This guide provides examples of invoice transaction for the most common situations.

In the sample images, some fields have been deactivated, which may result in a view different from the one in your environment.

For more information on configuring the invoice transaction view, please refer to the guide Sales invoice transaction view settings.

- To enter a new invoice, go to the Operations menu and select Sales invoices. In the list view, there is a button labeled “New invoice”.

- Alternatively, you can use a keyboard shortcut. To add a new sales invoice, use the combination Ctrl+I. If you are currently in the sales invoice view (on a saved sales invoice), the Ctrl+L combination also works.

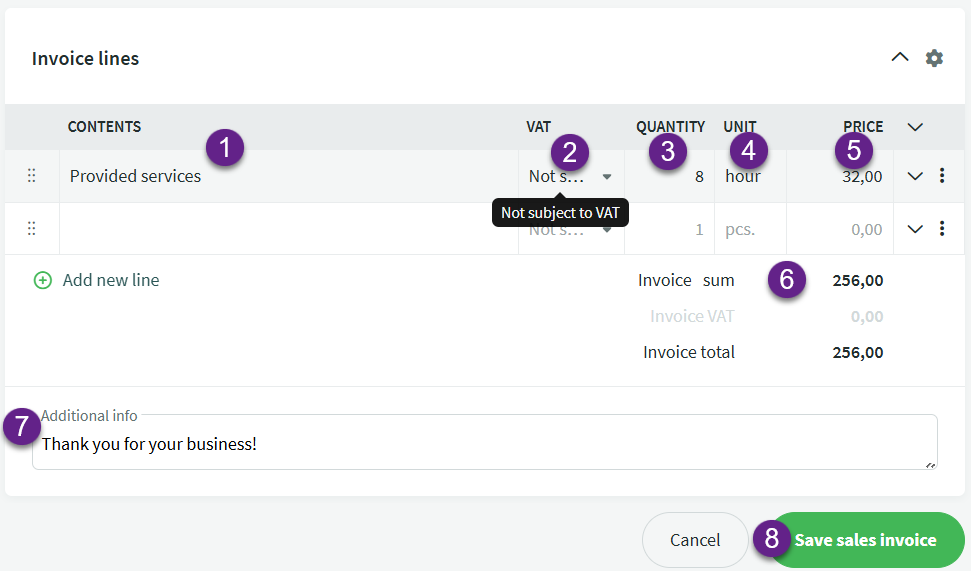

If your company is not a VAT liable, this must be marked in the company profile. In such cases, it is neither possible nor necessary to change the VAT type on the invoice lines.

