The intra-Community supply report (VD) can be exported from the SimplBooks software as an XML file and imported into the e-Tax Board (e-MTA).

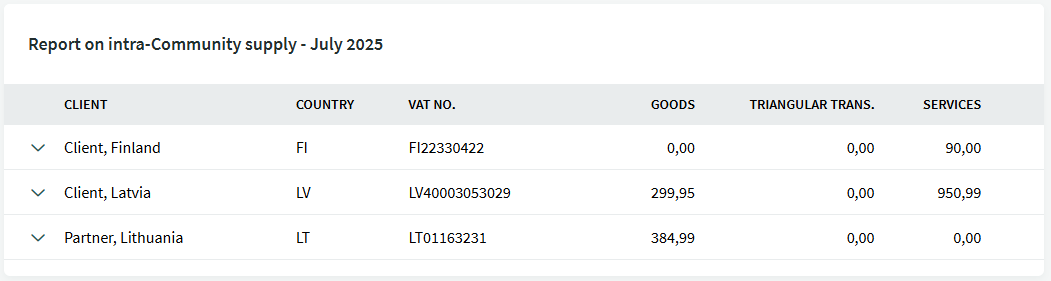

● The report data can be found under the VAT statement.Select the required period, the VD report data is located at the bottom of the report.

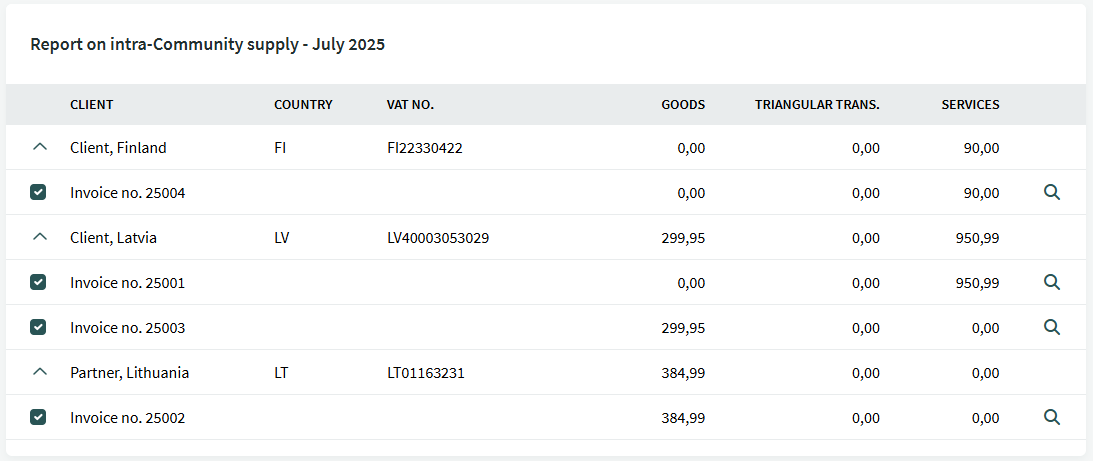

By clicking the expand icon in front of the company name, you can view the invoices included in the total amount.

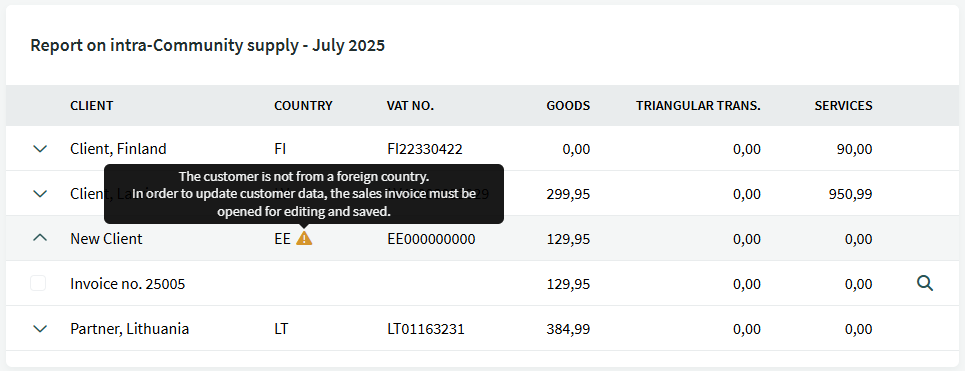

Important For the invoice data to be correctly included in the VD report, the client information must be entered accurately and the correct VAT class must be used on the invoice.The VAT number field (including the country prefix and number, without spaces or dots) and the country field must be filled in.

* Orange triangle in the VD report – the invoice contains incorrect data. Hover over the triangle to see additional information that can help identify the cause of the error.

