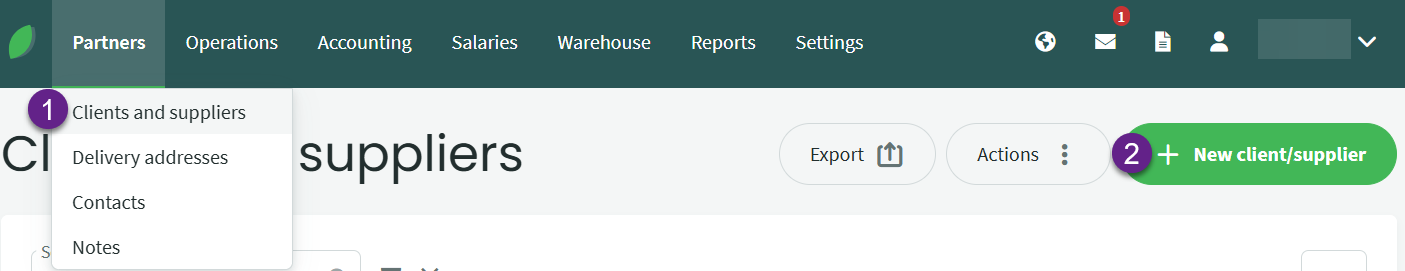

Partners -> Clients and suppliers

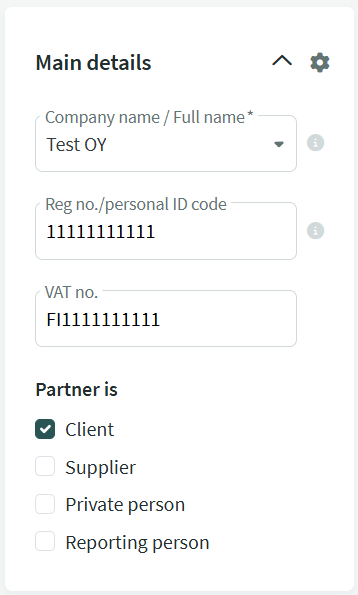

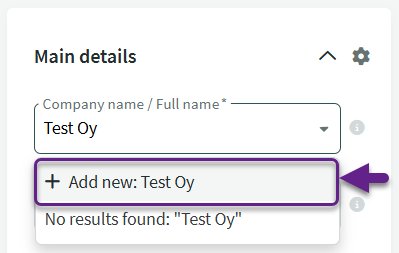

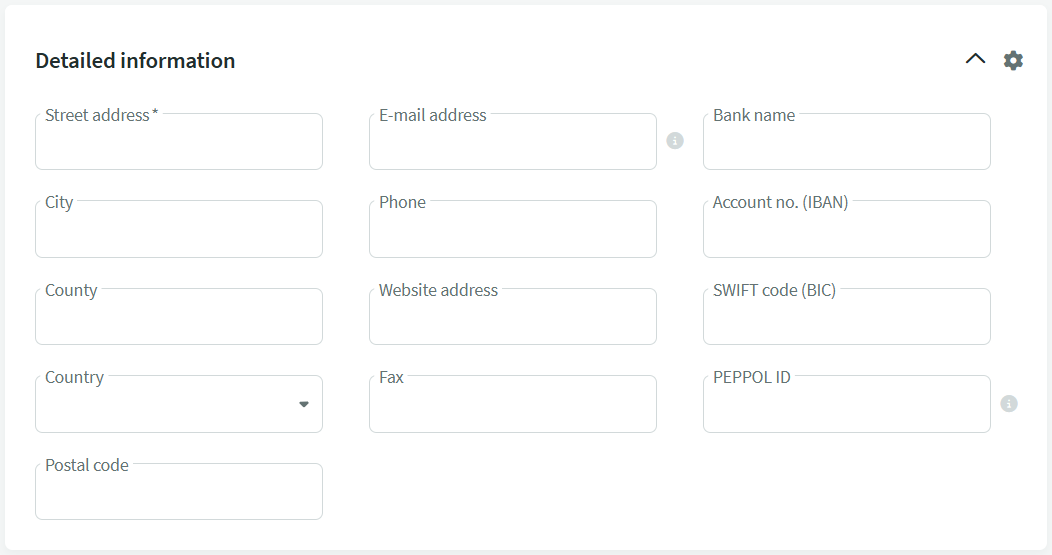

In the case of a foreign client or supplier, the data must be entered manually, as this information cannot be loaded directly from registers.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?