There are two options in the SimplBooks system for formalising the sale of fixed assets.

A) if the sales invoice has already been entered, then it is possible to specify a connection on the fixed asset information sheet

B) if you are currently entering or changing the sales invoice, then the connection to the sale of the fixed asset can be specified on the sales invoice

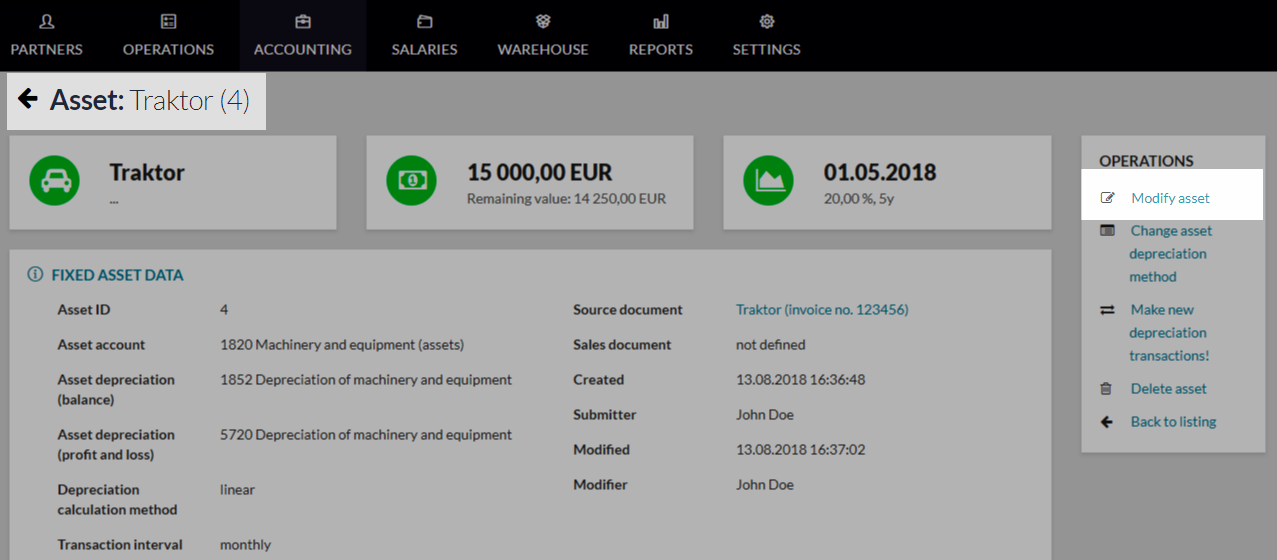

A) entry of the connection for the fixed asset sale from the fixed asset information sheet

If the sales invoice has already been entered but has not yet been associated with the fixed asset, then open the list of fixed assets from the main menu “Accounting – fixed asset” and click on the sold fixed asset’s row. Then select “Change fixed asset” from the transactions menu.

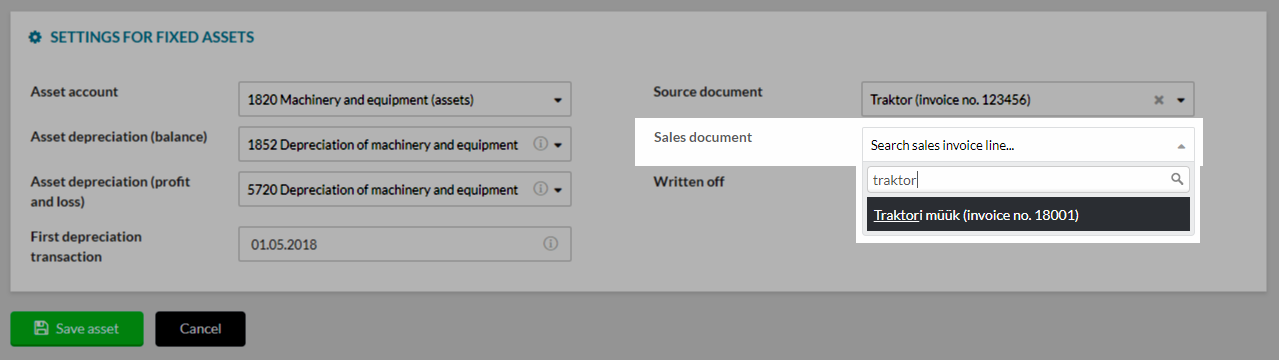

In the change view, directly below the selection area on the source document (purchase invoice row) there is now a field “Sales document” where you can enter the specific sales invoice row with which the fixed asset was sold. To do so, simply begin to type the sales invoice row content on the sales document and the system will automatically offer suitable variants from which you can make a selection.

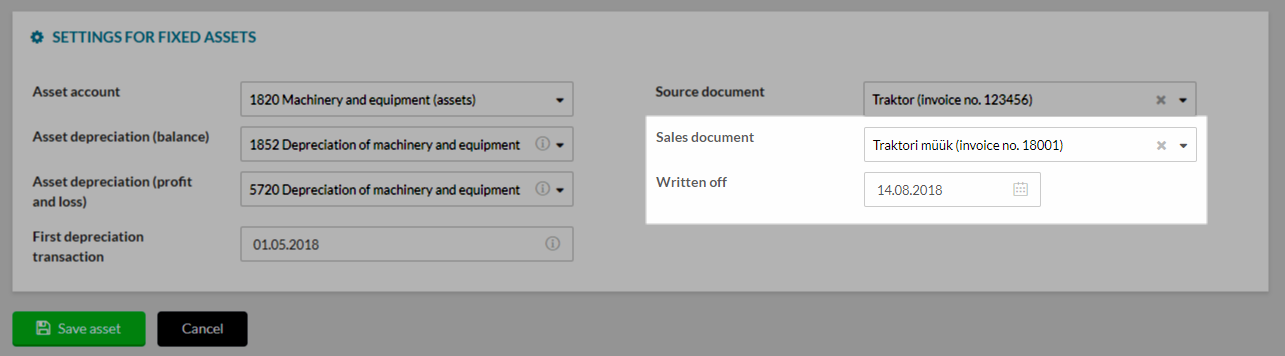

After selecting a suitable sales invoice row for the sales document field, the fixed asset write-off date field is also completed automatically, the value of which is the date on which the sales invoice was prepared.