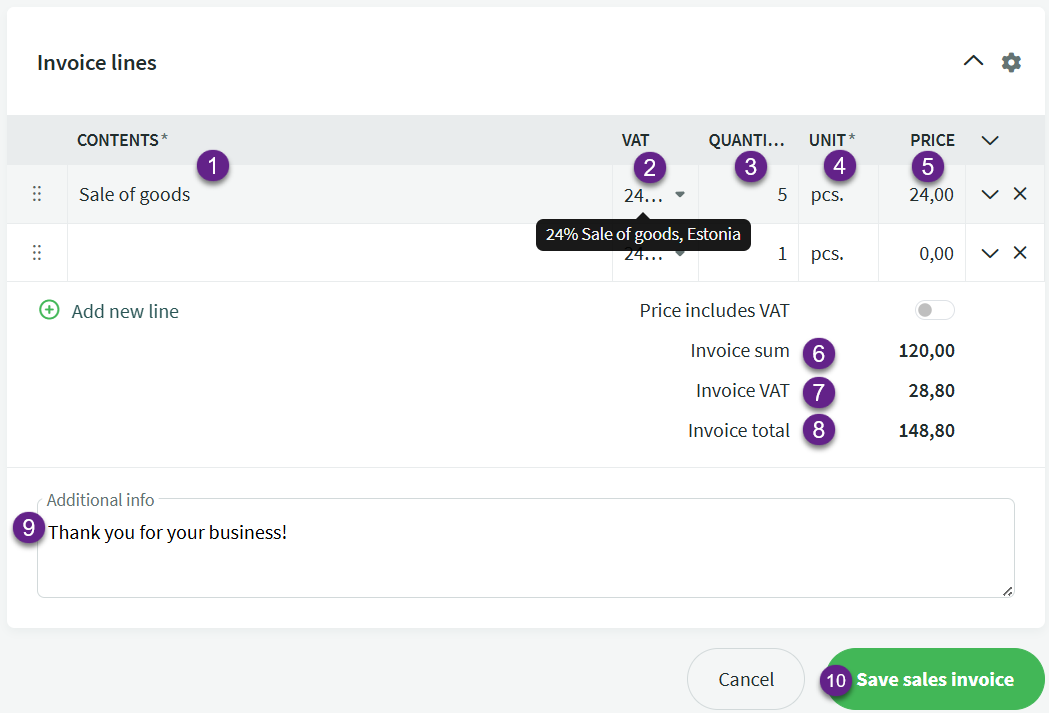

- Fill in the invoice line content.

- The VAT type cannot be changed, nor is there a need to do so.

- Enter the quantity.

- The unit field is pre-filled with “pcs” (pieces), but you can change it as needed.

- Unit price, total amount – calculated automatically and shown below (Invoice sum).

- Invoice sum.

- The additional information field is pre-filled with data from the environment settings. You can modify and add to this information for each invoice.

- Save the invoice.

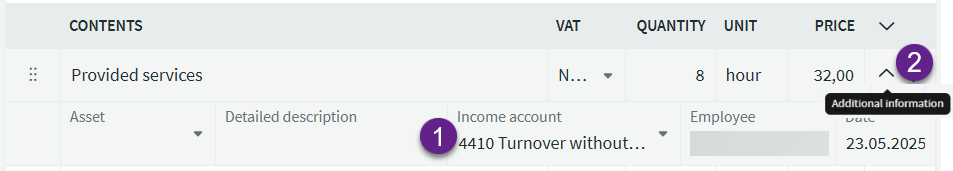

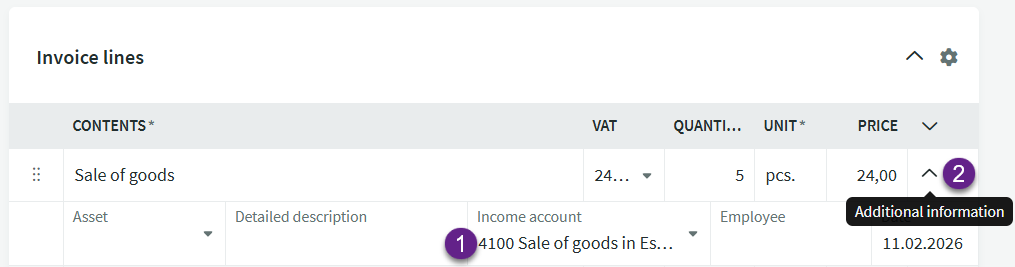

To view the sales income account (1) related to the invoice line, click the expand arrow (2) at the end of the invoice line.

