Under bank accounts and cash registers, you can view the details of existing accounts, edit them, and add new ones.

To add a new bank account or cash register, click the “New account/cash register” button.

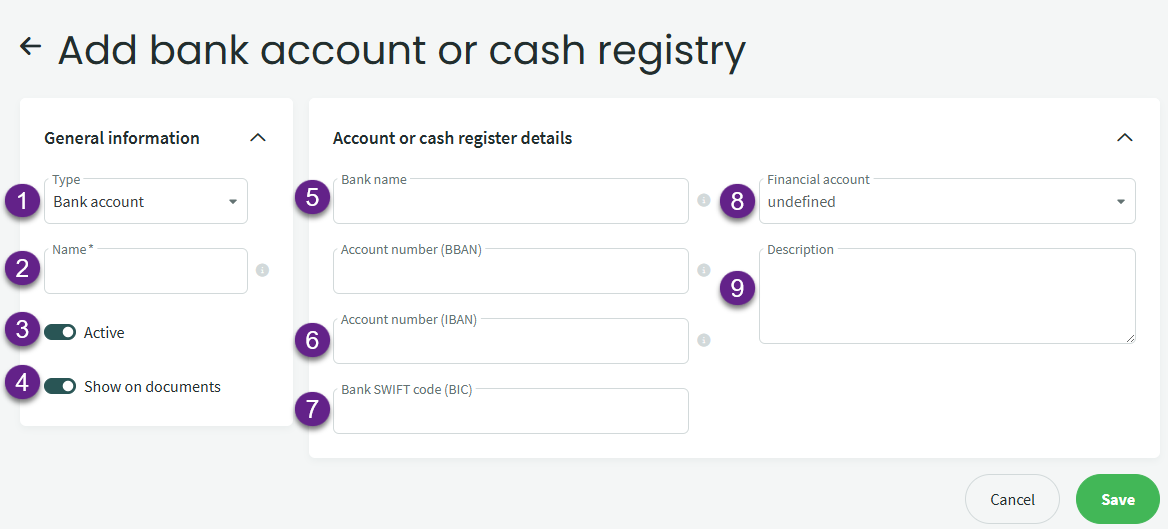

- Type – Bank account, cash register or offsetting *

- Name – Internal company information; if there are multiple bank accounts with the same bank, you can enter a name here to distinguish them (do not enter the company name).

- Active – If the account is active, it will be visible and usable in transactions. If changed to inactive, it cannot be used in payments or receipts and will not be shown on company documents.

- Show on documents – Allows you to specify whether the given account is displayed on company documents.

- Bank name – The name of the bank that will be displayed on company documents. The official name is automatically added for Estonian banks when entering the account’s IBAN number.

- Account IBAN number – The company’s account number in IBAN format without spaces.

- Account SWIFT code (BIC) – For Estonian banks, this is automatically added when entering the account’s IBAN number; for other banks, it must be entered manually.

- Financial account – Must be unique for each bank account or cash register and is used when creating financial entries. If a suitable account is not available in the chart of accounts, a new account must be created before adding a new bank account/cash register.

- Description – If you want to make additional notes about the account for your reference, this is the appropriate place.

* ● The account type “Cash registry” means that the balance of this account is always displayed on the “Total cash” panel of the company overview page.

The account type “Bank Account” means that the account balance is displayed on the “Total cash” panel only if an IBAN number has been added to the account settings. Therefore, this type should be used, for example, when adding an account to mark card payment service fees, capital lease agreements, or similar payments as paid.

The account type “Offsetting” is used for settlements, i.e. for marking invoices and credit invoices as paid.

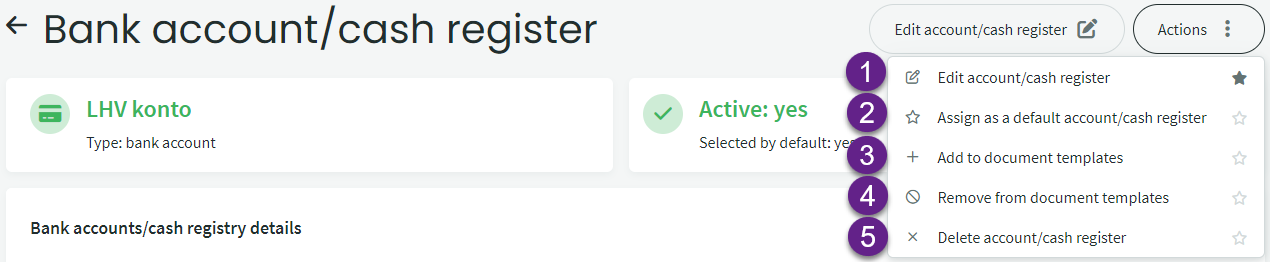

Once the bank account or cash register details are saved, you can perform the following actions through the Actions menu:

- Edit account/cash register – To supplement or modify the account details, or to deactivate an account that is no longer in use.

- Assign as a default account/cash register – If you want this account to be offered first when manually entering receipts/payments, make this selection here.

- Add to document templates – If you previously set the account to not be displayed on documents, you can change that here.

- Remove from document templates – If you have mistakenly added the account to document templates or if this account is no longer used as the primary one, you can remove it from the templates.

- Delete account/cash register – You can delete the account if you created it by mistake. However, if there are transactions associated with the account, it cannot be deleted.

For additional questions, please write to us at support@simplbooks.ee.

Leave A Comment?