HOW TO FIND? – From the main menu “Accounting -> Value added tax report”

The value added tax report is in terms of its content and appearance nearly identical to the Tax and Customs Board form KMD. If your SimplBooks system is correctly configured, then it is possible for value added tax report data to be transposed on a one-to-one basis to the KMD. We would like to recommend that you take advantage of the possibility to export data and to import KMD data from the file (XML) being sent to the Tax and Customs Board.

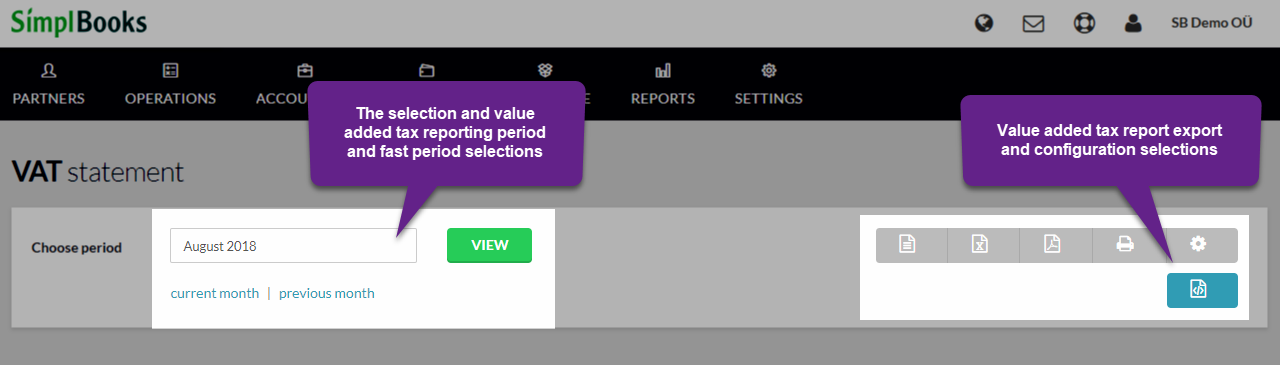

The blue button located in the header of the report (“Export KMD as XML file”) should be used for exporting report data to the e-Tax and Customs Board. CSV file exporting to the e-Tax and Customs Board IS NOT supported by the SimplBooks system.

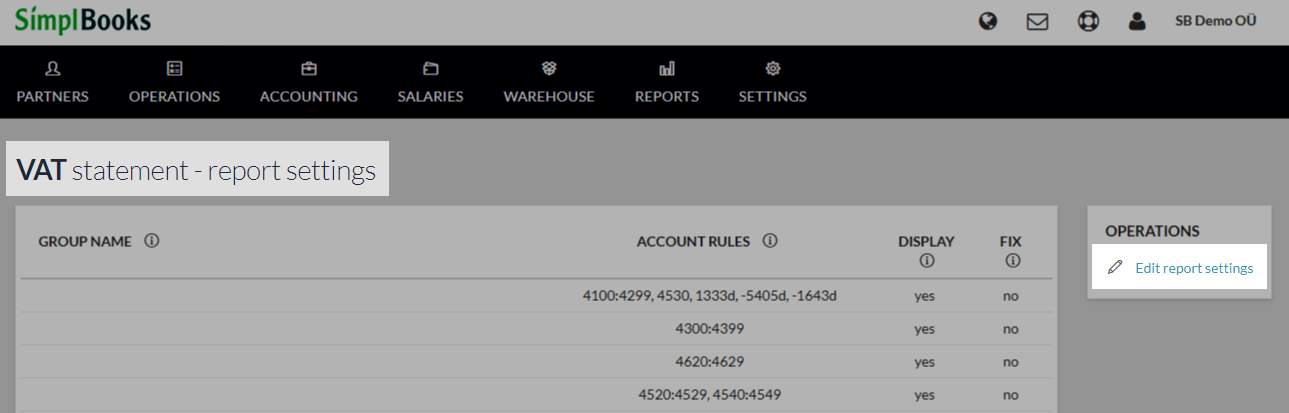

To change the report settings, the grey cog icon button located in the header of the report should be used (“See reporting settings”). By clicking on the button a view of the settings for the report will open. To change the settings, select “Change report settings” under operations.

The configuration of value added tax reports generally takes place in the same way as the configuration of main accounting reports. The biggest difference is that rows cannot be created or deleted and rows also cannot be repositioned. Account rules function in the same way as they do for main accounting reports.

The value added tax report has been preconfigured according to the initial account plan for standard sales and purchase transactions as well as reverse charges. In the following instructions the most common situations have been explained in case the account plan requires supplementing or changing.