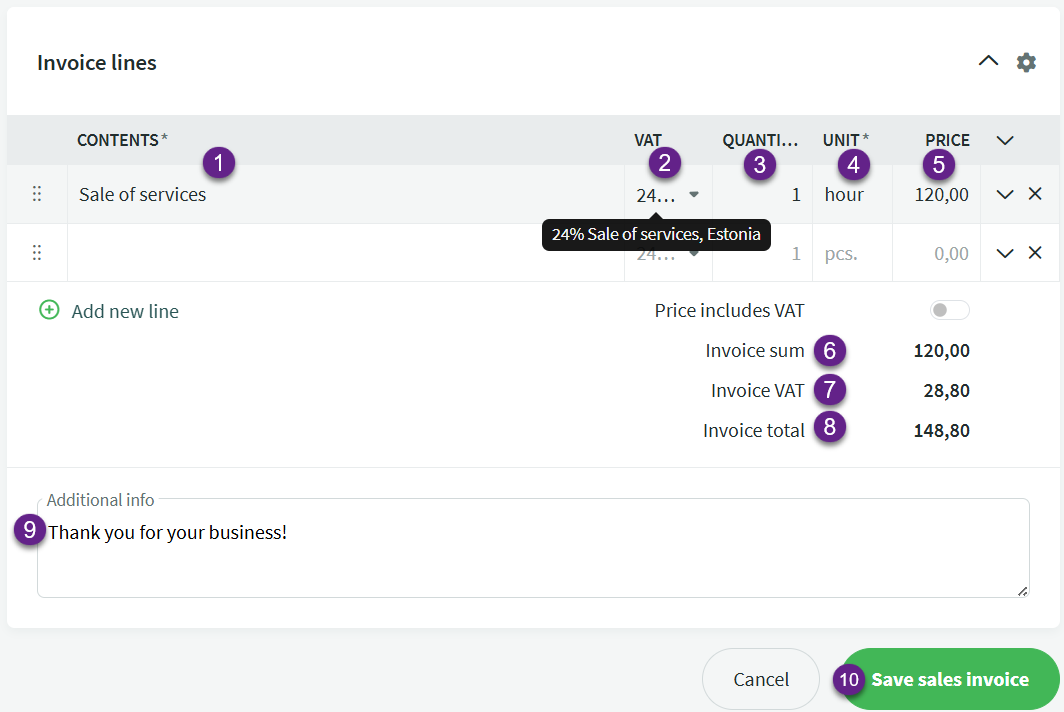

- Fill in the invoice line content.

- When selling services, the VAT type must be 24% Sale of services, Estonia. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Enter the quantity.

- The unit field is pre-filled by default with “pcs” (pieces), which you can overwrite according to your needs.

- Unit price, total amount – calculated automatically and shown below (Invoice sum).

- Invoice amount excluding VAT.

- VAT amount.

- Invoice total.

- The additional information field is pre-filled with data from the environment settings. You can modify and add to this information for each invoice.

- Save the invoice.

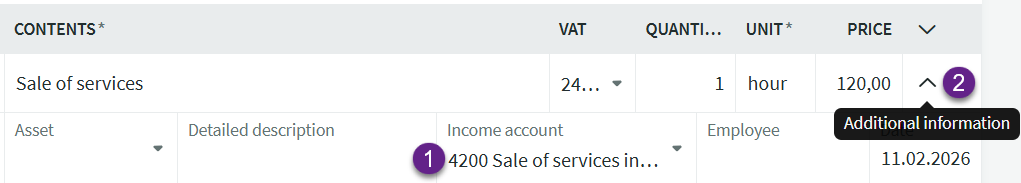

To view the sales income account (1) related to the invoice line, click the expand arrow (2) at the end of the invoice line.

- Fill in the invoice line content.

- When selling goods, the VAT type must be 24% Sale of goods, Estonia. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Enter the quantity.

- The unit field is pre-filled by default with “pcs” (pieces), which you can overwrite according to your needs.

- Unit price, total amount – calculated automatically and shown below (Invoice sum).

- Invoice amount excluding VAT.

- VAT amount.

- Invoice total.

- The additional information field is pre-filled with data from the environment settings. You can modify and add to this information for each invoice.

- Save the invoice.

To view the sales income account (1) related to the invoice line, click the expand arrow (2) at the end of the invoice line.

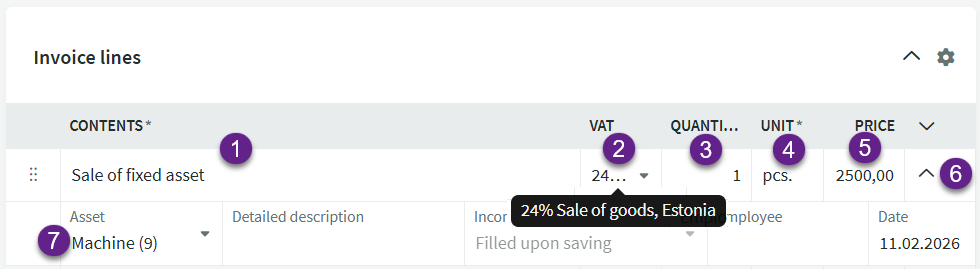

Essentially, this is a sale of goods, but you also need to link it to the fixed asset card.

