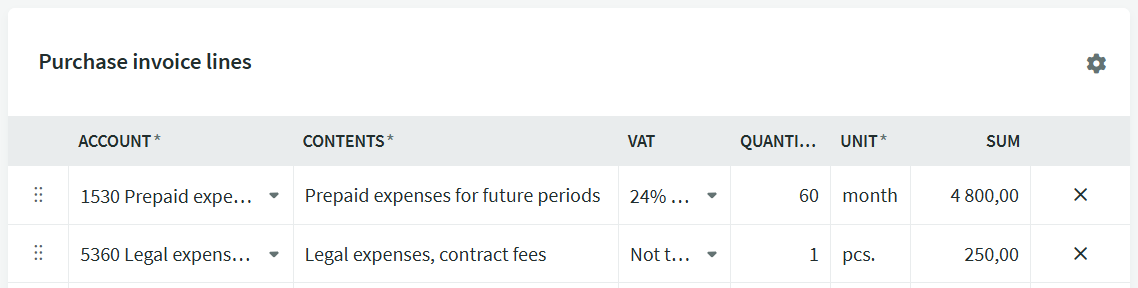

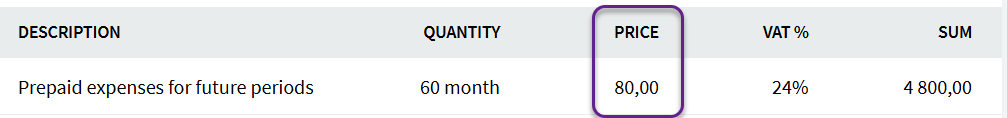

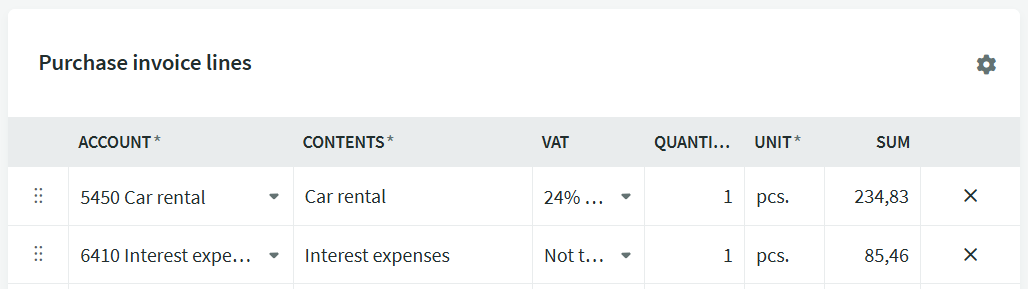

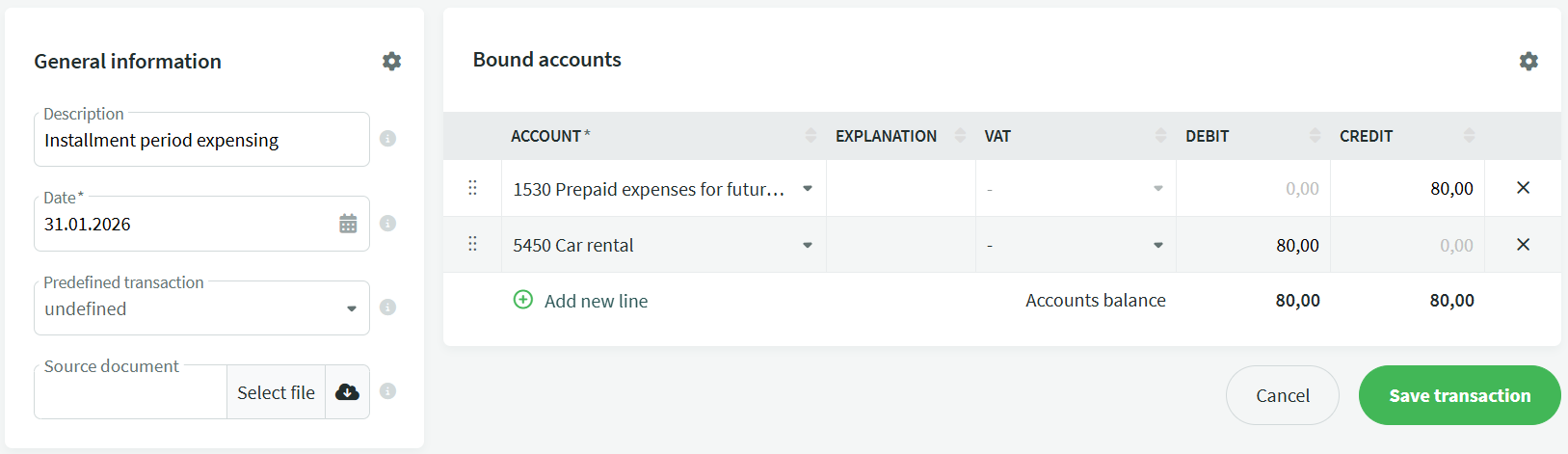

When an operating lease agreement is concluded, an initial payment invoice is usually issued. The amount is first recognized in the balance sheet as a prepaid expense and recorded as an expense over the lease term.

An example with a lease period of 5 years (60 months) has been used. The leased asset is a van, so the VAT type applied is 24% Estonia. For a passenger car, the VAT type should be selected based on its usage (100% or partial).

Useful reading:

ASBG 9 Accounting for leases

ASBG 5 Property, plant and equipment and intangible assets

All translations of the Accounting Standards Board guidelines can be found on the Ministry of Finance website.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?