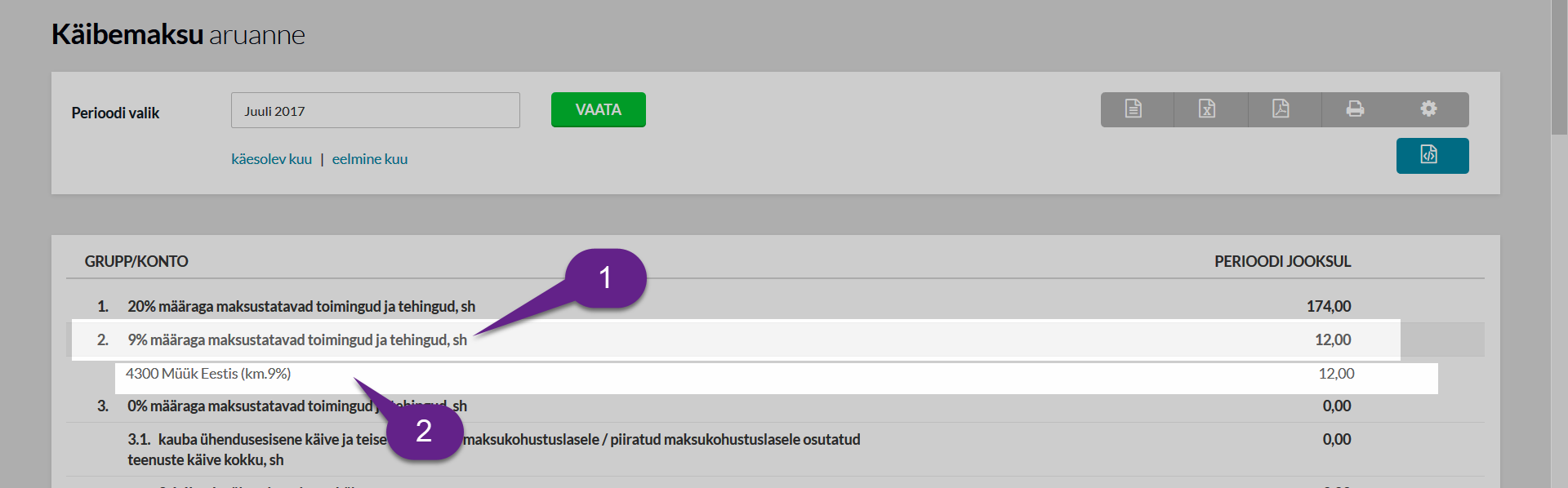

Please note! If you would like to view some of the value added tax report rows in greater detail, simply click on the row:

1. Opens accounts, which are included on the corresponding row

2. Entries are opened in the corresponding period (ledger view)

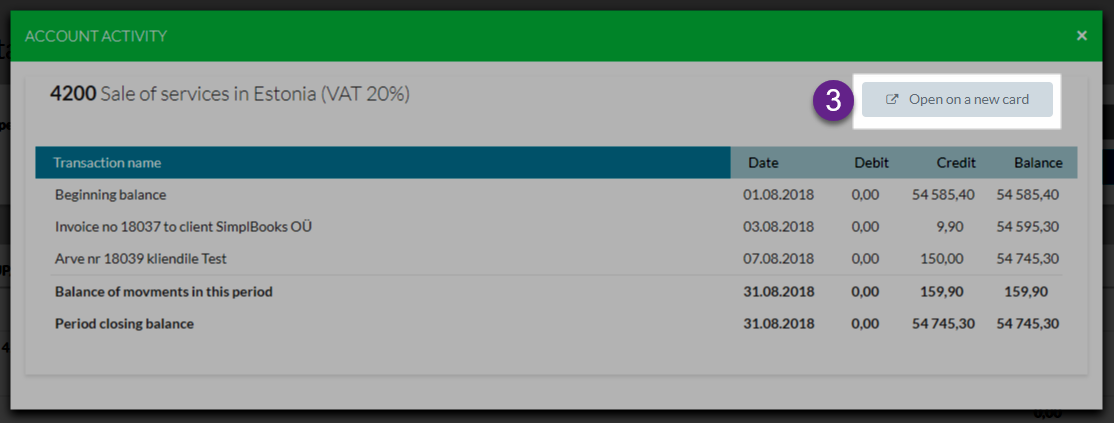

3. By selecting “Open in new card” in the opened window, the ledger will appear.

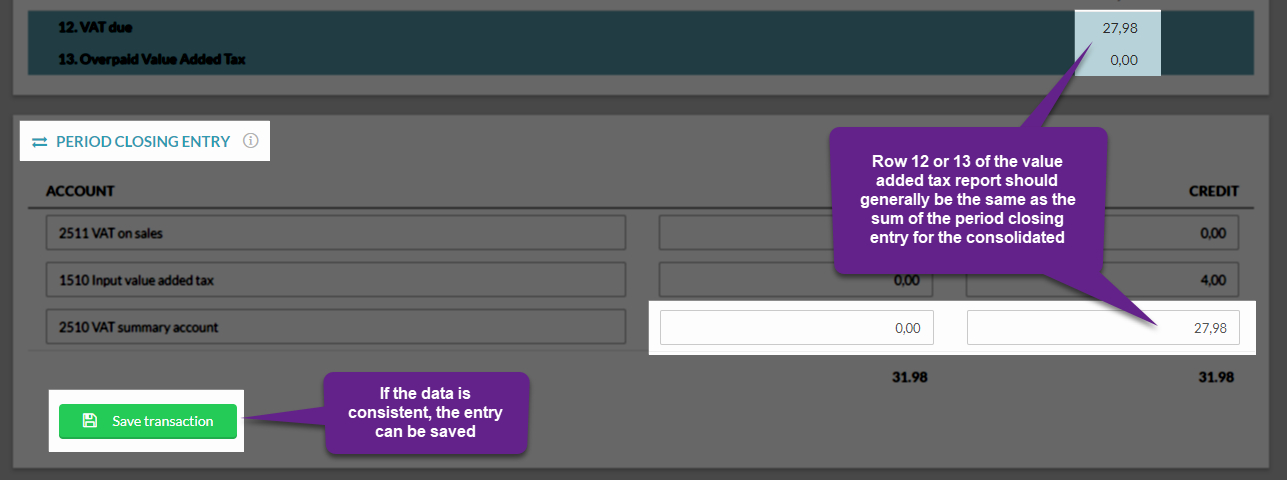

As opposed to the main reports, there is a period closing entry at the end of the value added tax report, which simplifies the monthly consolidation of VAT on sales and purchases into a single account.

Leave A Comment?