- In the contents field, type in the name of the asset you are selling.

- Set the VAT type to 24% Sale of goods, Estonia.

- The quantity is always 1, since the invoice line must be linked to a specific fixed asset.

- The unit remains the default “pcs”.

- Enter the asset’s selling price.

- Open the additional information fields by clicking the expand arrow.

- In the “Asset” field, start typing the name of the asset as it appears on the fixed asset card. Once you find the correct match, click to select it.

More detailed information about the sale of fixed assets can be found in the separate guide Sale of fixed assets.

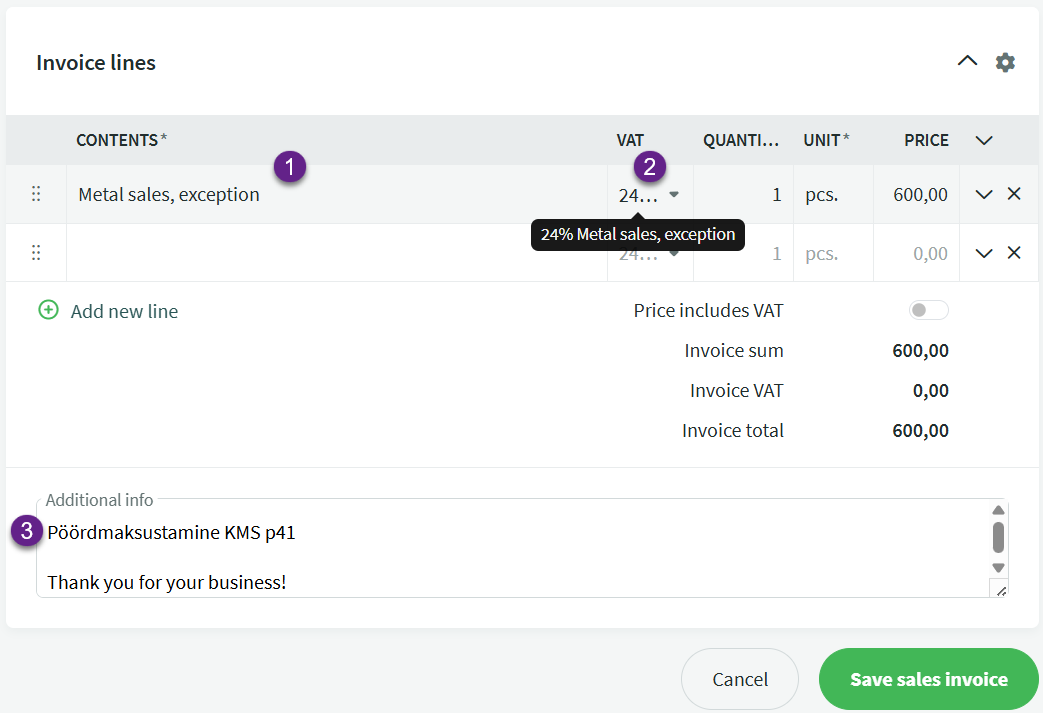

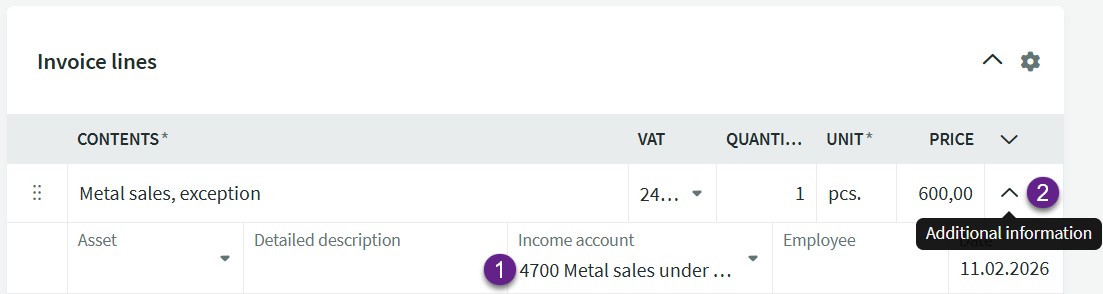

In the case of selling metal products listed in § 41¹(2) point 5 of the VAT Tax Act , the VAT type 24% Metal sales, exception must be used on the sales invoice. The income account for this must be set to account 4700 Metal sales under KMS p41 special arrangements.

The VAT type settings will also add a reference to reverse charge taxation in the additional information on the sales invoice.

For more information, see the Estonian Tax and Customs Board (EMTA) page: Domestically reverse-charged metal products (in Estonian).

- Fill in the invoice line content.

