Settings -> Environment settings -> VAT classes

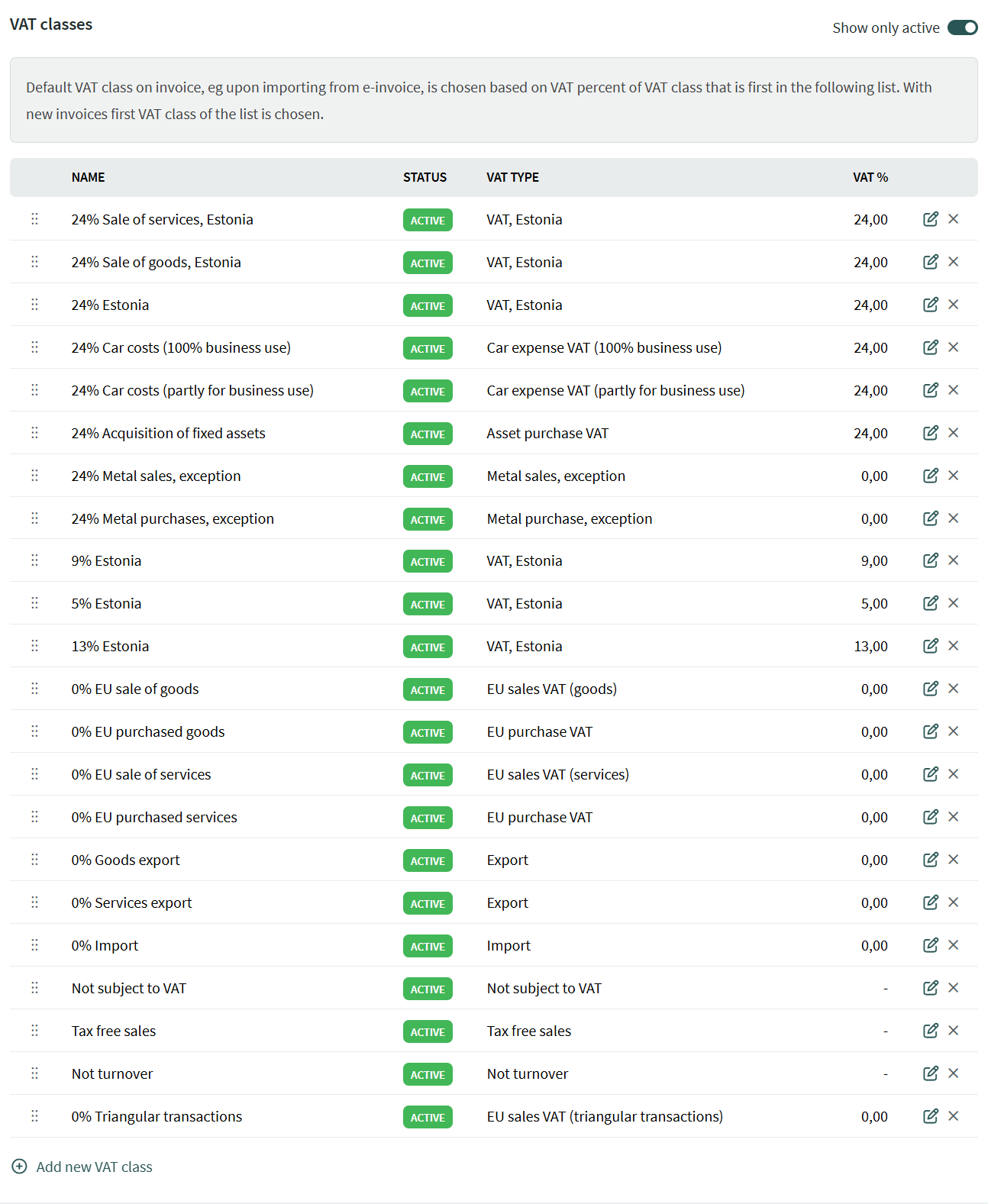

VAT classes are preconfigured by us for the most common situations. You can also add additional classes yourself based on your company’s specific needs.

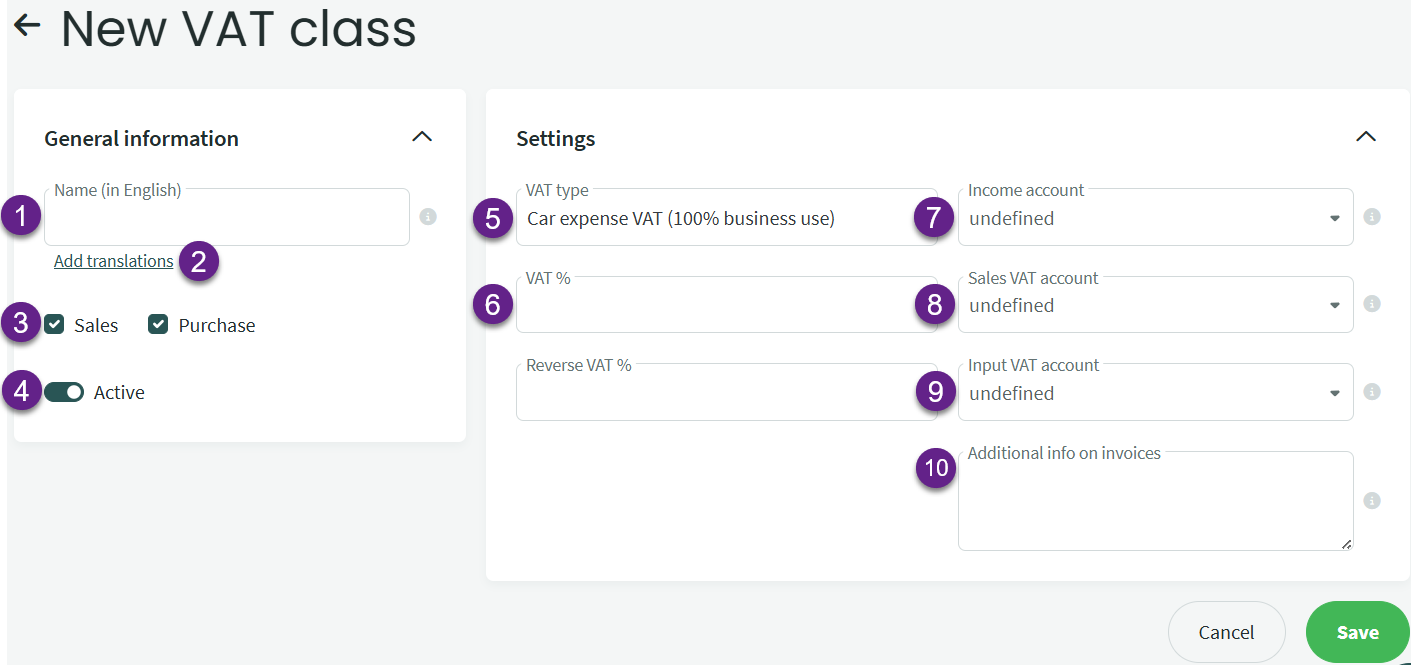

By clicking the pencil ![]() icon, you can modify the settings of VAT classes. For preconfigured classes, you can only change the financial accounts.

icon, you can modify the settings of VAT classes. For preconfigured classes, you can only change the financial accounts.

You can change the order of VAT classes by grabbing the “dots” on the left side of the row and dragging them to the desired position.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?