Both starting companies and companies already operating have to enter initial balances when they first start to use the Simplbooks accounting software. New transactions cannot be made until the initial balance is entered for at least one account. If initial balances are unknown or they are all zeroes for another reason, the initial balance should still be entered for at least one account, which may be zero.

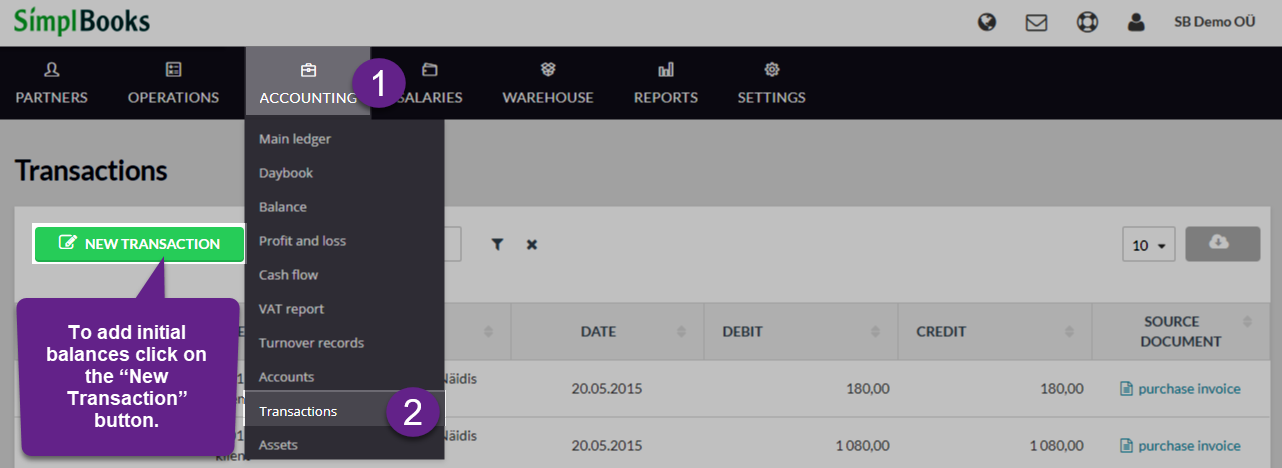

Initial balances can be entered by selecting “Accounting” from the main menu and then “Transactions” from the drop-down menu. On the next page click on “NEW TRANSACTION”.

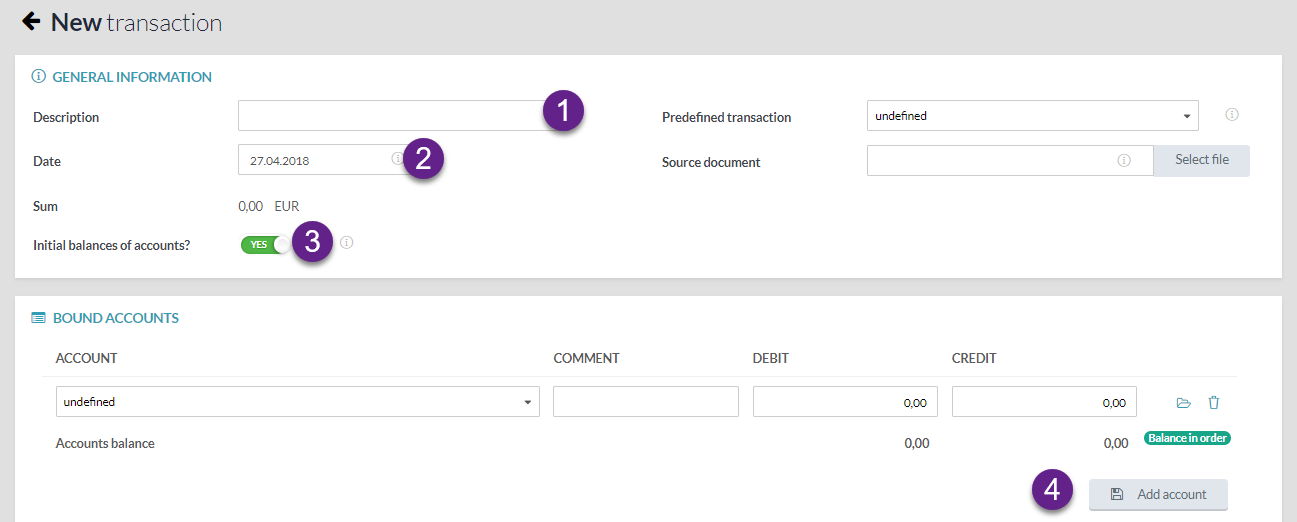

The Description box (1) is not required and it need not be filled in, however it is recommended for the purpose of later understanding the entered information. For example, for initial balances you may use the keyphrase “Initial balances as of …”.

The Date of an initial balance (2) is generally the starting date of the company’s financial year as set out in the commercial register or the start of the relevant financial year. If a company already operating starts to use the software in the middle of the financial year, the date should be the first day of the first accounting period for which Simplbooks is used (e.g. 1 January 20XX).

To add a new account, click on “Add account” (4).

Initial balances should be entered as one transaction. If necessary, transactions may later be changed. Only if initial balances have been entered the system allows different debit and credit of the total amount of a transaction or to leave both zeroes.

Simplbooks does not allow entering an amount with a minus sign. Instead of the minus sign the credit or debit of the relevant account should be used.

When entering an initial balance, the profit/loss of accounting period for the previous period (e.g. account 3700) shall be added to the retained profit/loss of previous periods (e.g. account 3600) and entered in the account. The profit/loss of accounting period account is an exceptional account where no initial balance should be entered. For this account the system calculates current profit/loss on the basis of income statement accounts.

Leave A Comment?