- When selling metal, the VAT type must be 24% Metal sales, exception. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Additional information includes a reverse charge reference from the VAT type settings.

To view the sales income account (1) related to the invoice line, click the expand arrow (2) at the end of the invoice line.

The VAT amount is also shown on the invoice PDF for the client:

In the case of Intra-community supply of goods and services, the buyer is a company from another European Union member state that is registered for VAT in their country. Before issuing the first invoice, you should definitely verify the validity of the VAT registration number provided to you. You can do this on the European Commission’s VIES VAT number validation website.

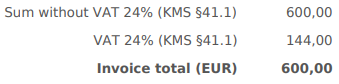

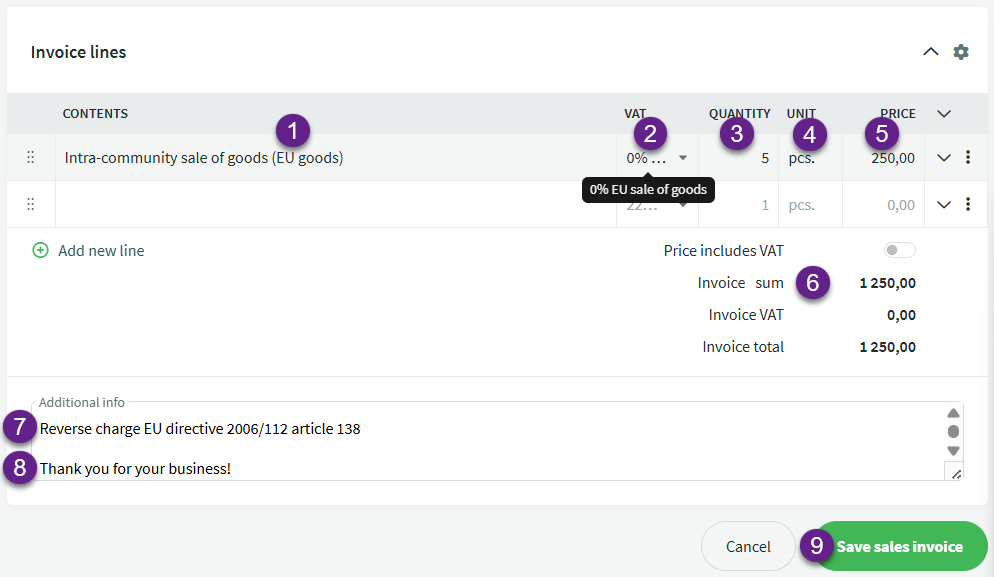

- Fill in the invoice line content.

- When selling services within the EU, the VAT type must be 0% EU sales of services. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Enter the quantity.

- The unit field is pre-filled by default with “pcs.” (pieces), which you can overwrite according to your needs.

- Unit price, total amount – calculated automatically and shown below (Invoice sum).

- The invoices sum and invoice total amount are the same, as no VAT is added to the invoice.

