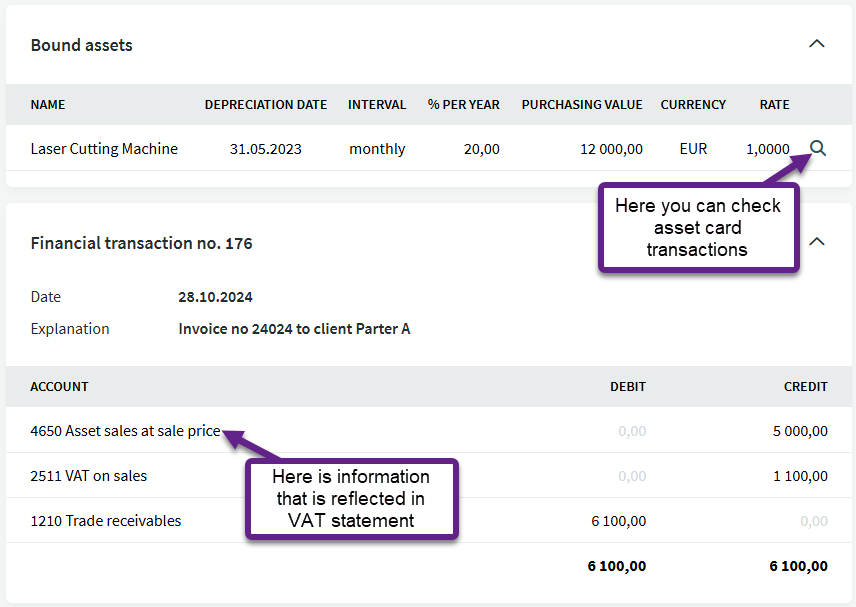

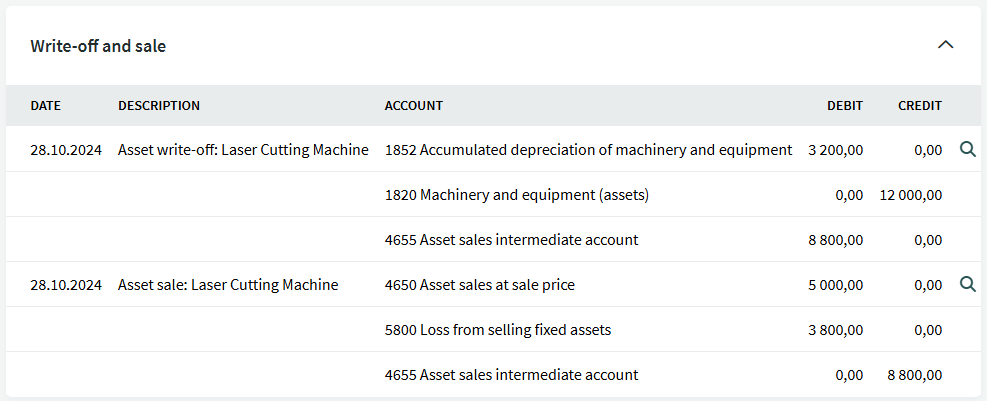

1 The most convenient and correct way to record fixed asset sales in SimplBooks is through a sales invoice. When entering the sales invoice, select the fixed asset in the additional information field (accessible via the magnifying glass icon), linking the sales invoice and the fixed asset card.

Important When selling fixed assets, do not use articles, as this prevents the system from creating the correct transactions for fixed asset sales and write-offs.

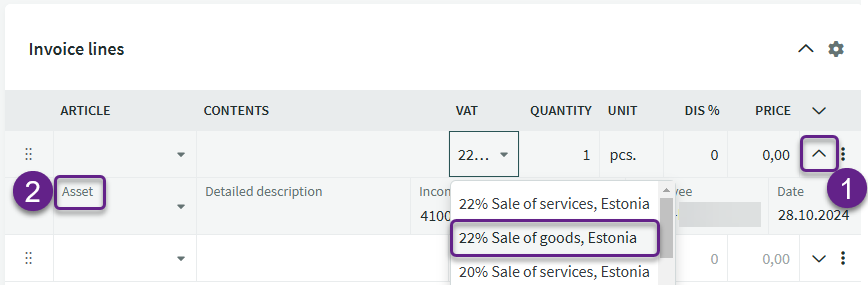

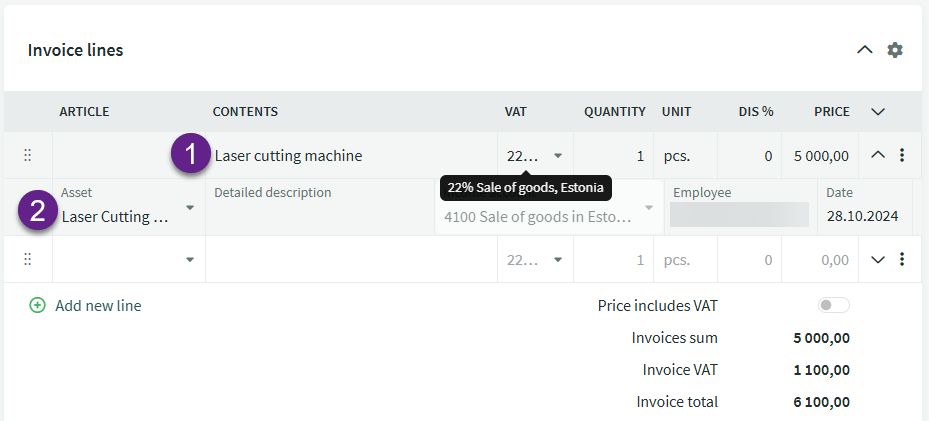

2 Enter the name of the fixed asset being sold in the “Contents” field, specify the sales price and in the detailed description field, start typing the name of the fixed asset in the “Asset” field and click on the name to select it. The income account associated with the fixed asset sale cannot be changed on the invoice, so it is inactive here.For fixed asset sales, use the VAT type “22% sale of goods, Estonia.”

- Content – fixed asset name

- Asset – enter the name from the system’s fixed asset card here

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?