For intra-Community goods that you want to track in warehouse , you can use a separate warehouse account (especially if you also purchase goods from Estonia or outside the EU). By default, the primary warehouse account is 1640 Goods purchased for sale – warehouse 1. As a second warehouse account, you can use account 1641 Goods purchased for sale – warehouse 2 (the account name can be changed if desired) or add a new account.

If you are purchasing intra-Community goods that go directly to an expense account, please read the guide: Intra-Community purchases accounting (goods and services)

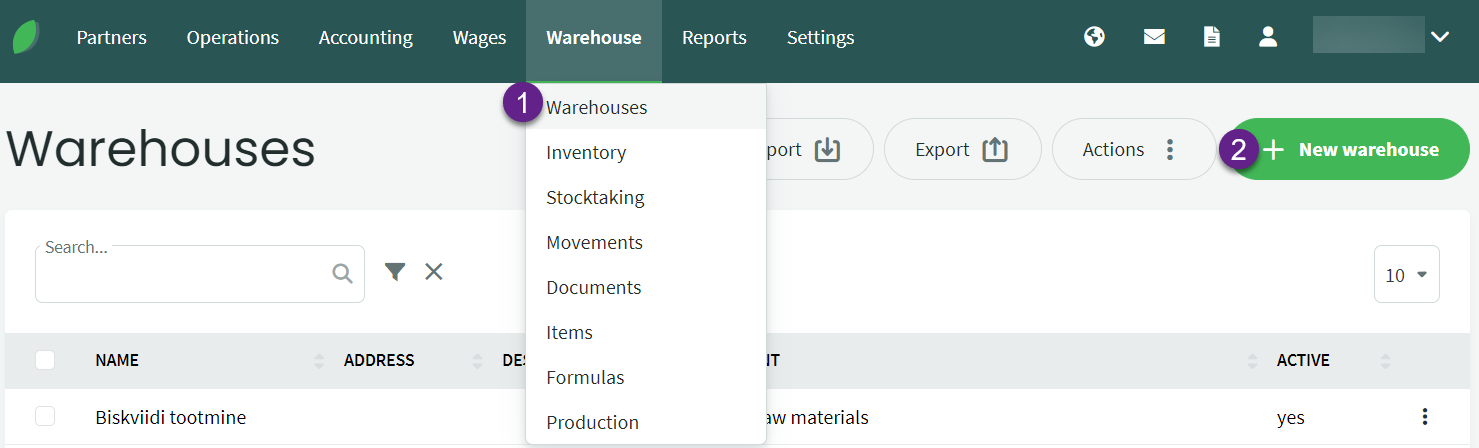

If you add a new financial account for the warehouse, you also need to add it under Warehouses: Warehouse -> Warehouses (1) -> New Warehouse (2).