- A reference to the directive according to the selected VAT type is included.

- The additional information field is pre-filled by default with data set in the environment settings. You can modify and add to this information for each individual invoice.

- Save the invoice.

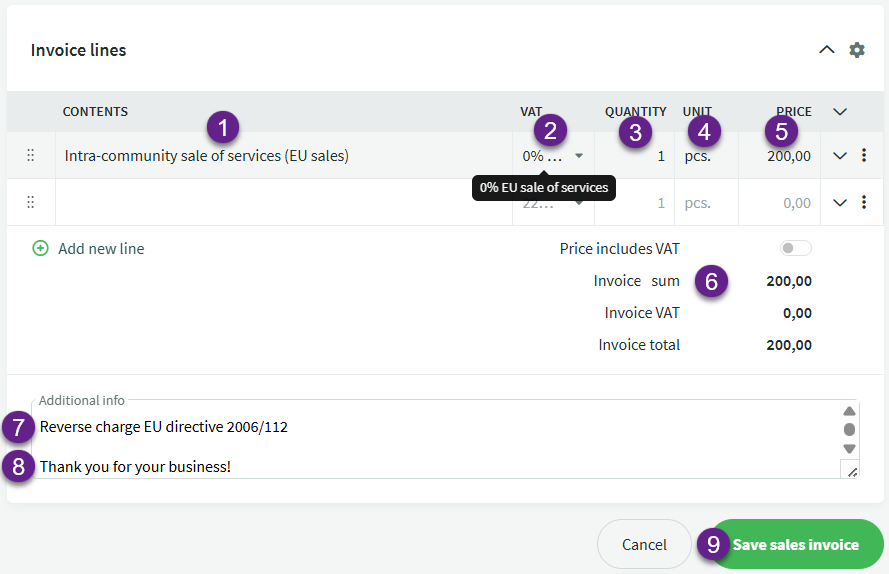

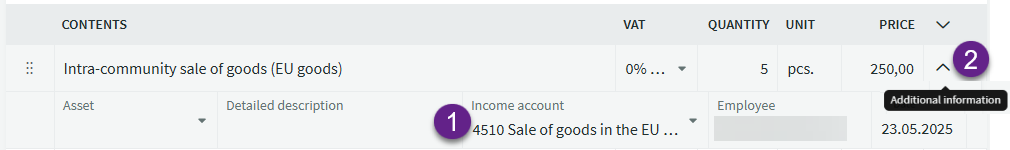

To view the sales income account (1) related to the invoice line, click the expand arrow (2) at the end of the invoice line.

In the case of Intra-community supply of goods and services, the buyer is a company from another European Union member state that is registered for VAT in their country. Before issuing the first invoice, you should definitely verify the validity of the VAT registration number provided to you. You can do this on the European Commission’s VIES VAT number validation website.

- Fill in the invoice line content.

- When selling goods within the EU, the VAT type must be 0% EU sales of goods. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Enter the quantity.

- The unit field is pre-filled by default with “pcs.” (pieces), which you can overwrite according to your needs.

- Unit price, total amount – calculated automatically and shown below (Invoice sum).

- The invoices sum and invoice total amount are the same, as no VAT is added to the invoice.

- A reference to the directive according to the selected VAT type is included.

- The additional information field is pre-filled by default with data set in the environment settings. You can modify and add to this information for each individual invoice.

- Save the invoice.

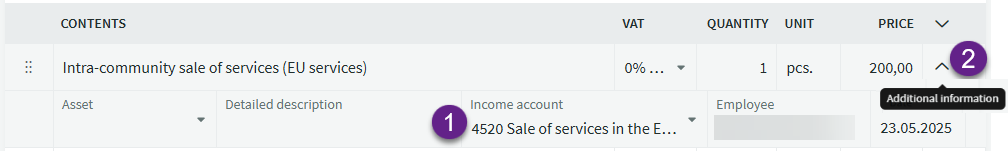

To view the sales income account (1) related to the invoice line, click the expand arrow (2) at the end of the invoice line.

