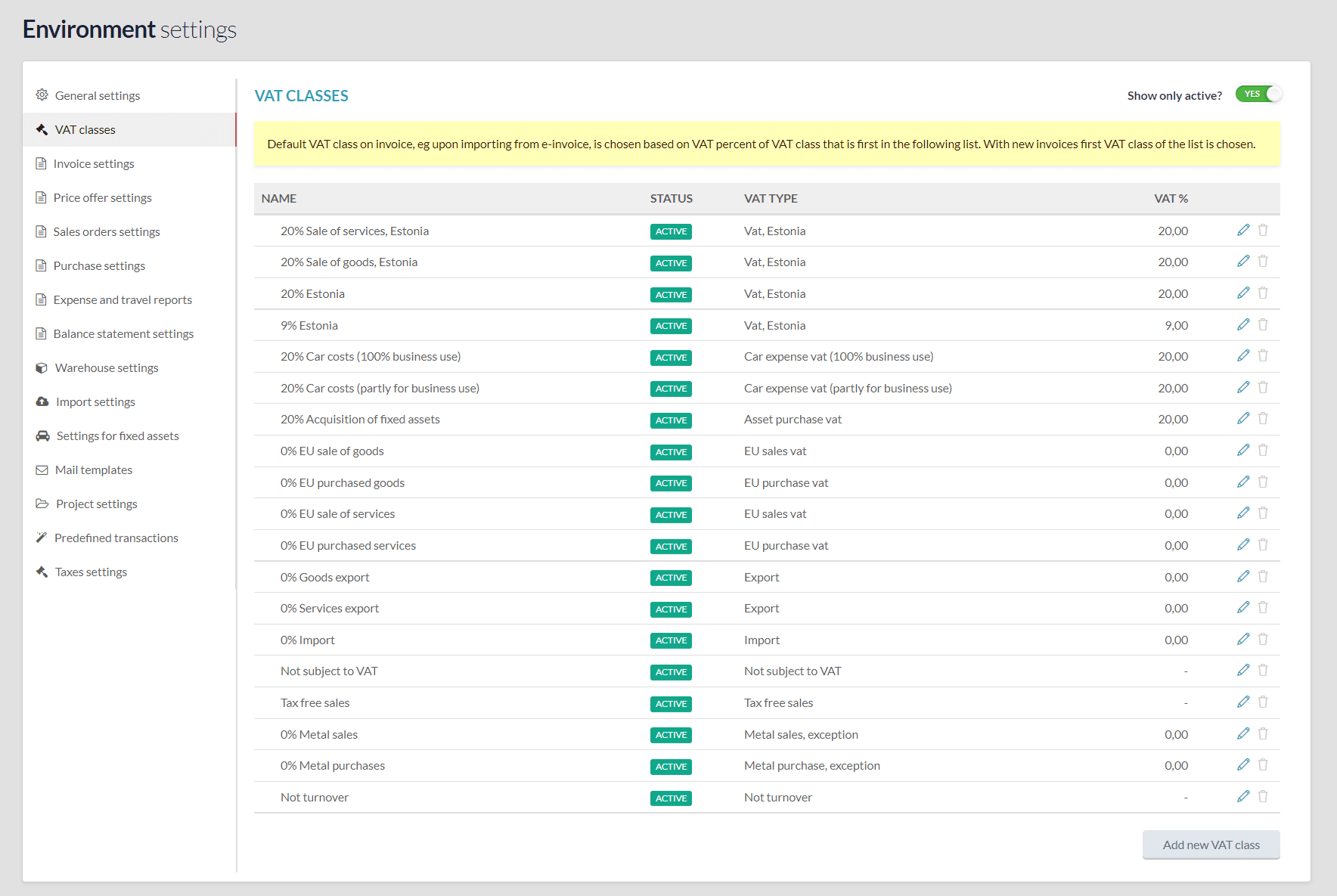

VAT classes are preset by us for the most common situations. You can also add them yourself based on your business needs.

You can change the settings by clicking on the ![]() icon. For preset types, you can only edit financial accounts.

icon. For preset types, you can only edit financial accounts.

