Documents, sales invoices and offers issued by the company shall include your company’s basic details and bank accounts. Such details are usually set out in the document footer.

N.B. When you change any details in your own environment the details in the Simplbooks database are not renewed! Please contact us to renew the details in our environment.

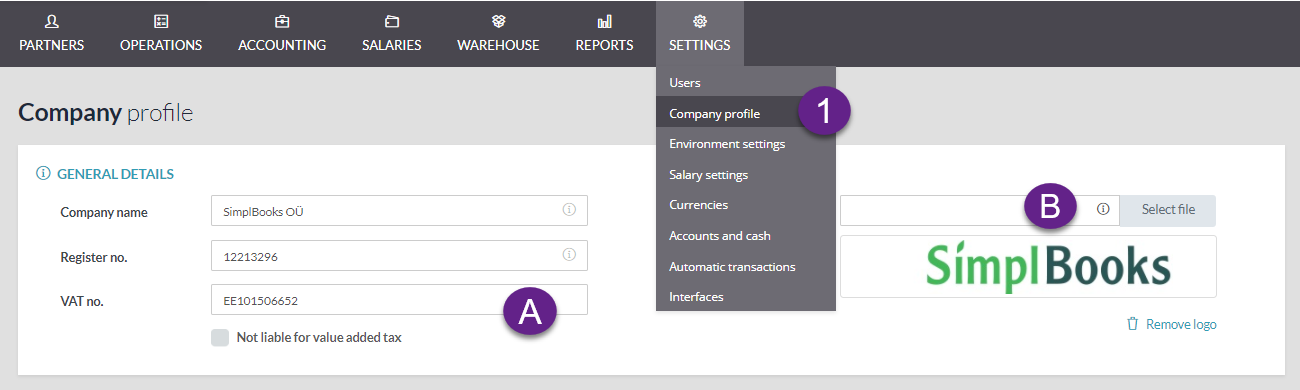

1. Open “SETTINGS” and select “Company profile”.

A. Company type, name and register number – already filled in according to your account registration information and you cannot change any of it (please contact us if necessary).

Company’s VAT liability status – attached to documents which means that if an invoice is created at a time the company was liable to VAT, the VAT can later be changed on the invoice; if an invoice is saved at a time the company was not liable to VAT, no VAT can later be added.

If you tick “Not liable for value added tax”, all fields pertaining to VAT are removed from the invoice.

The details are entered in the document footer.

B. Company logo – shown in the document header. The logo may be in jpeg, png or gif format and no larger than 50kB. Before any logo is added you will see the message “No logo”; after you have added your logo it will be displayed in reduced size. When you add a new logo, the old image file is overwritten.

When a new logo is added, the design of earlier documents will not be changed automatically. To change the logo on existing documents, the document (e.g. sales invoice) must be opened for editing and saved again.

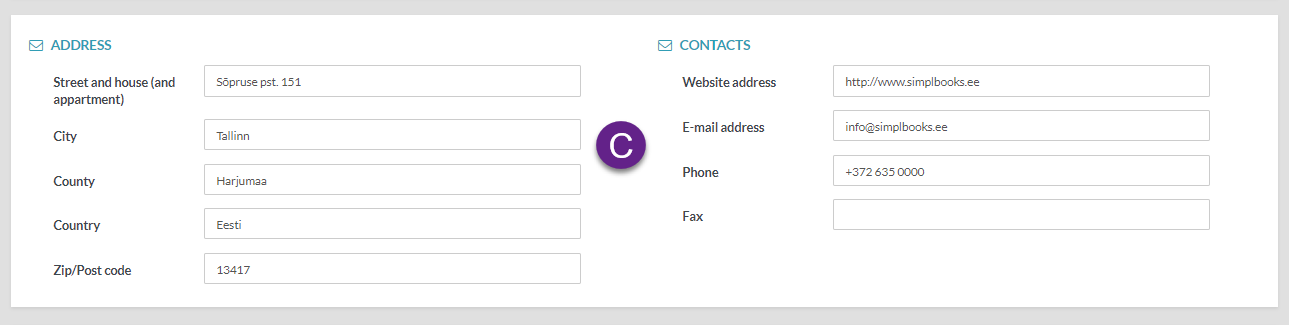

C. Company’s contacts, details saved here are entered in the document footer.

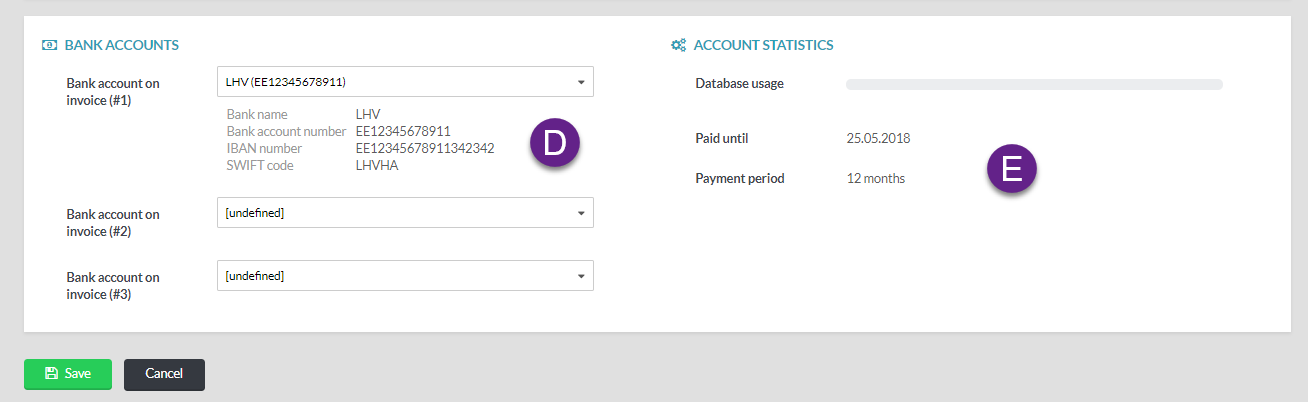

D. Bank accounts on invoices – it is possible to add up to three main bank accounts. These are entered in the document footer.

You can only add bank accounts that have been entered in the list of bank accounts used in the company under “Settings/Accounts and cash”.

E. Your company’s environment information – displays database usage, period paid for and payment period.

Leave A Comment?