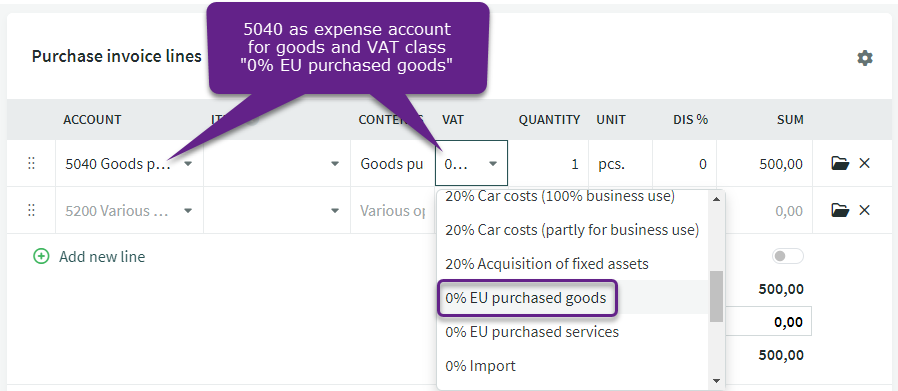

For the correct reporting of reverse-taxed intra-Community services and goods (expenses, not inventory goods) in the VAT statement, it is necessary to use the correct expense accounts (described in the appropriate lines of the VAT statement) and the correct VAT types.

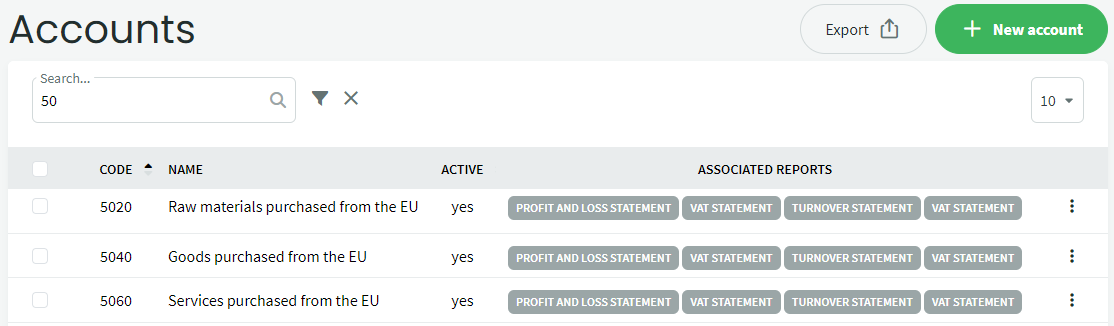

Advice If the transaction involves intra-Community WAREHOUSE GOODS, you will need to proceed slightly differently. You can read about this in the guide: Intra-Community purchases accounting – Warehouse goods.In Accounting -> Accounts, you can see which accounts are already set by default for the accounting of intra-Community purchases:

