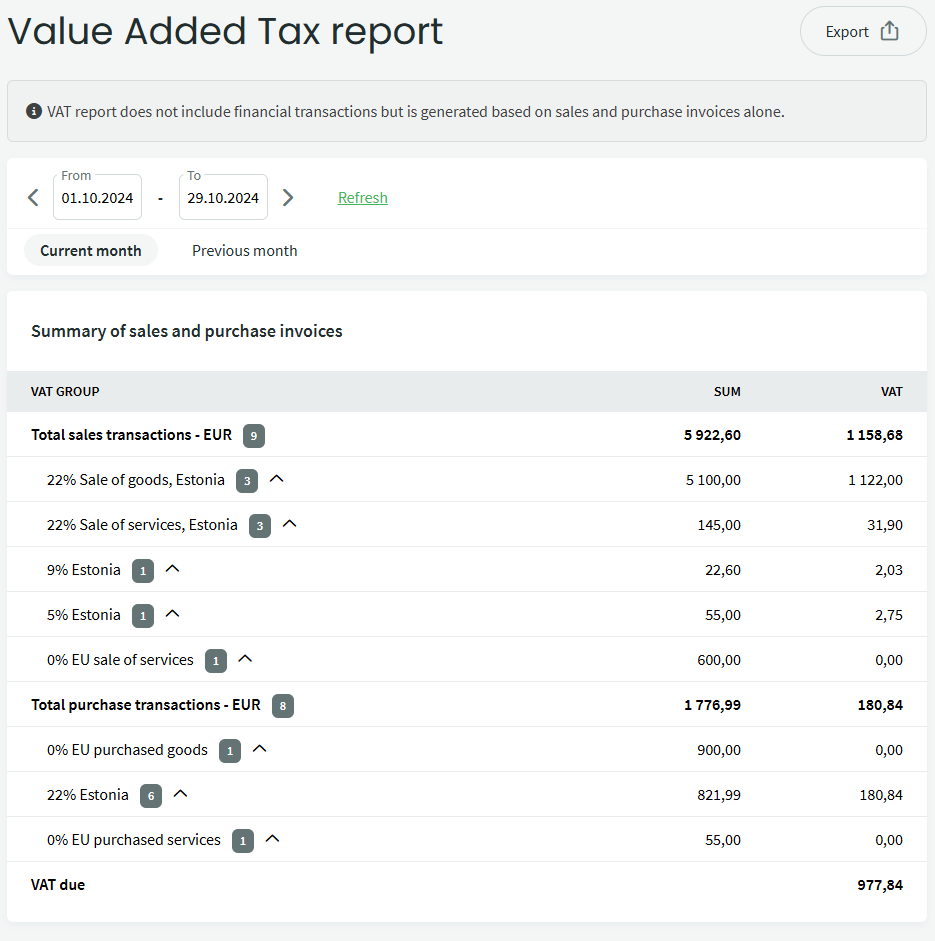

Reports -> VAT report

The VAT report is generated based on the data from sales invoices and purchase invoices and is categorized according to the VAT percentage specified by the type of VAT. Purchases or sales entered as financial transactions are not reflected in this report.

The purpose of the VAT report is to serve as an additional tool to verify the accuracy of the VAT amount due for payment or prepayment.

You can read more about the VAT report and related topics .

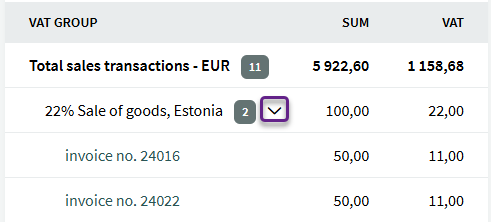

Clicking on the row in the report will display additional information about the invoices where the corresponding VAT rate has been applied.

In this example, sales revenue is recorded with a 22% tax rate on two sales invoices, and the VAT amount is also shown.

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?