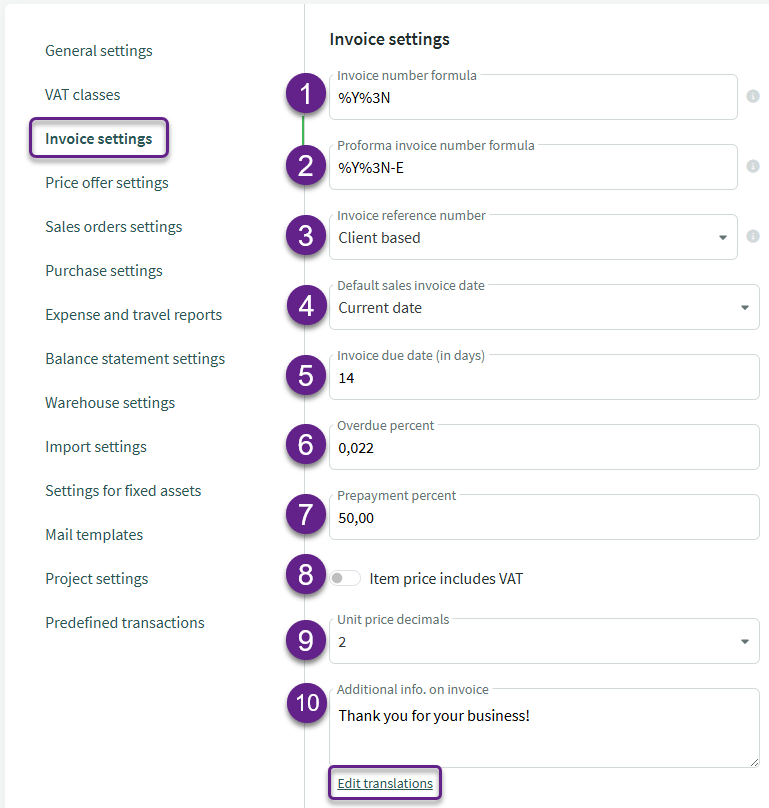

Settings -> Environment settings -> Invoice settings

Here you can define numbering formulas for sales and proforma invoices and customize the appearance of document templates.

- Invoice number formula – by default, the format includes the year (%Y) and a three-digit sequential number. This means that invoice numbers issued in 2019 will range from 19001 to 19999. It is also possible to add letters in front of the invoice number (see the instructions below)

- Proforma invoice number formula– invoice numbers end with the suffix -E. Sales invoices and proforma invoices have their own separate number sequences.

- Invoice reference number – it is possible to add a reference number to the invoice, which can be linked either to the customer or to the invoice. If “Invoice-based” is selected, each sales invoice will be assigned a unique number. If “Client-based” is selected, each client will be assigned a fixed reference number, which will appear on the invoice. The reference number helps to match incoming payments with the corresponding invoices during bank import

- Default sales invoice date – this setting determines whether the default date for a new invoice is today’s date or the date of the previous invoice

- Invoice due date (in days) – if the clients’s profile doesn’t have a payment term, the number of days entered here will be used to set the payment due date on invoices

- Overdue percent – Default penalty interest rate if not set on the customer card. This is an informational field, penalty invoices are not created automatically

- Prepayment percent– the default prepayment percentage used on the proforma invoice, which determines the amount to be paid

- Item price includes VAT – yes/no option. By default, prices are entered without VAT. If needed, you can set the default so that prices are entered including VAT and the program will calculate the amount excluding VAT and the VAT amount

- Unit price decimals – how many decimal places (2 to 6) are shown for the unit price on documents

- Additional information on invoice – the text entered here will be printed on all sales invoices. If you change the text, don’t forget to review the translations as well. To do this, click on the “Edit translations” link

It is worth adding translations in different languages if invoices are also sent in other environment languages.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?