For example: Changes made to the client card after the invoice was created will not be automatically reflected on the existing invoice. To correct the data, open the invoice for editing, click the pencil icon next to the client name, update the information, and save the invoice again.

Refresh the report data by clicking the “View” button.

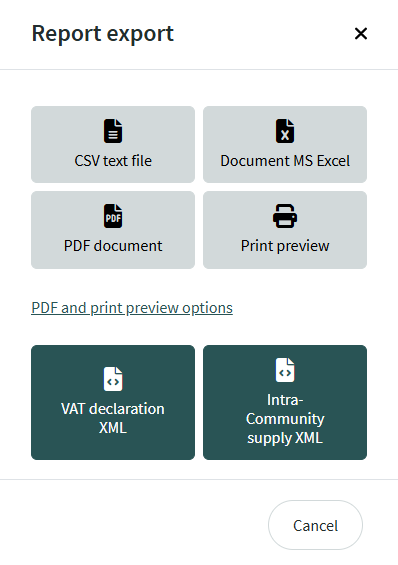

In the opened view, choose “Intra-community supply report XML“, save the file to your computer and then you can import the file into the e-Tax Board.

● Activities in the e-MTA environment

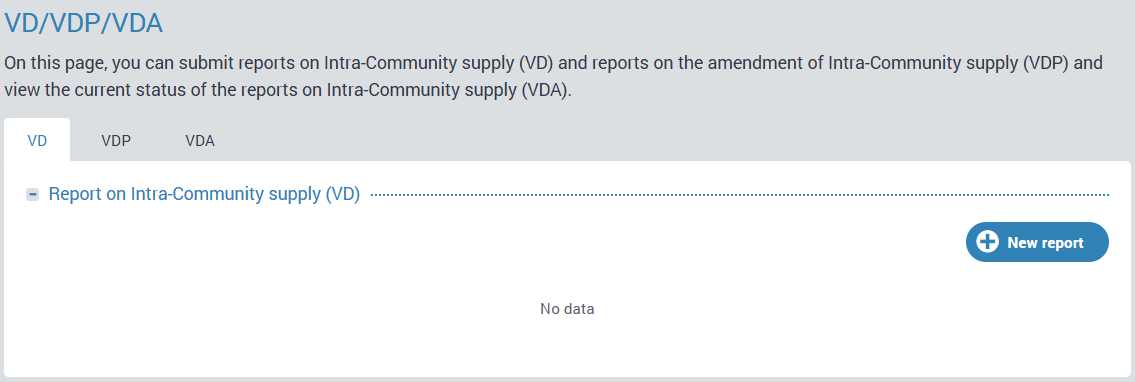

Taxes -> Report on Intra-Community supply (VD) -> New report

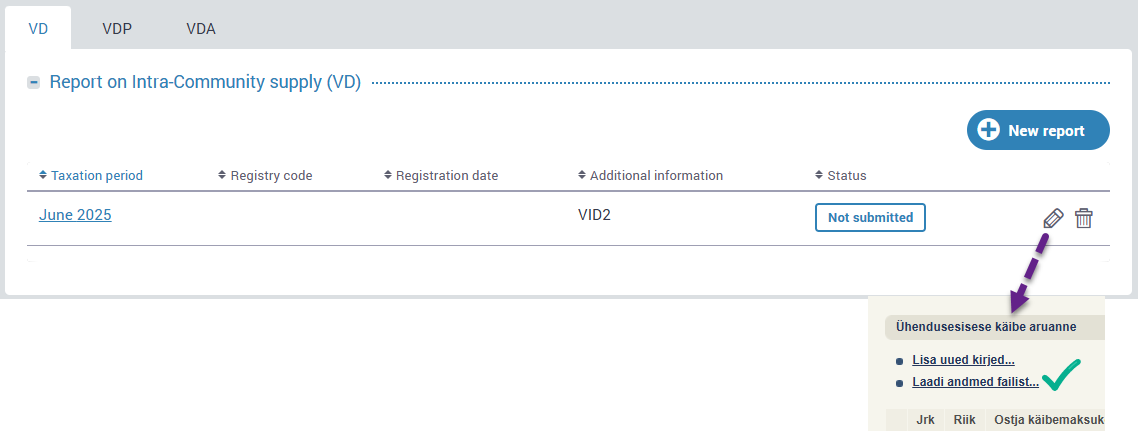

Clicking the New report button creates a report, and you can add data to it by clicking the pencil icon.

In the report view, select “Upload data from file” then save and confirm the report.

If you have any additional questions, please write to us at support@simplbooks.ee

For questions related to the Tax Board environment, please contact their specialists.

Leave A Comment?