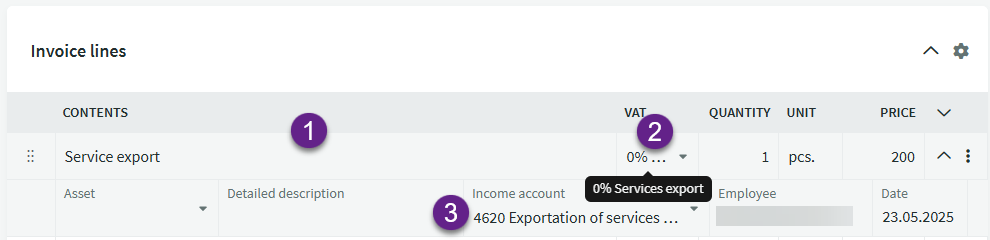

Service export

- Fill in the invoice line content.

- When exporting services, the VAT type must be 0% Services export. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Here you can see the income account 4620 Exportation of services (VAT 0%)

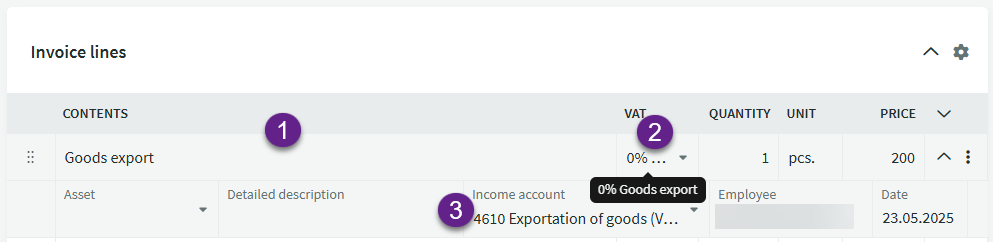

Goods export

- Fill in the invoice line content.

- When exporting goods, the VAT type must be 0% Goods export. Based on the selected VAT type, the corresponding sales income account is automatically set on the invoice. In the VAT report settings, the income account is linked to the VAT type, so you should not change the income account in a way that conflicts with these settings.

- Here you can see the income account 4610 Exportation of goods (VAT 0%).

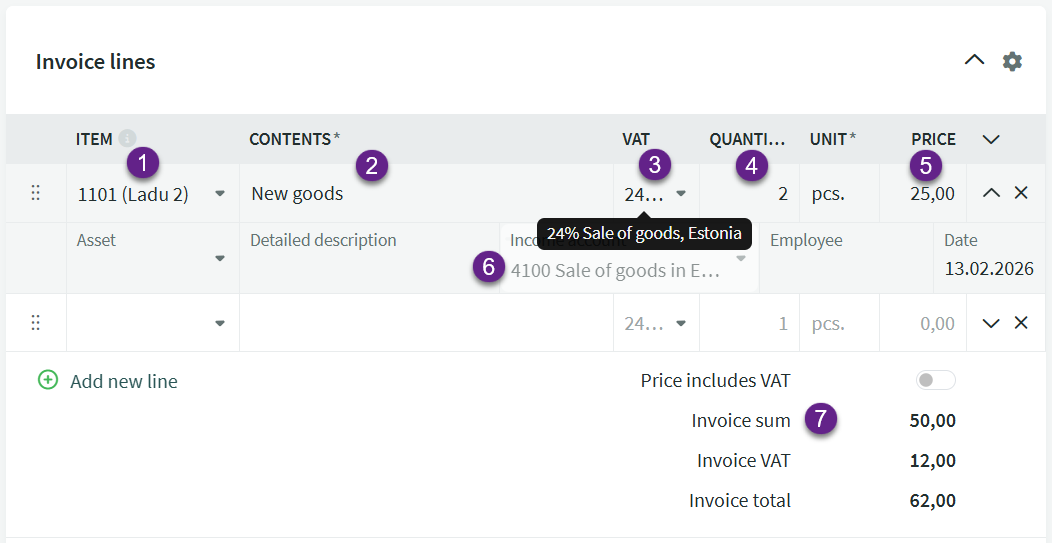

For the sale of goods that require inventory tracking, you must use items. Items need to be entered into the system beforehand and must have inventory available. By default, sales that result in negative stock are not allowed.

