The VAT statement (KMD) and appendices INF A and INF B can be sent directly to the Estonian Tax and Customs Board from SimplBooks once the has been activated.

The statement can still be submitted using a file. By selecting “Export” from the Actions menu, the file download view will open. To save the VAT statement file, select “VAT declaration XML”. You can find more information on this topic .

Before sending the statement to the Tax and Customs Board, check that all data is correct to avoid the need for corrections later.

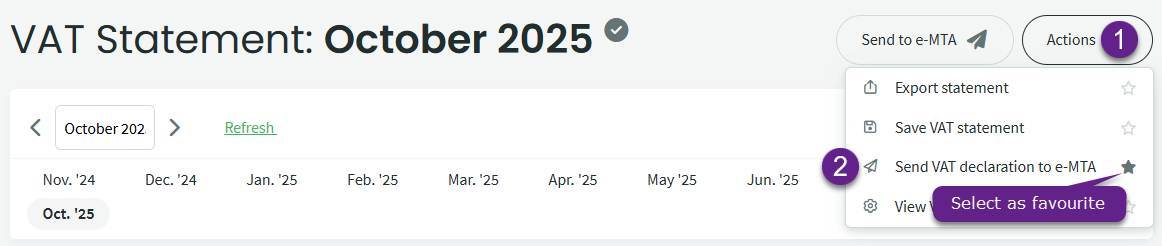

From the Actions menu, select “Send VAT declaration to e-MTA“. For convenience, you can mark it as a favourite so that the button is visible next to the Actions menu.

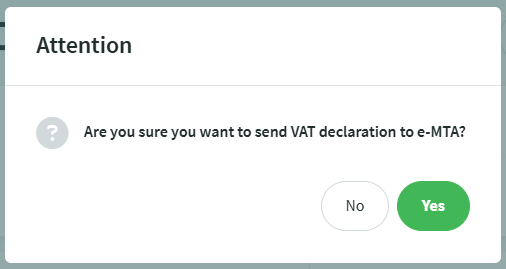

To prevent the statement from being sent accidentally, a confirmation window will appear. If you were not yet ready to submit the statement, you can either cancel here or confirm that you wish to submit the data to e-MTA.

When the statement has been successfully submitted, a confirmation message will appear at the top of the statement view on a green background. If the statement was sent in an unconfirmed status, this will also be noted in the message.

Tip If the integration settings specify that the statement is sent in an not confirmed status, you will need to log in to e-MTA and confirm the statement there. If the integration is set to send the statement as confirmed, no further action is required.When the statement is submitted, both the statement and the closing transaction for the VAT accounts are saved. The grey indicator next to the reporting month turns green. The colour shows whether the statement has been saved or not.

If you make changes within the period of a saved statement that affect sales revenue and/or VAT amounts, the corresponding row is highlighted in red. Hovering over the number displays the amount from the previously saved statement. If the changes affect the INF appendices, warnings are also shown there.

When submitting data to e-MTA through the integration for the first time, the user must identify themselves using an ID card or Mobile-ID. You won’t need to do this in the future.

Ensure that the person submitting the VAT statement has a valid access right in e-MTA, either “Administering value added tax returns (form KMD)” or “Accountant’s package”.

The cannot be submitted directly to e-MTA and must be submitted from a file.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?