Usually, you don’t need to record inventory income separately, as it is generated automatically when you enter purchase invoices for inventory items.

You can read about entering a purchase invoice for inventory items in the guide Entering a purchase invoice – warehouse items and an example of entering a sales invoice for inventory items can be found in section 9 of the guide Adding sales invoices (examples of transactions).

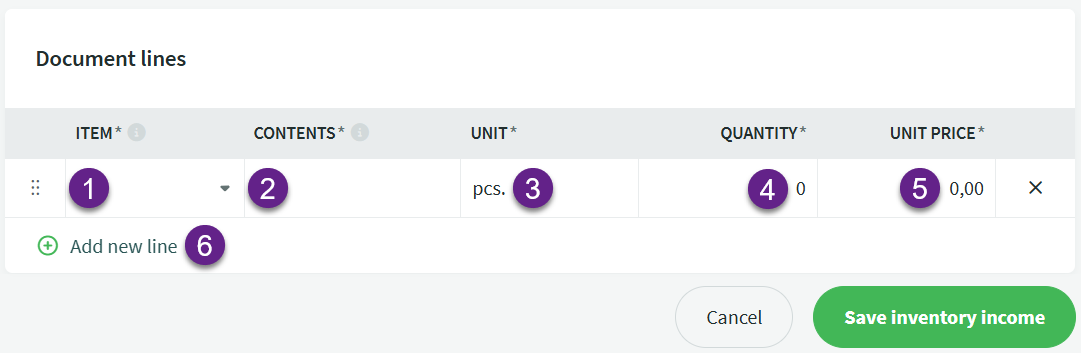

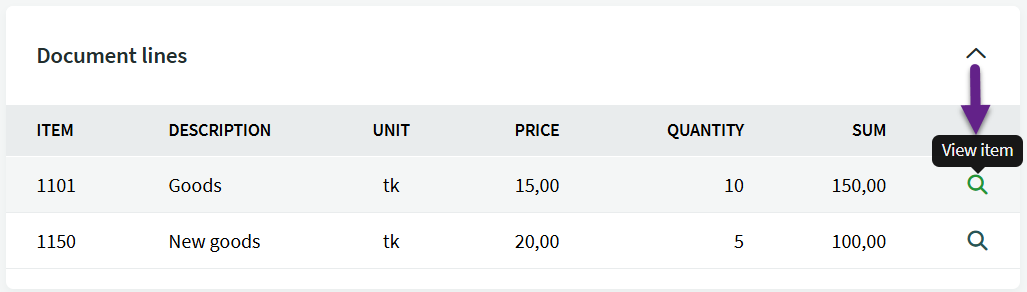

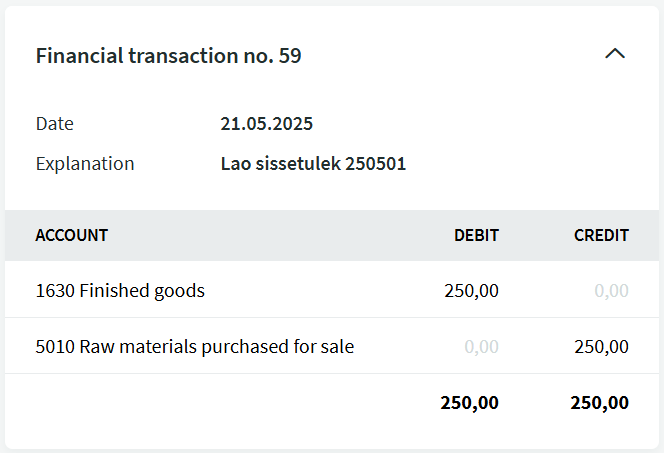

Adding an inventory income manually is mainly necessary when registering in-house production, where the materials used were initially recorded as expenses. In the inventory income transaction, the cost price of the product must be specified. This reduces the cost of goods sold (in the profit and loss statement) and increases the inventory account (in the balance sheet).

When using P&L statement scheme 1, labour costs cannot be included in the product’s cost price. This is possible when using P&L statement scheme 2, which is more suitable for production-oriented companies.

The choice of profit and loss statement format should be made when starting the business. It is not advisable to change it repeatedly, as consistency and comparability of data must be ensured.

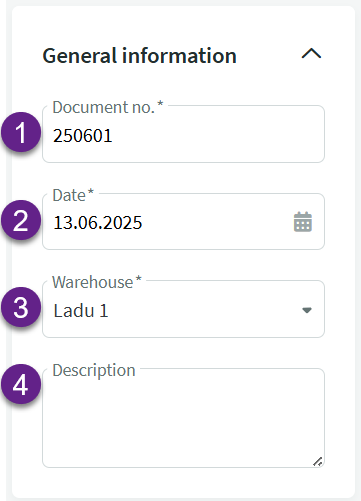

Inventory income can be added in Inventory -> Documents -> New Document -> Inventory Income.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?