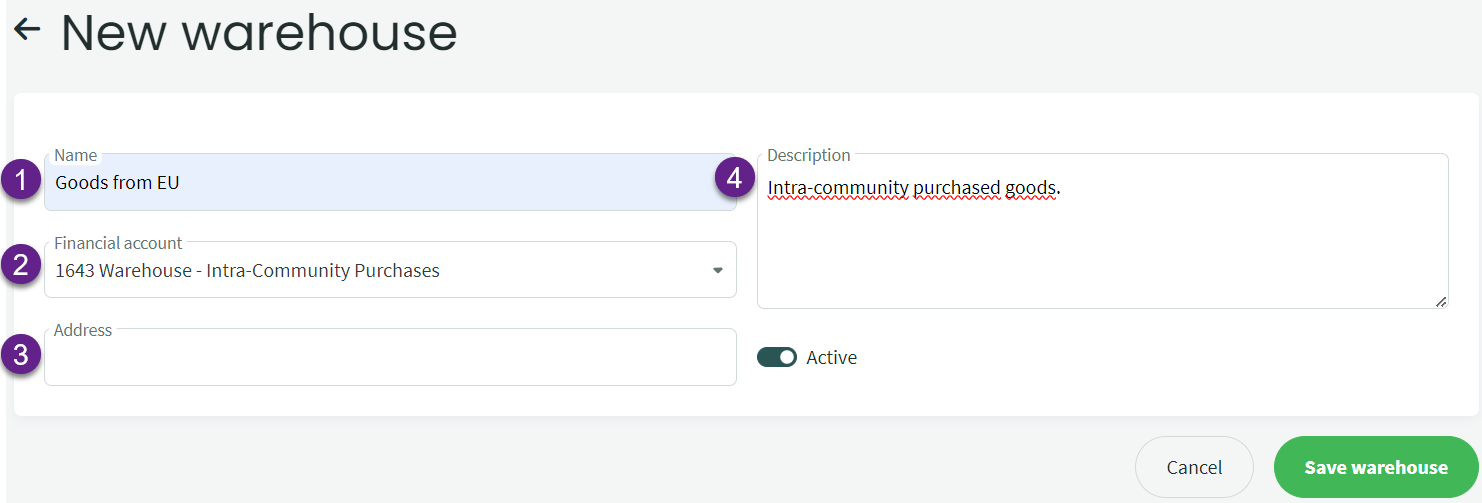

- Warehouse name, which is displayed, for example in warehouse movement reports and inventory.

- Financial account – mandatory field, all movements of goods related to this warehouse are recorded on this account.

- Address – can be added if it is necessary to differentiate locations by address.

- Description – shown in the list of warehouses, additional information, not mandatory to fill in.

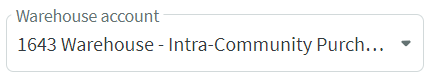

Important For inventory items purchased from another EU country, you need to set the inventory account to the account you want to use.

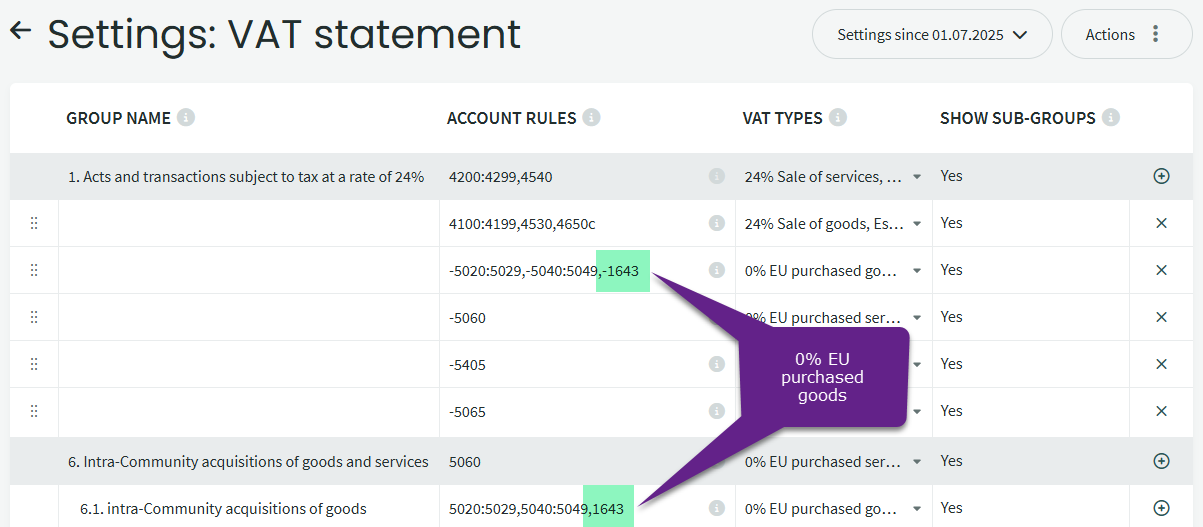

The inventory account should be added to the VAT statement settings in the appropriate lines.

Add the necessary inventory account (for example 1643 Warehouse – intra-Community purchases) to the account rules for line 1 “0% EU purchased goods” under the VAT type. Separate the account from other accounts with a comma, do not leave a space in between and be sure to use a minus sign before the account.

Also, add this account to line 6.1, but now without the minus sign.

If you have any additional questions, please write to u at support@simplbooks.ee

Leave A Comment?