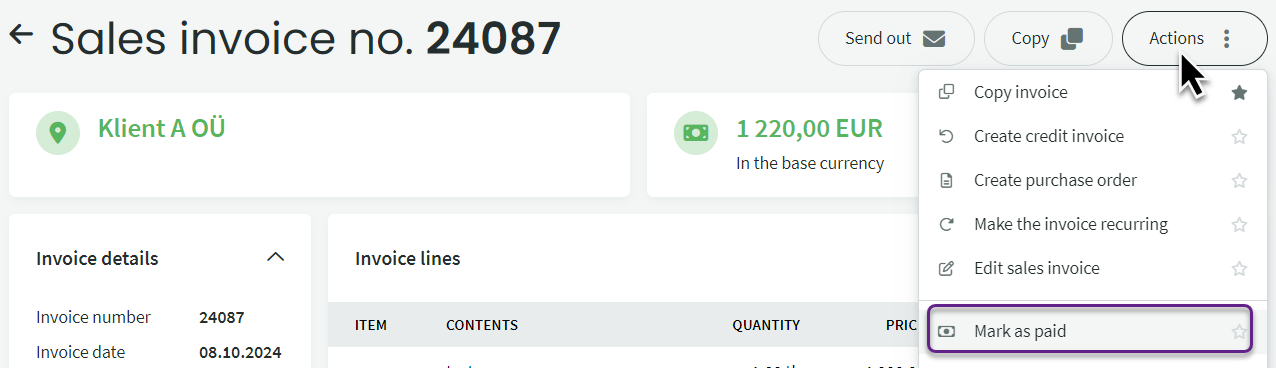

If you have signed a contract with a card payment solutions provider, you will also need to make some additional settings in the SimplBooks software to ensure everything works smoothly. This guide is one possible approach.

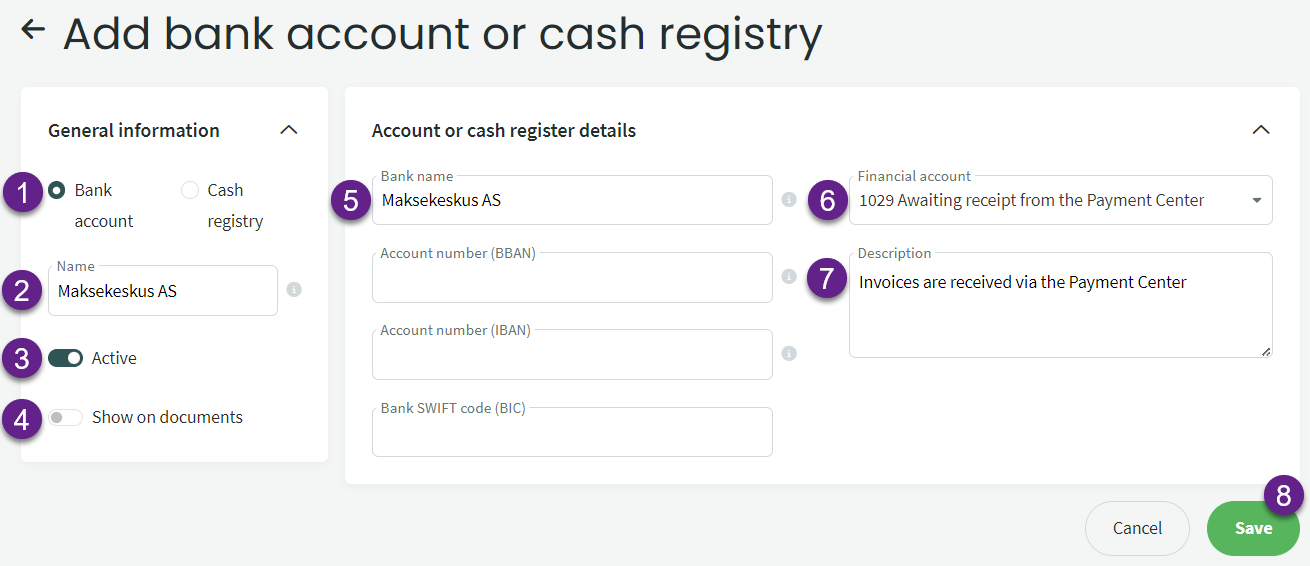

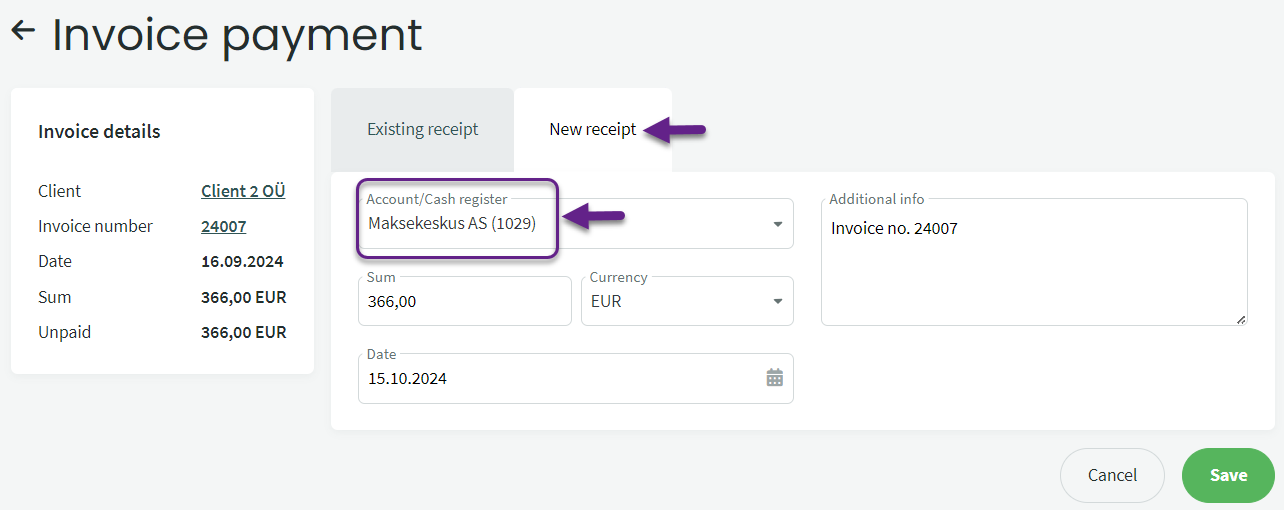

Advice This guide uses Maksekeskus (Payment Center) as an example, but the solution works on the same principle for all card payment service providers.First, you need to set up the financial accounts to be used. Since money from Maksekeskus arrives in the company’s account with some delay, it would be good to keep the receivable from Maksekeskus on a separate balance sheet account. The chart of accounts includes account 1030 Money in transit, which can be used, or you can create a separate account such as 1029 or 1031 Awaiting receipt from the Payment Center. Check that the created account is reflected in the balance sheet settings and update the if necessary. Next, decide whether to record the service fee on the same account as bank services (5350) or create a separate service fee account (in the 5xxx series).

For additional questions, please contact us support@simplbooks.ee .

Leave A Comment?