Logbook is useful to keep track of business rides taken with a personal car (categories M1 and M1G). Compensation can be paid for the use of a car that is not owned or possessed by the employer. Thus, the car does not have to be in the personal possession of the user, but its right to use it must be proven. The right of use is fixed either on the vehicle registration certificate or in a attorney prepared by the owner.

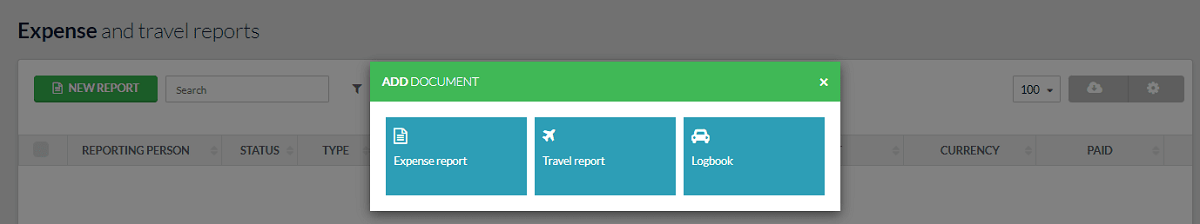

You can find the logbook from „Operations” menu under the „Expense and travel reports”.

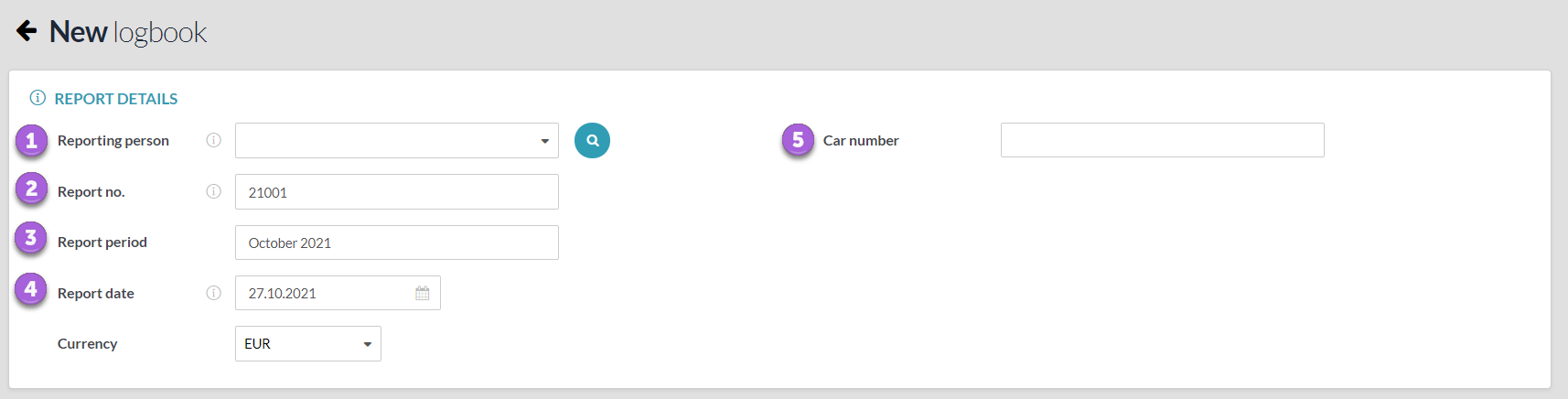

- Reporting person– person who is presenting the logbook

- Report no. – the number is added automatically according to the number formula specified in the settings

- Report period – the logbook is usually compiled per month, the default entry month (editable).

- Report date – an entry in the accounts shall be made on that date. If the amount exceeds the allowable tax-free limit, a special tax entry is also automatically created.

- Car number – you must enter the car registration number here. If one person uses several different cars, a logbook is prepared for each car separately.

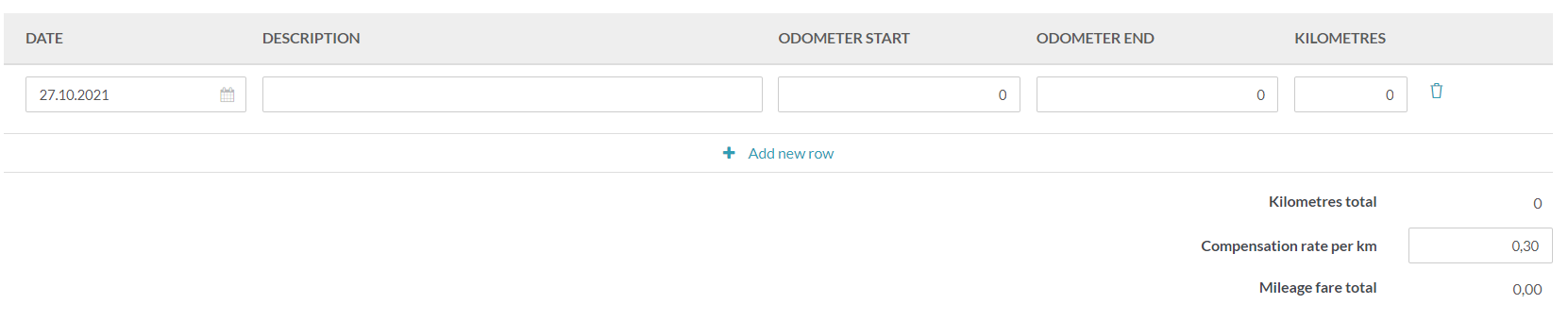

Here, each business trip is marked on a separate line. The kilometers field is calculated according to the initial and final mileage. If you change the kilometers, the final mileage also changes automatically.