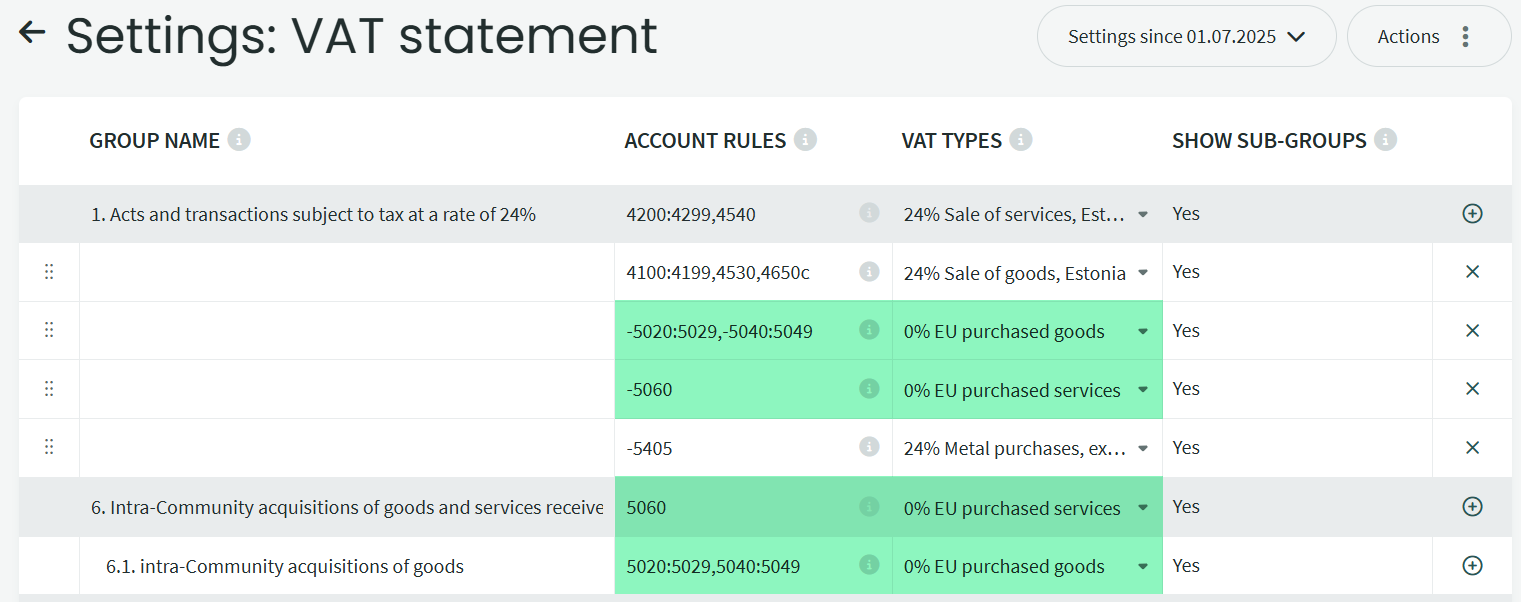

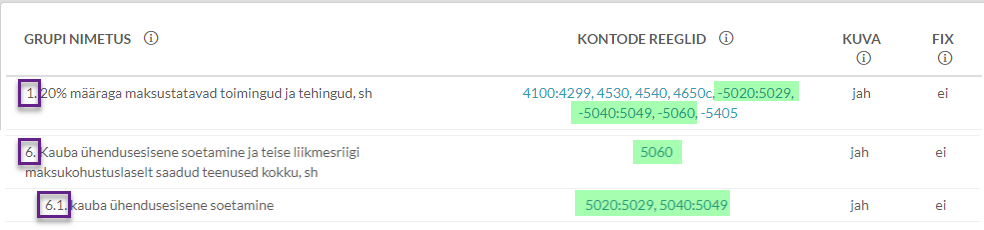

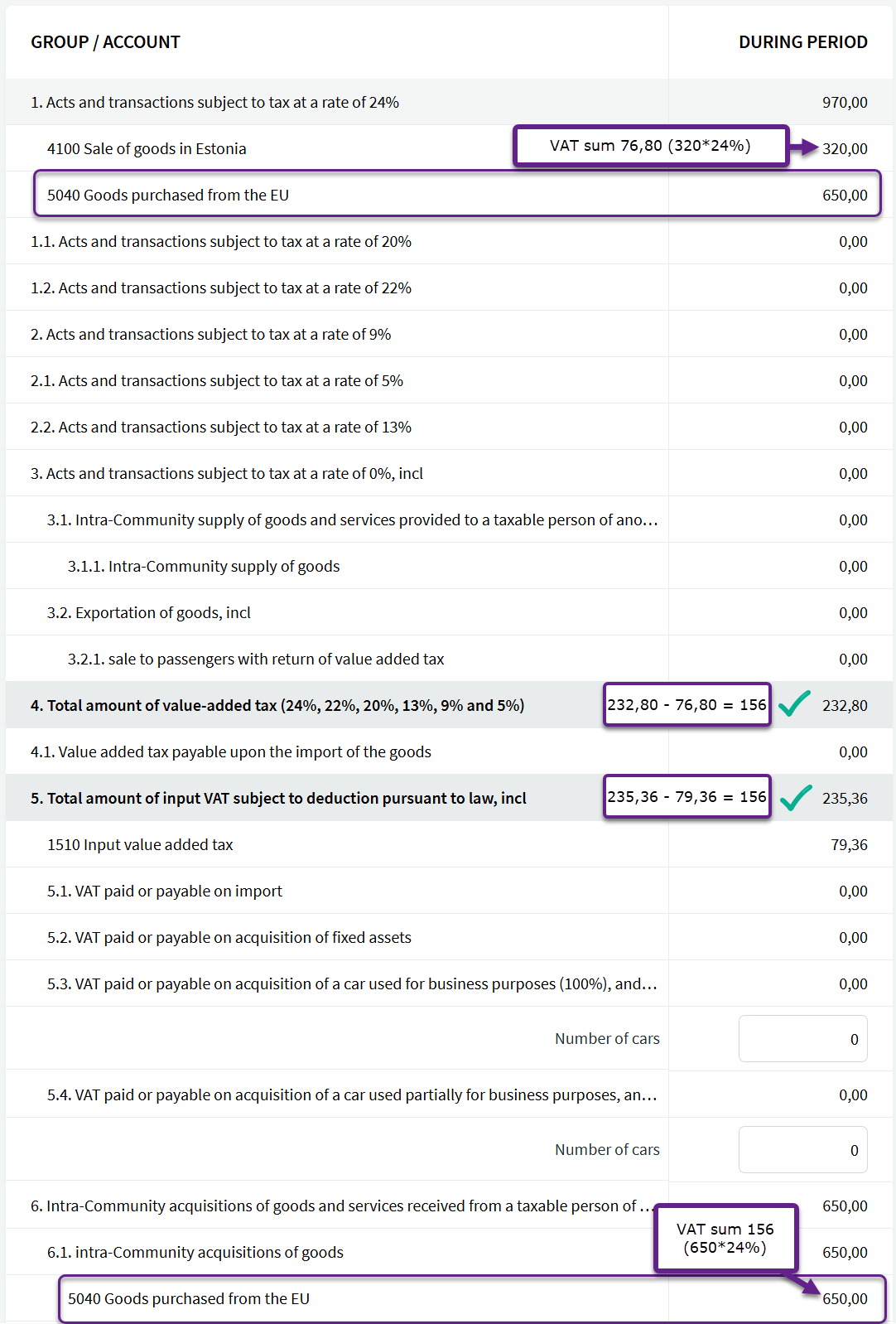

You can also check the VAT report settings to see where these accounts are reflected:

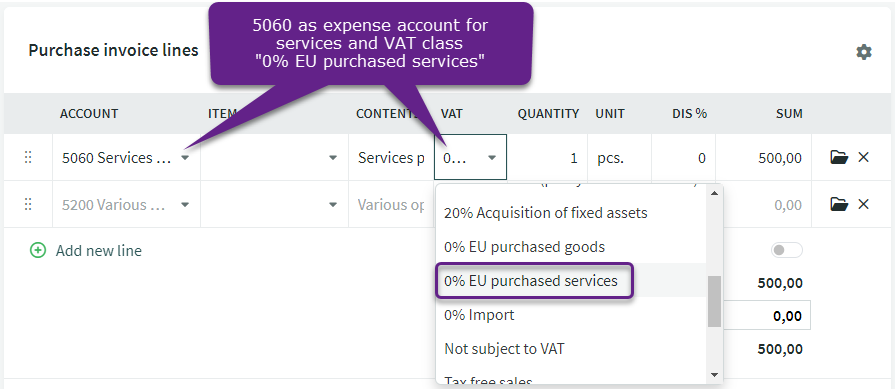

For reverse taxation to function correctly, the accounts must be set in the statement settings on row 1 and rows 6 or 6.1 (depending on whether it’s goods or services). As you can see in the image, some accounts are set as ranges. This means that if you add an account within this range, it will automatically be included in the statement and there’s no need to add it separately. Account 5060 is added individually, but you can make adjustments as needed to include additional accounts. Since the data in the VAT statement is based on the combination of account + VAT type, it is possible to use the same expense accounts that you use for purchasing services from Estonian suppliers (for example, the same type of service from both Estonian and intra-Community suppliers). In such cases, you will need to manually add the necessary expense account to the statement settings. Purchase of Goods Advice Reverse VAT is calculated only in the VAT report and does not appear in the purchase invoice entry. If you have any additional questions, please write to us support@simplbooks.ee

Leave A Comment?