When choosing a profit and loss statement scheme, you should consider whether you want to classify operating expenses by their nature or by functionality.

- In Scheme 1 of the profit and loss statement, operating expenses are classified by their nature (e.g., material costs, labor costs). Scheme 1 is generally easier to apply because it does not require allocating costs to different functions within the company.

- In Scheme 2 of the profit and loss statement, operating expenses are classified based on their function within the company (e.g., cost of goods sold, marketing expenses). Scheme 2 is generally more complex to apply because it requires determining which company function each operating expense is associated with. Certain costs (e.g., labor costs) must be proportionally distributed across different functions. This scheme is more commonly used by manufacturing companies.

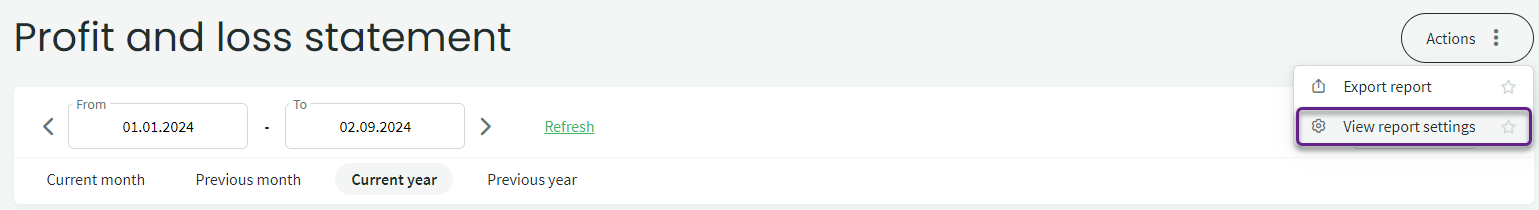

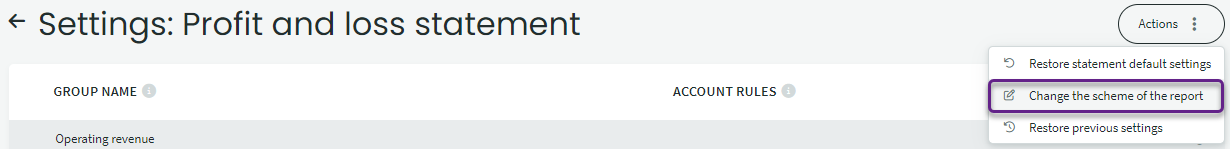

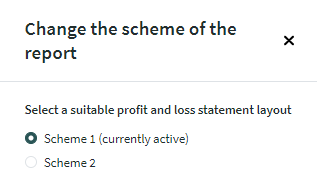

You can change the scheme in the report settings: Accounting -> Profit and Loss Statement -> Actions -> View Report Settings -> Actions -> Change the scheme of the Report.

You can also see which profit and loss statement scheme is currently in use from the report scheme change view.

For additional questions, please write to us at support@simplbooks.ee.

Leave A Comment?