When entering expenses related to the company’s passenger vehicles, it is necessary to use separate VAT types for car costs so that the input VAT is recorded in the correct lines of the VAT report.

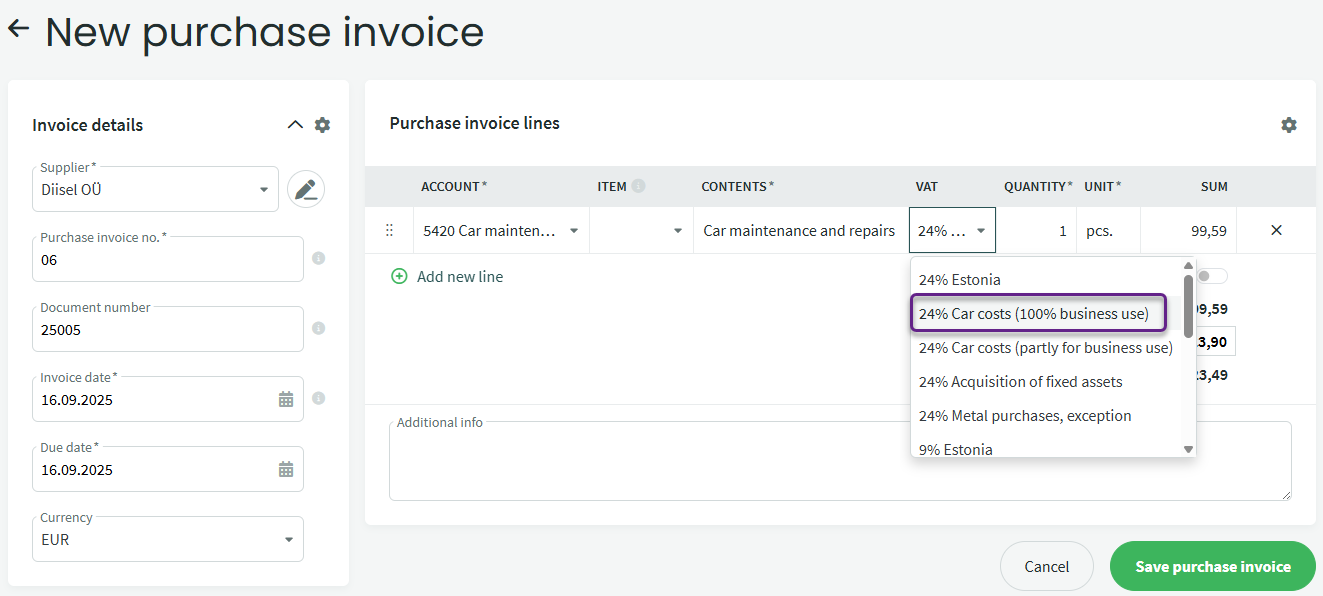

When entering the purchase invoice, select the appropriate expense account and choose the VAT type as “24% Car costs (100% business use)”.

In the purchase invoice entry, the input VAT account 1513 Car costs VAT (100%) is used, which is reflected in the VAT report under line 5.3.

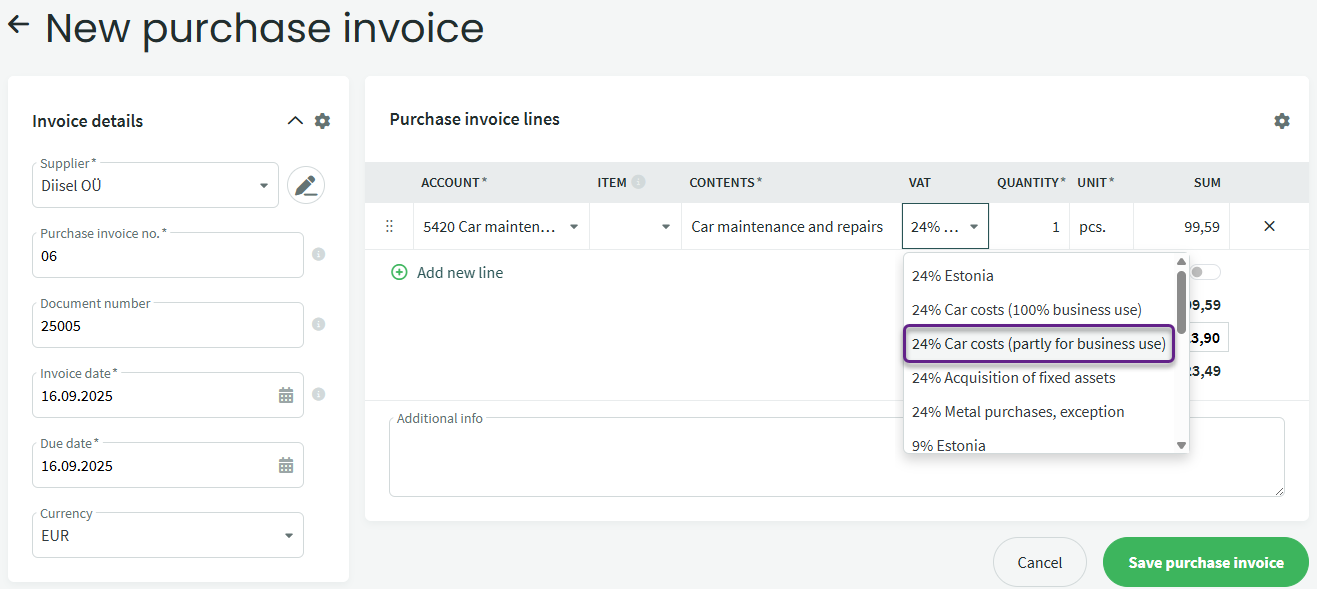

When entering the purchase invoice, select the appropriate expense account and choose the VAT type as “24% Car costs (partly for business use)”.

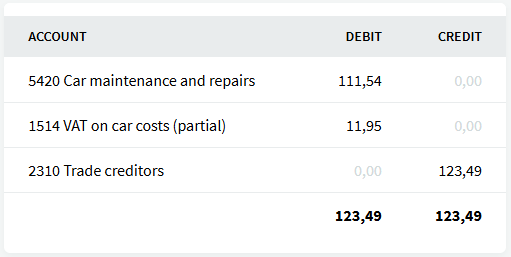

In the invoice entry view, you can see the input VAT amount as it appears on the expense document. When saving the purchase invoice, half of the VAT amount is added to the expense account and the other half is recorded in the input VAT account.

The input VAT account used is 1514 VAT on car costs (partial) which is reflected in the VAT report on line 5.4.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?