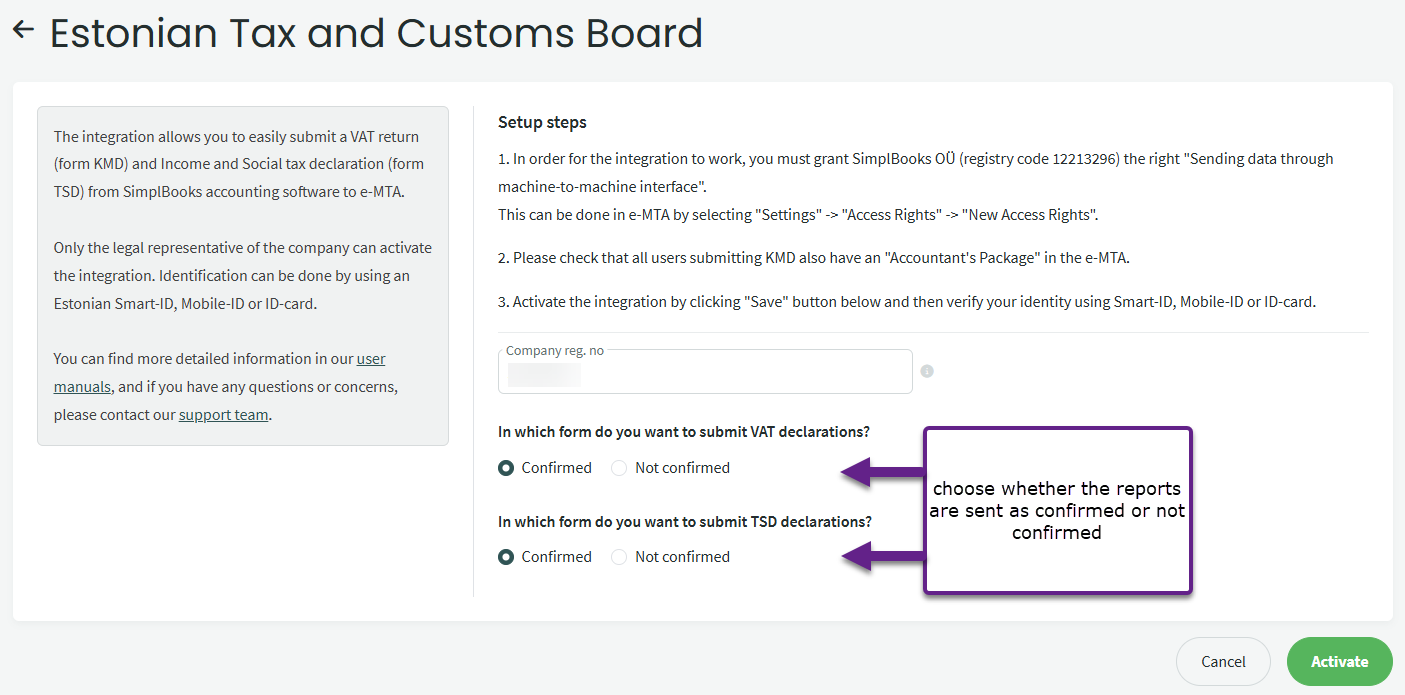

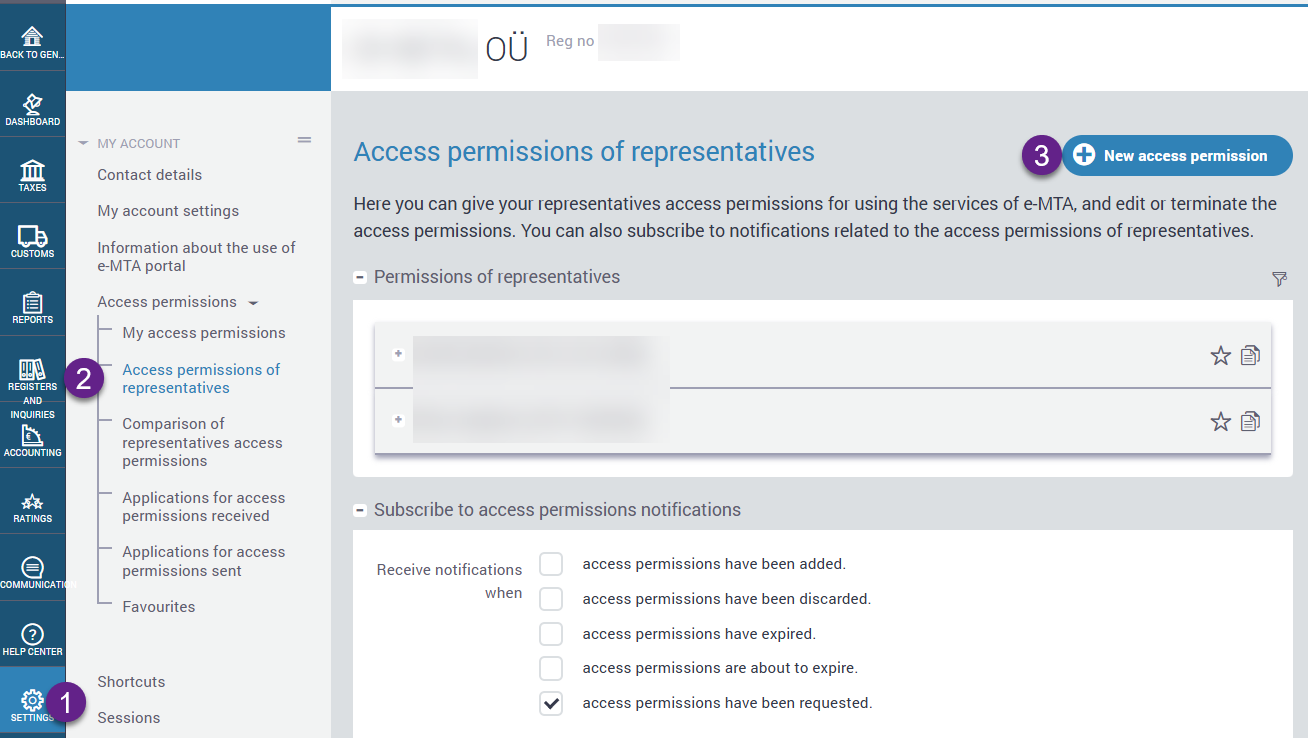

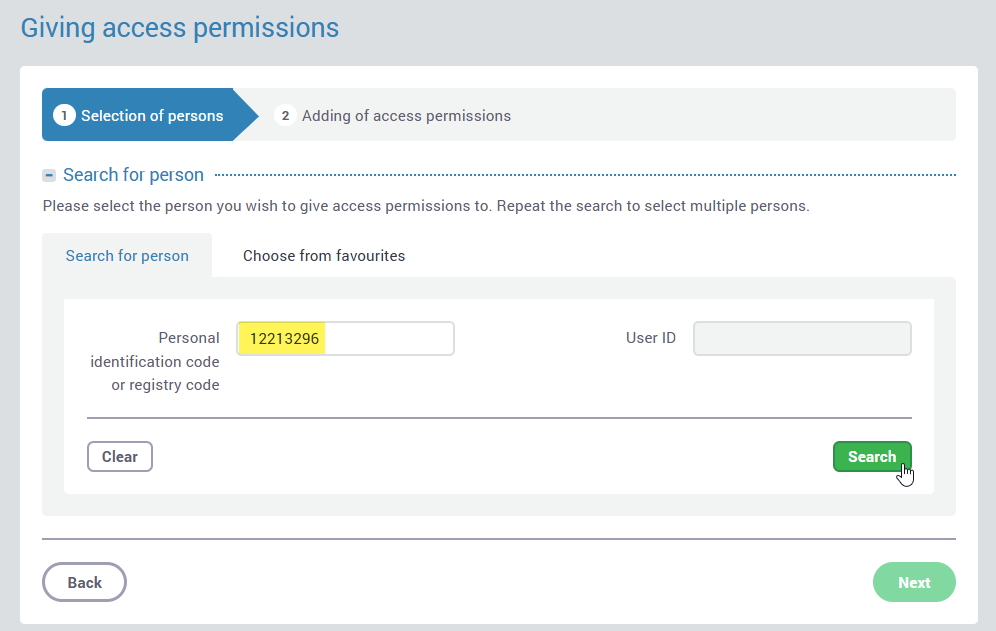

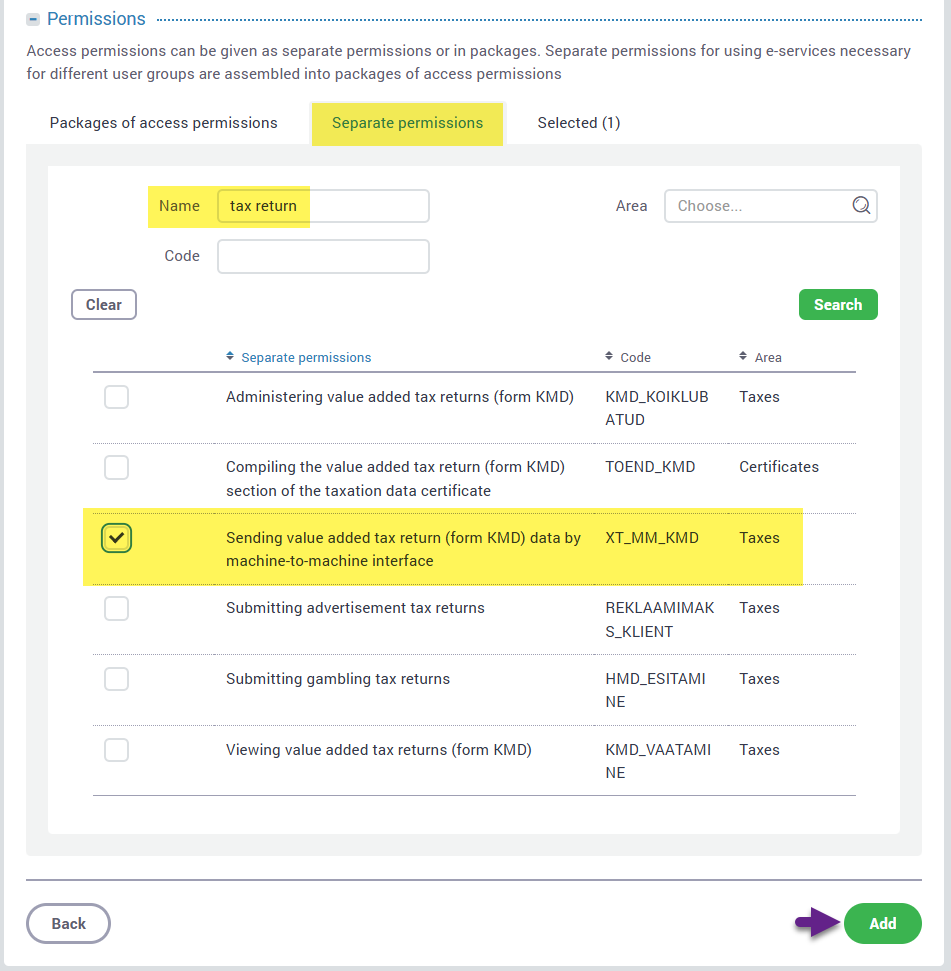

Integration with the e-Tax Board enables you to send VAT declarations (KMD) along with appendices INF A and INF B, as well as TSD declarations, directly from the software to the Tax Board.

It is not possible to send the intra-Community supply (VD) report to the e-Tax Board.

You can read about submitting VAT return in this guide: Sending a VAT return to the e-MTA via the interface

If you have any additional questions, write to us at support@simplbooks.ee.

If you have any questions about the e-MTA environment, please contact e-MTA directly.

Leave A Comment?