The total amount of car compensation is calculated according to the compensation rate. If the amount exceeds the tax-free limit, you’ll see a notification telling you how much the tax-free limit has been exceeded. According to this amount, the entry of the special incentive charges is automatically added to the entry in the logbook.

If the company does not want to pay the special benefit and reduces the amount of compensation, the mileage should be changed so that the correct amount can be calculated.

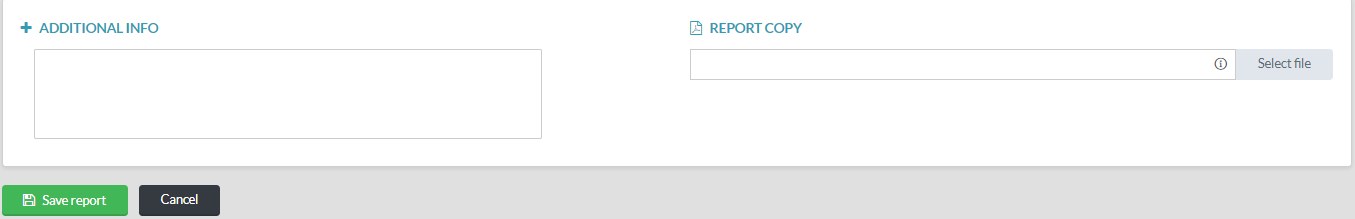

If necessary, you can add additional information to the additional information field.

The copy field of the report is usually left blank and the system generates a report in PDF format, which can be saved as a cost document or printed out if desired.

If all data is correct, then save the report.

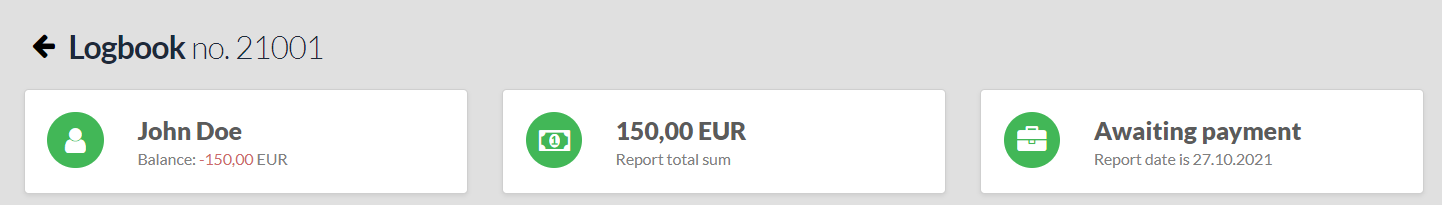

After saving your report, you’ll see the balance associated with the reporting person, the amount of this report, and the status of your report (unpaid or paid) in the header. If the same person is also unpaid for the expense report and / or the posting report, you will see the total amount due in the balance.

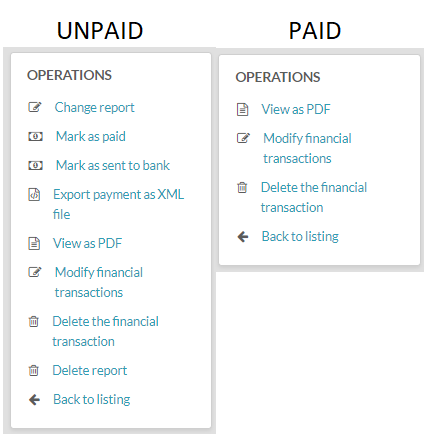

Operations menu options depend on whether the report is pending or in a paid status. To make a payment to the reporting person, you can create a payment file or send the payment directly to the bank (if Swedbank or LHV banking interface is activated).

If necessary, an advance payment can also be made to the reporting person. In this case, it must be saved under Operations -> Payments in the name of the reporting person and after entering the report, linking the report to the payment.

Tip You can also view the balance of the reporting person in Reports -> Reporting Persons. You can also see the transactions related to the reporting person (payments, expense reports) when you go to Partners -> Clients and suppliers, you open the reporting person’s card. In the Operations menu, select “View Transaction Statement”, select the period of interest and click the “Generate” button.If you have additional questions, feel free to contact us support@simplbooks.ee

Leave A Comment?