If you are entering a purchase invoice with which fixed assets have been purchased but after the entry of the purchase invoice into the system a fixed asset information sheet is not created, the situation can be corrected as follows.

A) open the entered purchase invoice for amendment and adjust the accounts on the purchase invoice rows;

B) or manually create a fixed asset information sheet and associate it with the purchase invoice row.

Continue reading to learn how to do so.

A) Purchase invoice adjustment

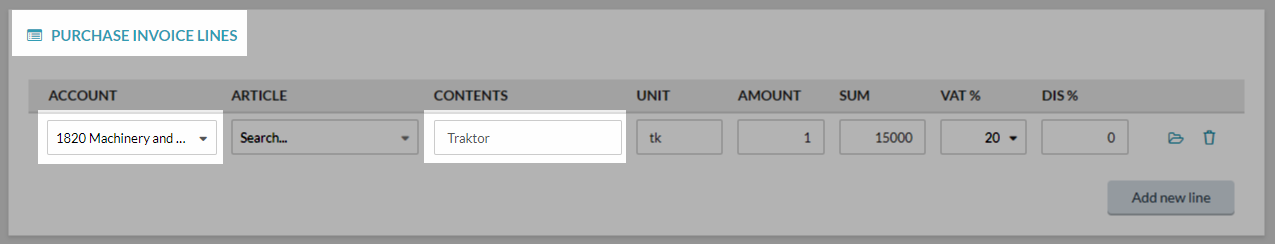

Select “Change purchase invoice“ from the purchase invoice transaction menu. On the form for changing the purchase invoice, adjust the value of the account on the rows associated with the fixed asset in such a way that it would either partially or completely match values in the “Fixed asset account” field in the automatic entry settings.

B) Creating a fixed asset information sheet

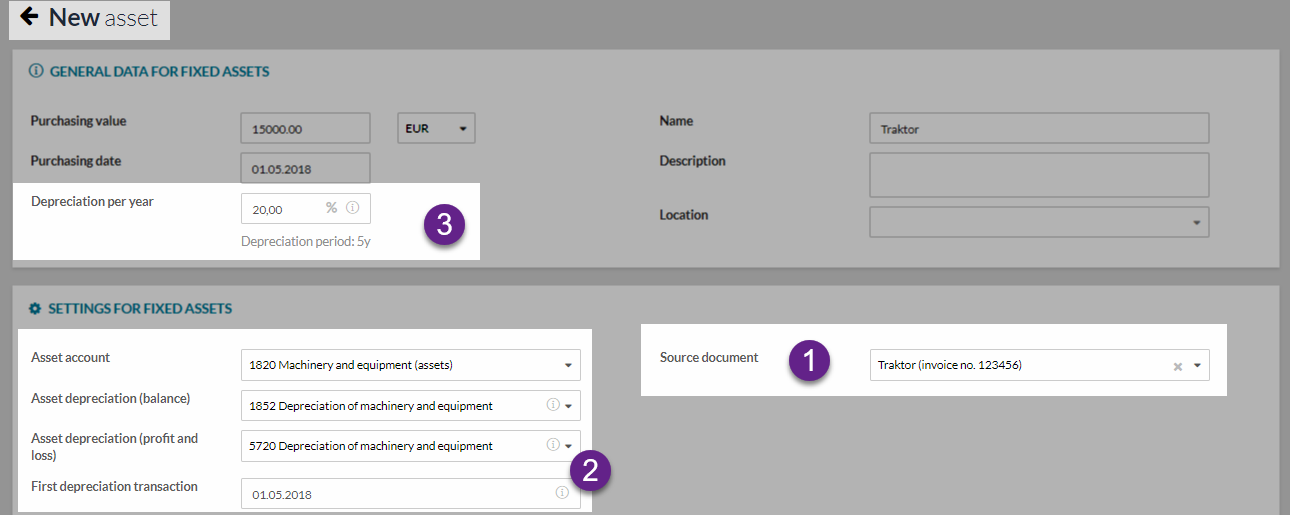

This is a somewhat longer solution, but it is still possible. Open “Accounting – fixed asset” and select from the upper left corner of the list “New fixed asset” (green button). Then begin to select the source document on the form that opens, where you can search for purchase invoice rows (enter part of the content from the purchase invoice row).

After you select the source document (purchase invoice row), the majority of the fixed asset fields are completed automatically and these can no longer be changed – i.e. they must match the data in the purchase invoice row (content, date, value and account).

Additionally, it is possible to also designate some more of the settings associated with this fixed asset card:

- Source document – after purchase invoice row has been selected the majority of the date is loaded automatically to the fixed asset information sheet and can no longer be changed before the association with the purchase invoice is removed

- Depreciation per year – enter the annual depreciation calculation percentage, dependent upon which is the intended period of use of the asset (for example, if the asset’s useful life is set at 5 years, then 20% should be entered here, i.e. 100% / 5 years = 20 %)

- Fixed asset account, Fixed asset depreciation (balance sheet) and Fixed asset depreciation (income statement) – these settings affect the recording of automatic entries

- First depreciation entry – this is the same, by default, as the acquisition date for the fixed asset and should be changed based on the date of preparation of the first depreciation entry.

Click on the button “Save fixed asset”.

Leave A Comment?