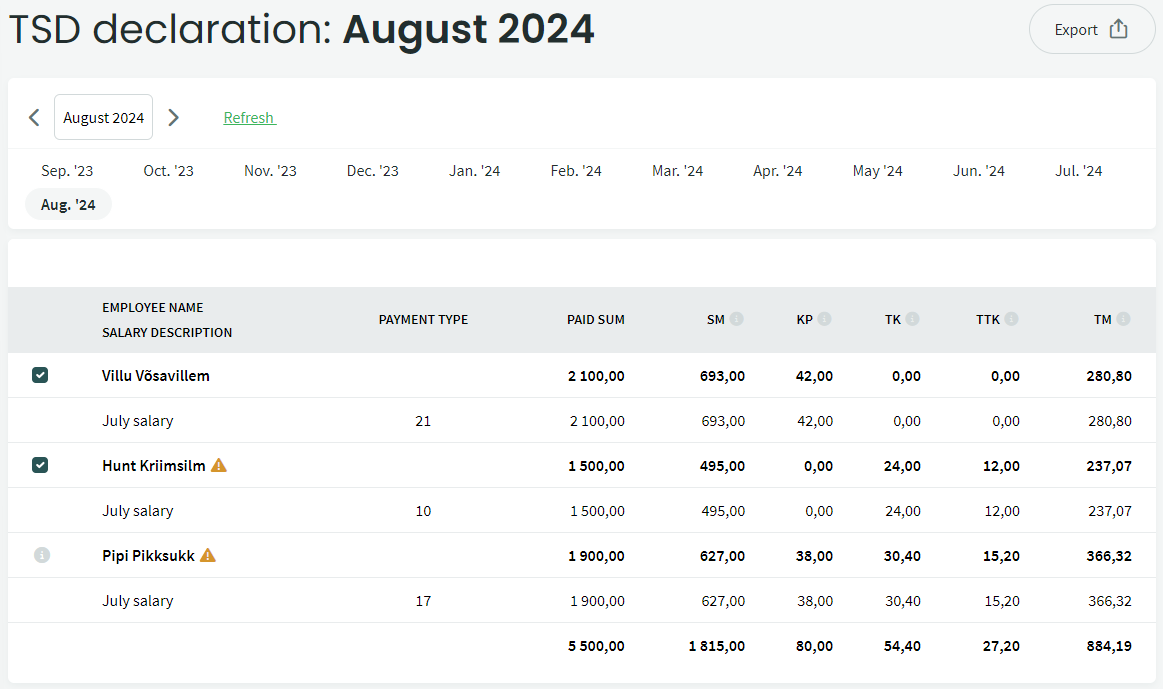

Reports -> TSD report

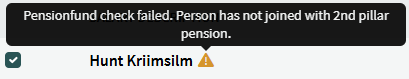

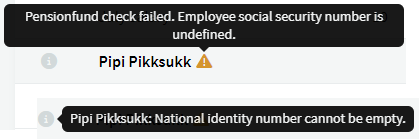

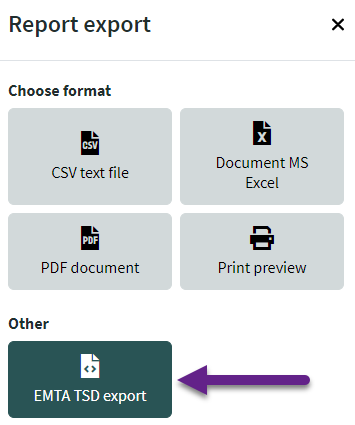

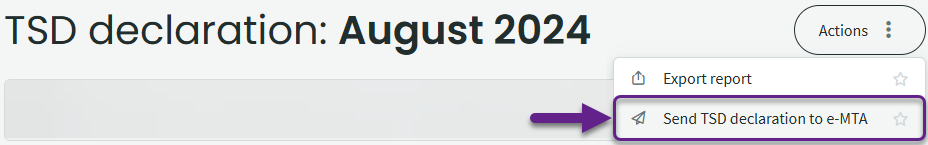

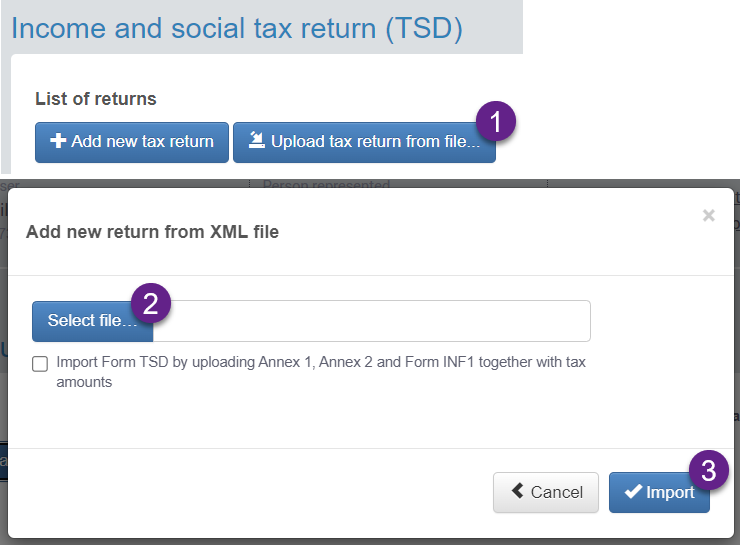

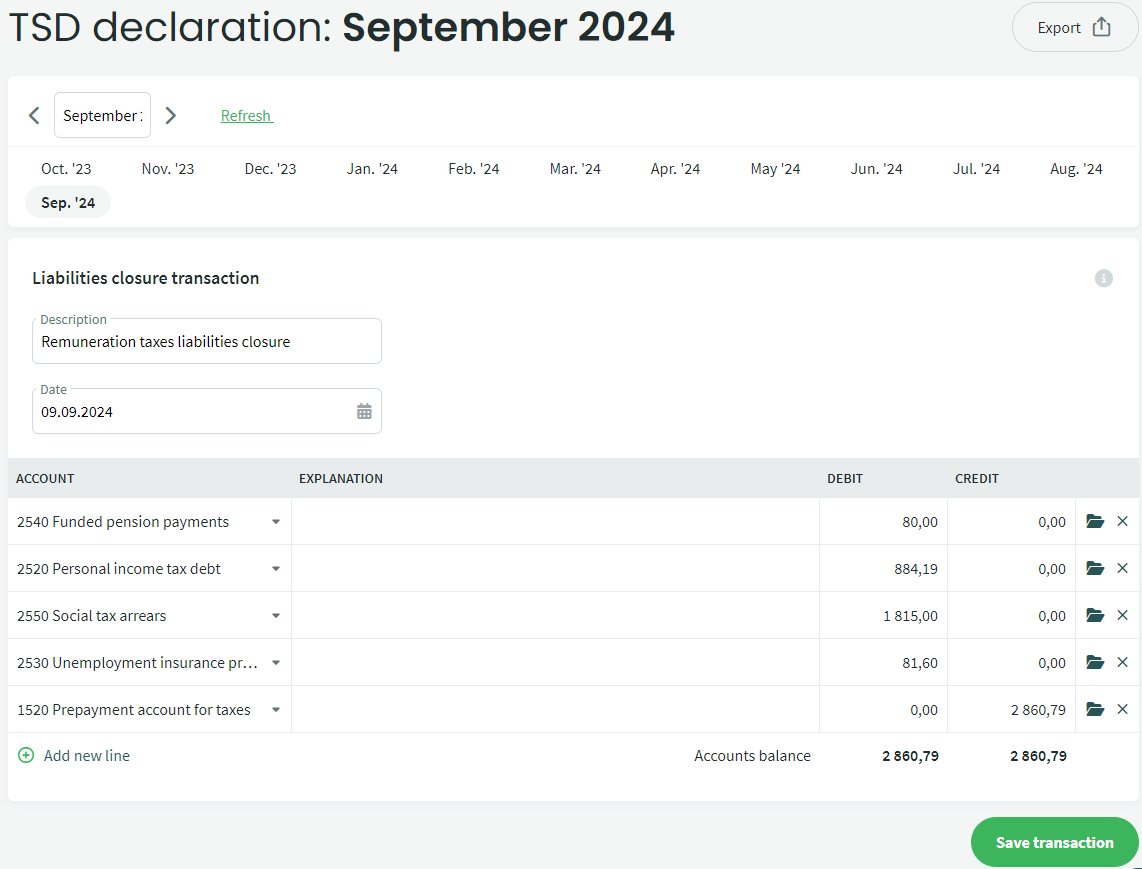

The TSD report consists of two parts. The upper section of the report reflects salary payments, while the lower section includes the closing transaction for salary taxes. The report displays data based on the payout month. In SimplBooks only Annex 1 can be generated. If other annexes need to be completed, the data must be entered manually. When using the EMTA integration for data submission, the report should be sent as not confirmed in the integration settings.

In the sample data, the salary period is July 2024, the salary was paid in August 2024 and it must be declared by September 10th.

For any additional questions, please write to us at support@simplbooks.ee.

Leave A Comment?