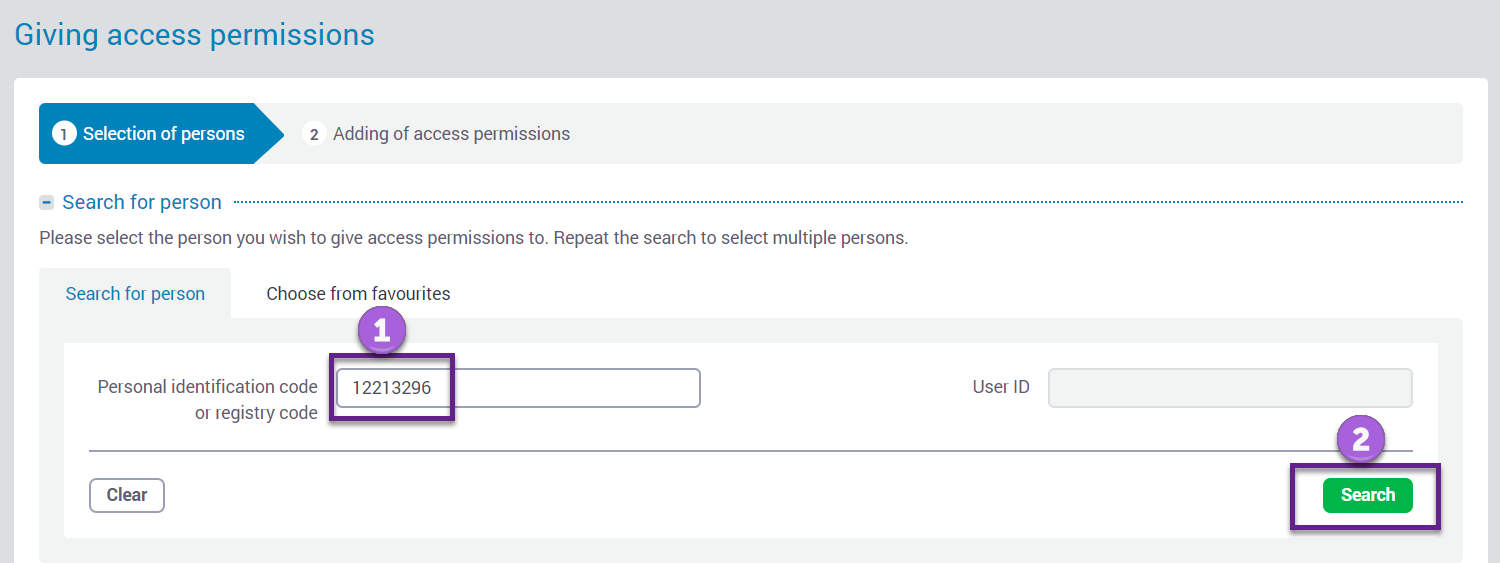

It is necessary to give the right to send data from SimplBooks software. Enter the registry code of SimplBooks OÜ, which is 12213296, into “Personal identification code or registry code” field and click “Search”.

“SimplBooks OÜ” will appear in the selected people section and click the “Next” button.

Under “Separate permissions” you will find “Name” field, where you need to type “tax return” and click “Search”.

Now you can see the rights associated with the search string. Check “Sending value added tax return (form KMD) data by machine-to-machine interface” and click the “Add” button to confirm.

The settings are ready to send the VAT return directly to the e-MTA now.

From March 17, 2022 according to the information from the Estonian Tax and Customs Board, limited access to the board members of SimplBooks OÜ is also added to their system. SimplBooks OÜ board members will not be able to see the declarations or other data with these permissions. These added permissions are actually not necessary for machine-to-machine data exchange and the Tax and Customs Board is working to resolve this issue. You can immediately resolve the matter by terminating SimplBooks OÜ management board members rights under “Access permissions of representatives”.

You can read about submitting VAT return in this guide: Sending a VAT return to the e-MTA via the interface

If you have additional questions, write to support@simplbooks.ee.

If you have any questions about the e-MTA environment, please contact e-MTA directly.

Leave A Comment?