Option 1. If the credited sales invoice has been paid (invoice status: paid) and the payment has been made in the bank/cash register on the basis of the credit invoice.

Option 2. If the sales invoice is not paid and no refund has been made in the bank on the basis of the credit invoice created for it. That means no money has actually been moved.

1. Open “OPERATIONS” and select “Invoices”. On the next page select the credit invoice that needs to be offset.

2. Open the selected credit invoice by clicking on the invoice line.

3. Click on “Mark as paid”.

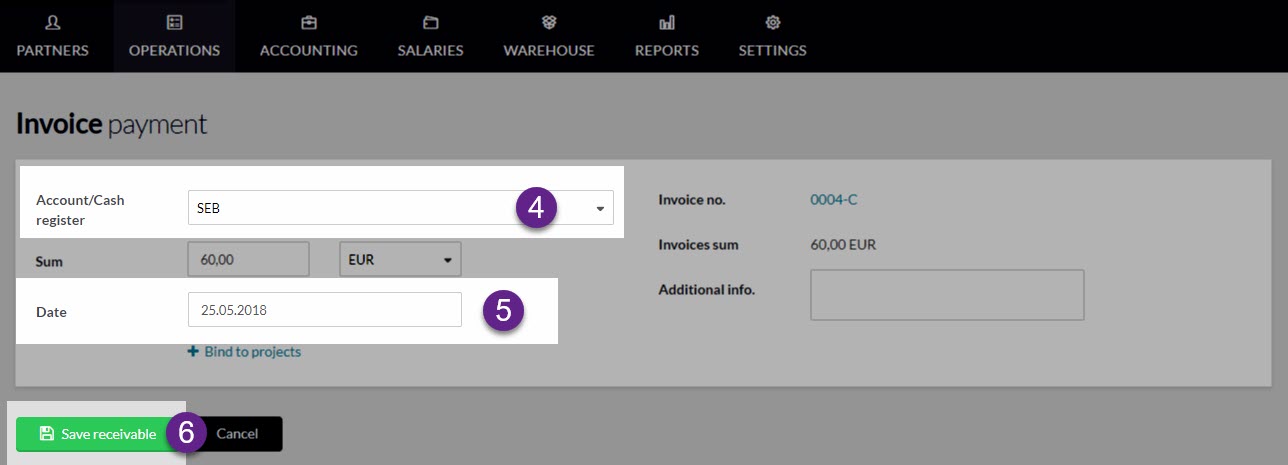

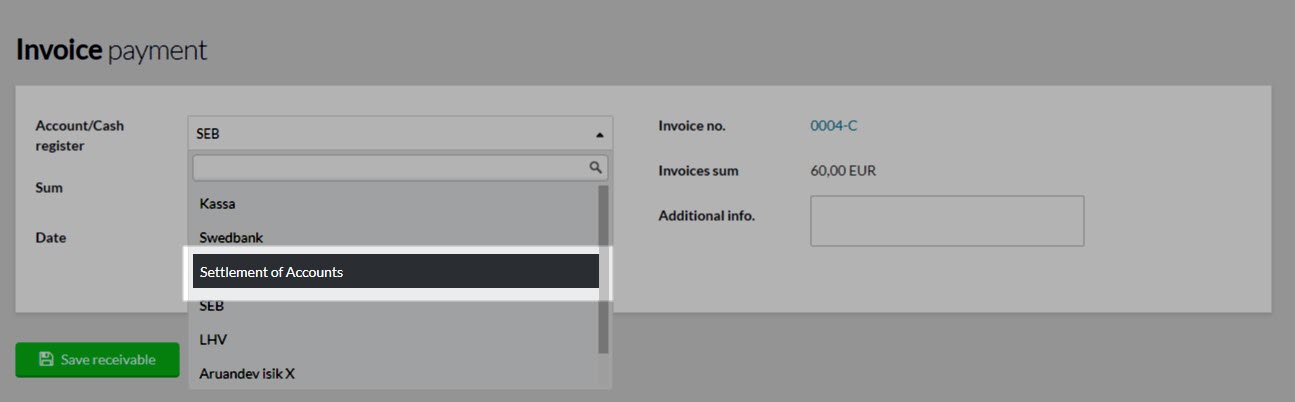

4. For option 1 you must select on the next page the bank account in the “Account/Cash register” field from which the credit invoice was paid.

For option 2 you must select “Offsets” in the “Account/Cash register” field.

5. For option 1 set the date when the credit invoice was paid.

For option 2 set the same date as is set as the date of the credited invoice.

6. Click on “Save receivable”.

7. Only for option 2. Marking sales invoice as paid: you should proceed the same as when manually marking a sales invoice as paid.

- Open “OPERATIONS” and select “Invoices”.

- On the next page select the sales invoice that needs to be offset.

- Open the selected sales invoice by clicking on the invoice line.

- Click on “Mark as paid”.

- Under “Account/Cash register” select “Offsets”.

Leave A Comment?