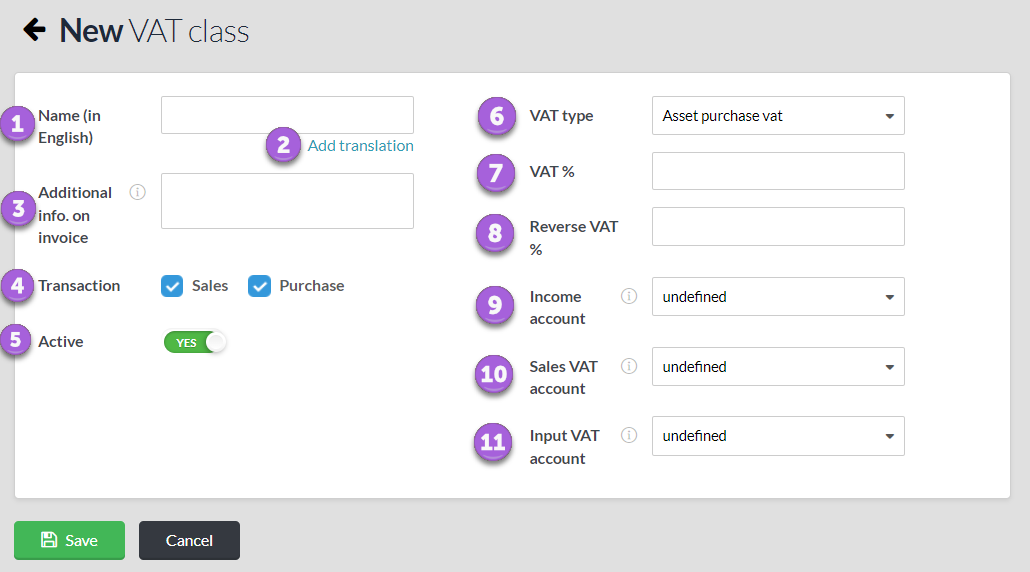

- Name – The name of the VAT class as it appears in the document entry views.

- Add translation – clicking on the link will open a window where you can enter the name eg in English and in Russian (if desired or necessary).

- Additional info. on invoice – the text written in this field is added to the additional information field of the sales document if this VAT class is assigned to one of the lines of the sales document.

- Transaction – determines whether VAT class is used in connection with sales or purchases or both.

- Active – shows whether the VAT class is active, ie visible and usable when entering documents.

- VAT type – determines the type of VAT within the meaning of the law, on the basis of which the program applies specifications if necessary, eg for VAT return.

- VAT % – VAT rate in figures. An empty value means that there is no rate.

- Reverse VAT % – used for eg intra-community VAT classes if you want financial transactions to reflect reverse VAT. This percent is used to calculate the VAT for the financial transaction.

- Income account – if set then chosen financial account is used on sales document line as revenue account. Otherwise the default account from automatic transactions settings is used.

- Sales VAT account – if set then selected financial account is used for VAT sum from sales invoice row where this VAT class is used. Otherwise the default account for sales VAT from automatic transactions settings is used.

- Input VAT account – if set then chosen financial account is used for VAT sum from purchase document line where this VAT class is used. Otherwise the default account for purchase VAT from automatic transactions settings is used.

Attention!

If your company’s environment has been created before 02.04.2019….

To use the new simplified car cost entry, you should take two steps:

- Open VAT classes under Settings and activate VAT on car expenses that are inactive by default in pre-upgrade environments. Be sure to check and set up an input VAT account for your VAT class on car expenses. You may need to create this account yourself (Accounting -> Accounts).

- Change the settings in the VAT statement (under the Accounting menu) on lines 5.3 and 5.4 so that the balance sheets related to VAT on car expenses are set up instead of the current expense accounts.

NB! After these changes, VAT statements for previous periods are likely to show the unexpected figures, so it would be advisable to plan this change, for example around the change of calendar month or year.

If you have additional questions, write to us at support@simplbooks.ee

Leave A Comment?