- Item – select the item (article). If the same item is stored in multiple warehouses, make sure to also select the correct warehouse when adding the item.

- Description – this displays the information entered on the item card. In the lower row, the “Detailed Description” field shows the info entered in the “description” field on the item card.

- VAT type – for the sale of goods, this must be “24% sale of goods, Estonia“.

- Quantity – the quantity of goods sold.

- Price – price per unit.

- Income account – for the sale of goods, this is by default “4100 Sale of goods, Estonia” according to the VAT type. The VAT type and income account are linked in the VAT report settings. When adding additional income accounts related to the sale of goods, ensure they are also linked to the “24% Sale of goods, Estonia” VAT type in the VAT report settings.

- Invoice sum – the invoices sum excluding VAT.

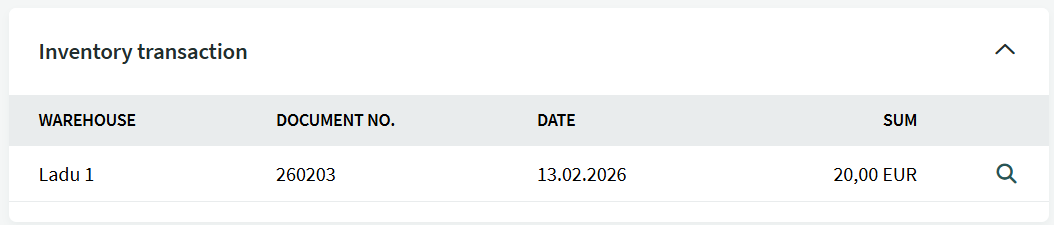

When saving the invoice, the system automatically creates a cost of goods sold transaction. You can view the detailed content of the warehouse document by clicking the magnifying glass icon at the end of the line.

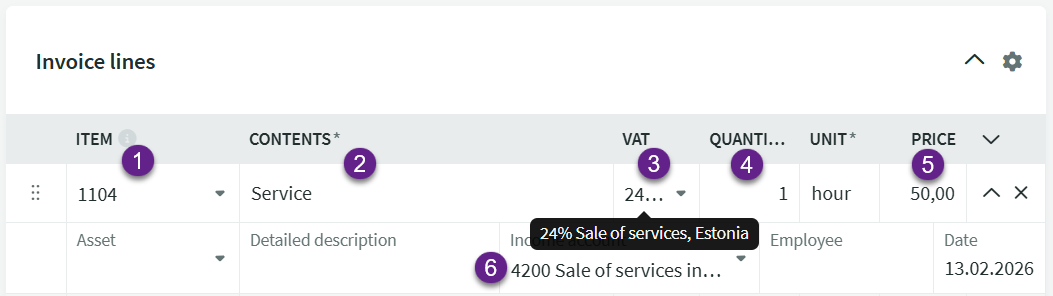

Items are generally not required for the sale of services. However, they can be useful when service names are long or consistently the same and you prefer not to retype the same text each time.

When creating such items, make sure to select the type as “service item” and set the VAT type to “22% sale of services, Estonia”.

- Item – select the item.

- Description – displays the information entered on the item card. If needed, you can overwrite this or add additional information. The “Detailed description” field in the lower row displays the text entered in the “Description” field of the item card.

- VAT type – when selling services, this must be “24% Sale of services, Estonia“.

- Quantity – the quantity of services sold.

- Price – price per unit.

- Income account – when selling services, this is by default “4200 Sale of services, Estonia” based on the VAT type. The VAT type and income account are linked in the VAT report settings. If you add additional income accounts for service sales, ensure they are also linked to the “24% Sale of services, Estonia” VAT type in the VAT report settings.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?