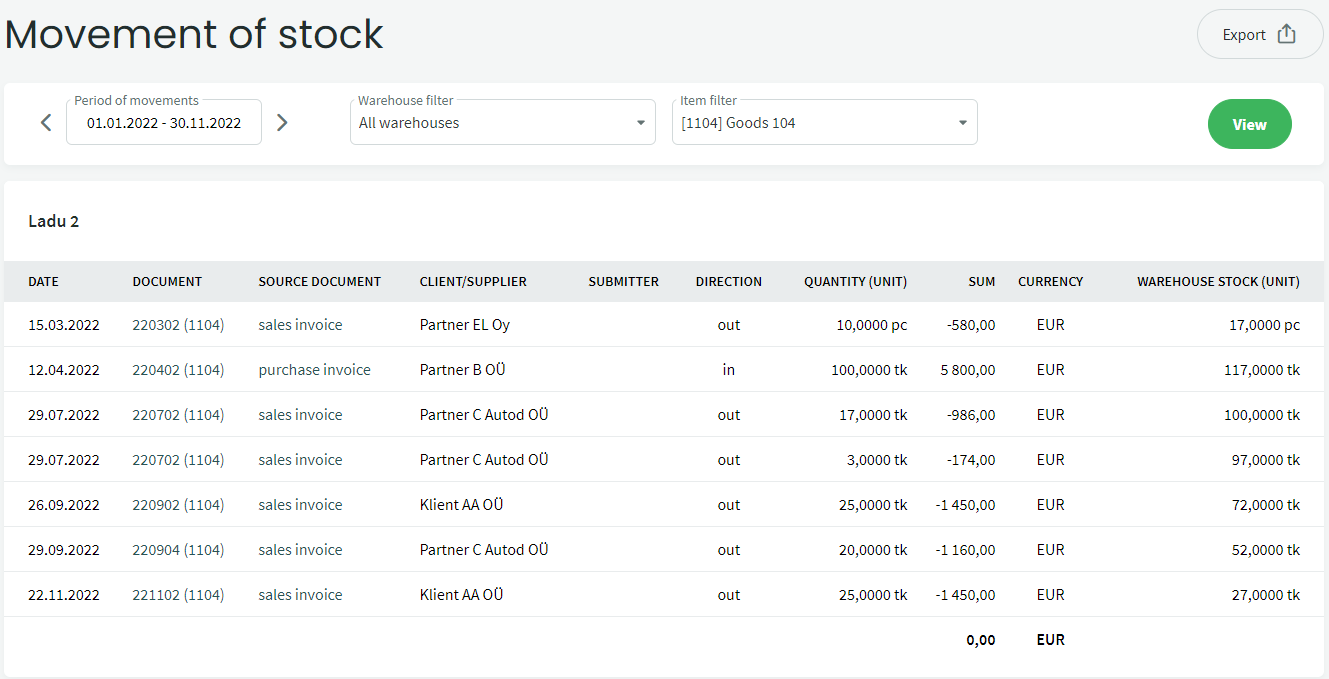

To create a credit note, first open the invoice through which the item was entered into the inventory. If the invoice number is not known, you can find it under inventory movements by using the item filter.

Now you can see the item’s movements during the selected period.

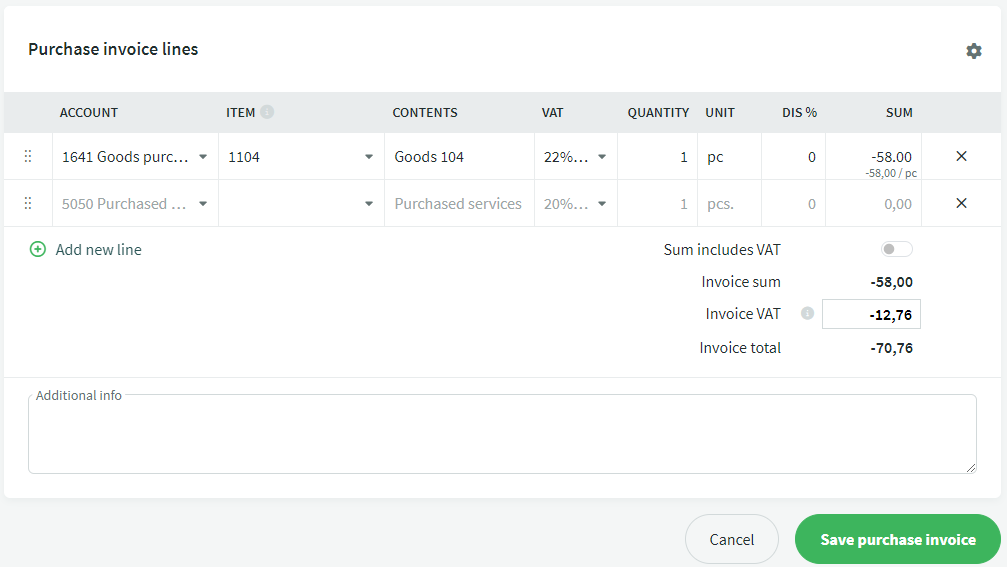

By clicking on the source document (“purchase invoice”), you will be taken directly to the purchase invoice view.

From the Actions menu, select Create credit invoice.

The credit note will be created with the exact same quantities and prices as the original purchase invoice. If the credit note is not for all the goods, you can now adjust the correct returned quantities and remove any unnecessary lines.

The quantity of goods is always a positive number, and the minus sign appears in front of the amount.

For additional questions, please write to us support@simplbooks.ee.

Leave A Comment?