The sum of input value added tax on fixed assets acquired for use in business, included in the sum in row 5, is marked in Row 5.2.

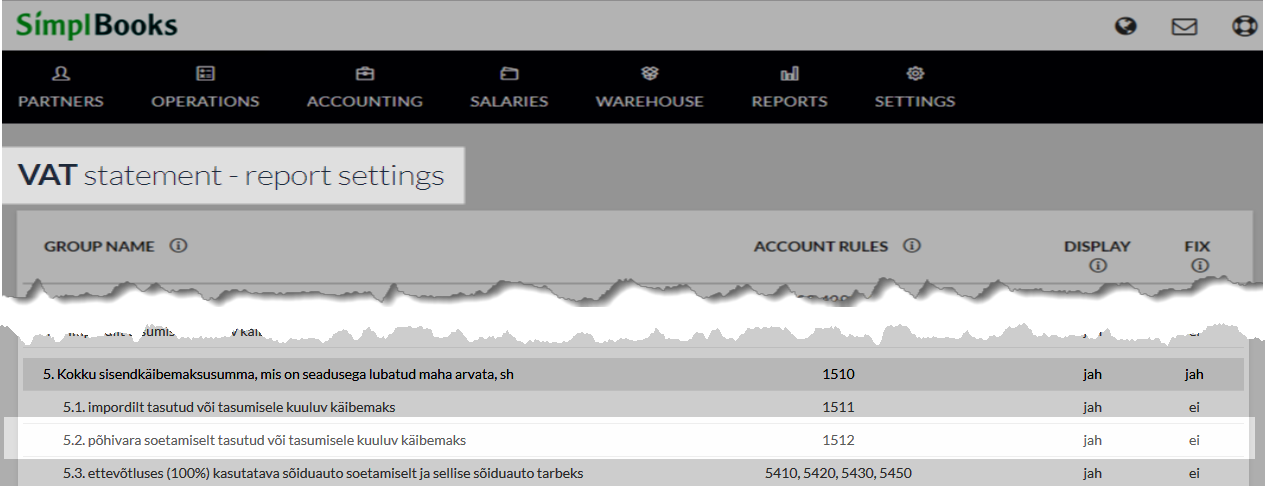

In order for the SimplBooks value added tax report to be able to automatically find the necessary sum for the specified row, when necessary a separate account for the value added tax on fixed assets acquired for use by the business must be created. For example, account code 1512 Value added tax paid on the acquisition of the fixed asset. In addition, the account in question must be added to row 5.2 of the value added tax report.

When entering the purchase invoice for registering a fixed asset the system will automatically prepare a suitable entry, which places the value added tax paid upon the acquisition of the fixed asset in a separate fixed asset acquisition value added tax account (for example, 1512). This of course is subject to the “Fixed asset value added tax upon purchase” field value is specified in the automatic entry settings. If necessary, the financial entry for the purchase invoice can be changed after the purchase invoice is saved, using the purchase operations menu, by selection “Change financial entries“. The input value added tax account for financial entries must be either partially or completely replaced with a fixed asset acquisition value added tax account (for example, 1512).

Leave A Comment?