This guide includes references to the initial settings you may want to review in relation to sales invoices, as well as explanations of the different fields in the sales invoice entry view.

Reminder If the has not been saved, no transactions will be generated for the documents. ● Before creating your first sales invoice, it’s important to decide the invoice numbering format.By default, the format is set to use the year followed by three digits. You may also want to consider using a reference number, which makes it easier to match incoming payments with invoices during bank import.

Both the number format and reference number settings can be set up under Settings -> Environment settings -> Invoice settings in the section . ● While you’re in the invoice settings, it’s a good idea to review the invoice templates as well. Choose a preferred one from the existing templates or create a new one. You can read more about how to do that . ● If you want the system to automatically send reminders to customers about unpaid invoices, you can set this up under Settings -> Environment settings -> Invoice settings in the section . ● If your company is registered for VAT, make sure to review the as well.

● To enter a new sales invoice, go to Operations -> Sales invoices -> New invoice

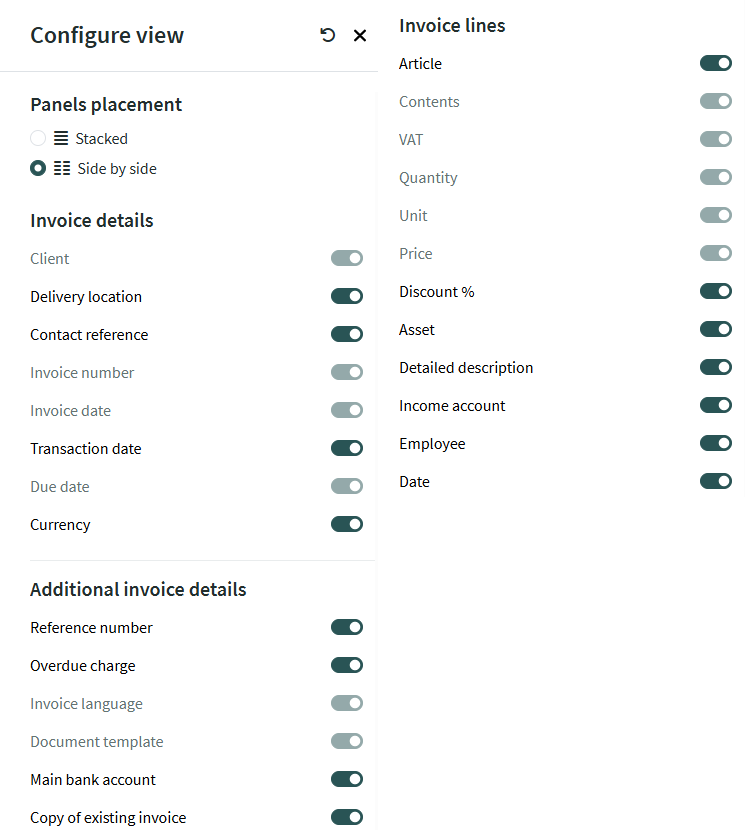

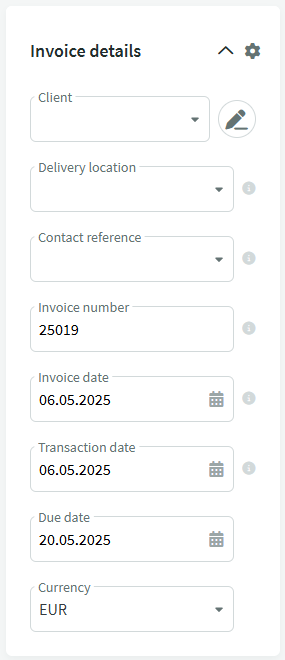

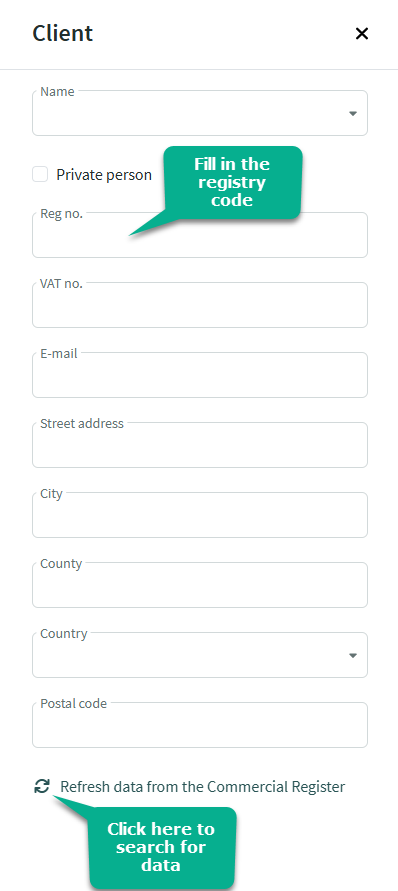

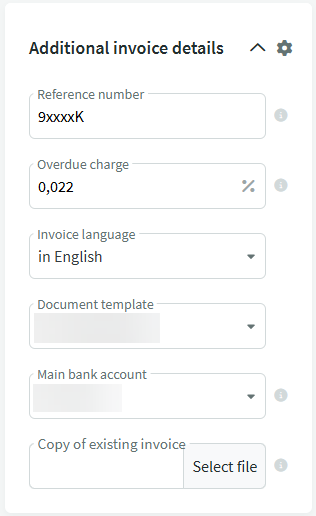

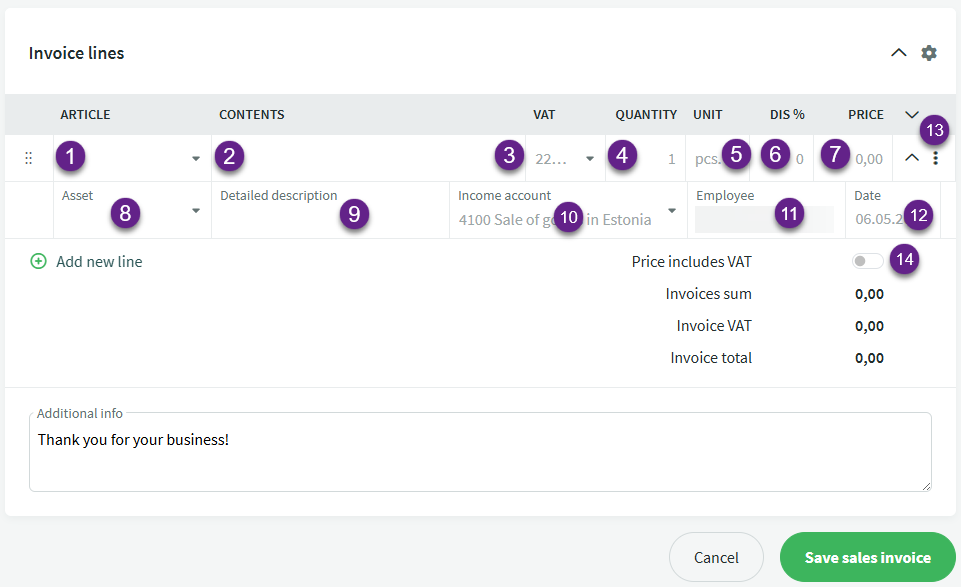

● Below, we’ll take a closer look at the different panels and configuration options. Click on a topic to read more detailed information.

The key combination Ctrl + L adds a new document based on your current location (sales invoices, purchase invoices, orders, transactions). ● If you have made changes based on the invoice and want to see them on the already saved invoice, open the invoice for editing and save it again. This will update the invoice PDF. ● If the company has multiple bank accounts and you want the customer to pay to a specific bank, create multiple invoice templates where only the necessary bank account is displayed. On the customer card, you can set the default invoice template for the customer (in the Client/supplier settings section).

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?