After specifying the sales document, click on the button “Save fixed asset”.

B) entry of the sales invoice along with the sale of the fixed asset

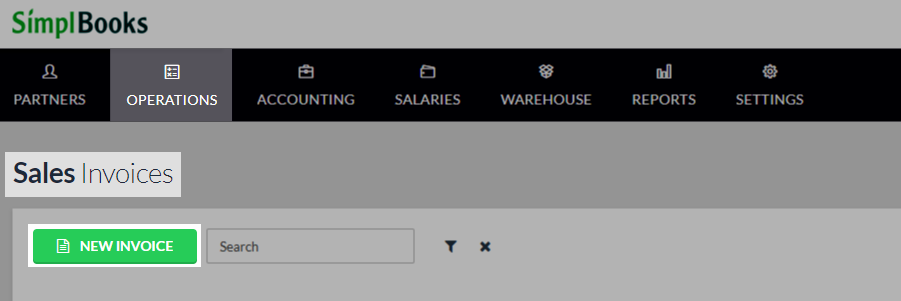

The sale of the fixed asset can be formalised directly while entering the sales invoice. To do so, do as you normally would when entering a sales invoice and select “Operations > Sales invoices” from the menu and then click on the “New sales invoice” button in the upper left corner of the list.

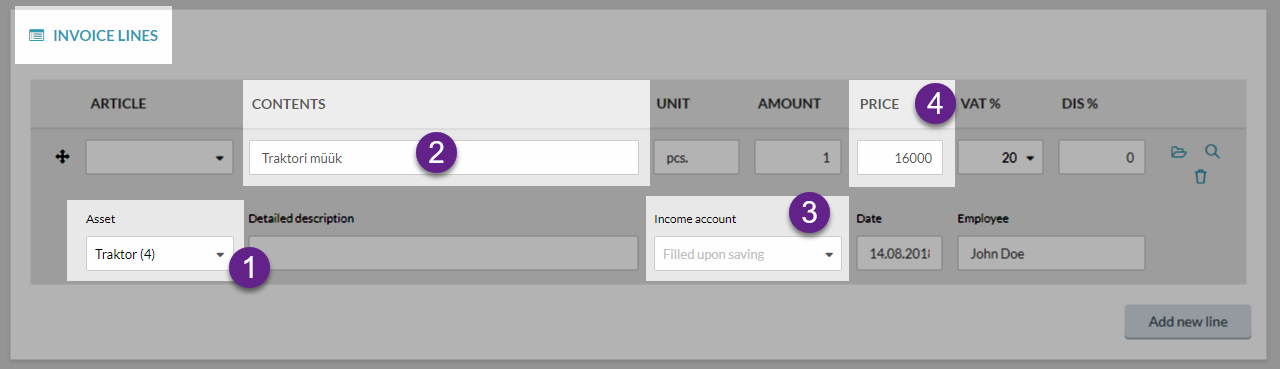

When completing the sales invoice row you should now click on the magnifying glass icon at the end of the row, after which an additional row of fields will open for the sales invoice.

- Fixed asset – select a fixed asset that you would like to sell

- Content – content of the invoice row displayed on the sales invoice, which does not affect the fixed asset or the entries associated with its sale

- Income account – is completed after the saving of the sales invoice, depending on whether the fixed asset is sold below or above its residual value

- Price – the amount, net of VAT, for which the fixed asset is sold

If the sales invoice rows and other fields are completed, then click on the “Save sales invoice“ button at the bottom of the form. If saving is successful, then the associated fixed asset will also be displayed in a separate panel in the sales invoice view.

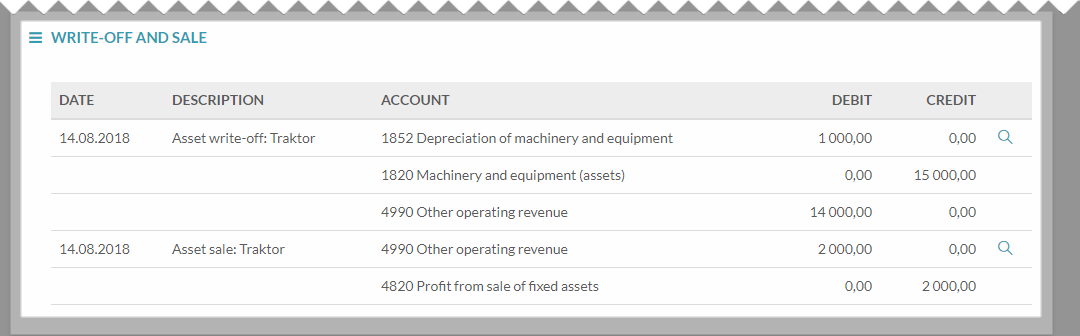

Saving the sales invoice will also result in changes to the associated fixed asset entries, such that entries for the sale and write-off of fixed assets will be prepared.

Automatic financial entry accounts associated with the sale and write-off of fixed assets can be affected through the settings for automatic entry “Settings > Automatic entries > Fixed assets“.

Leave A Comment?