This guide describes how to change the statement settings.

You can also find related instructions by using the keyword “VAT” in the search box on our support page.

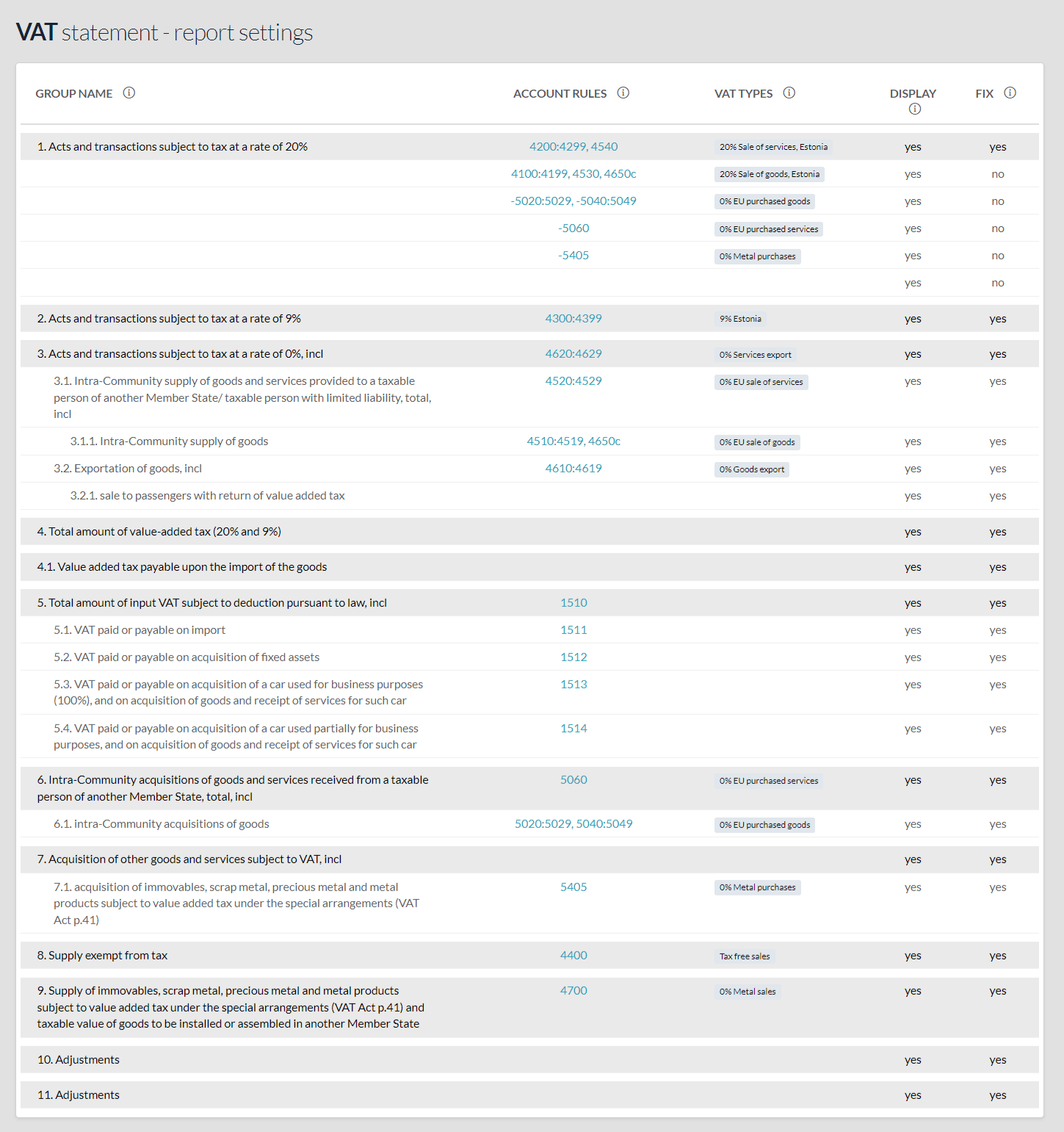

The structure of the VAT statement of the program corresponds to the structure of the statement which is used by the e-MTA. In order to be able to transmit the data to the e-MTA without errors, it is not possible to add rows to the report or delete existing rows.

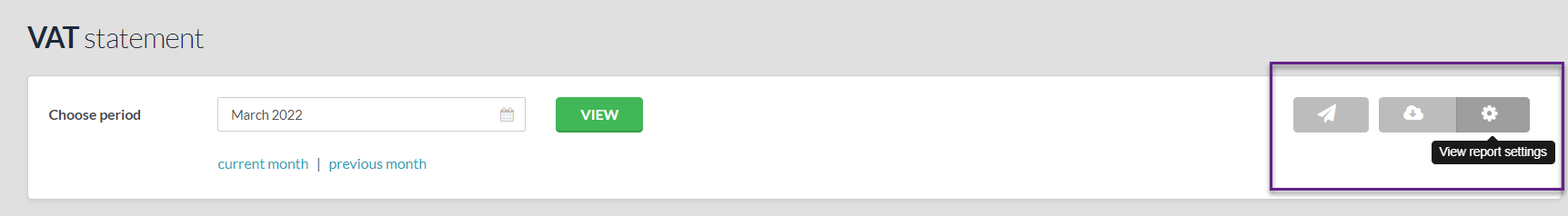

To see the report settings, click the gear icon in the gray bar above the report (the icon on the right).

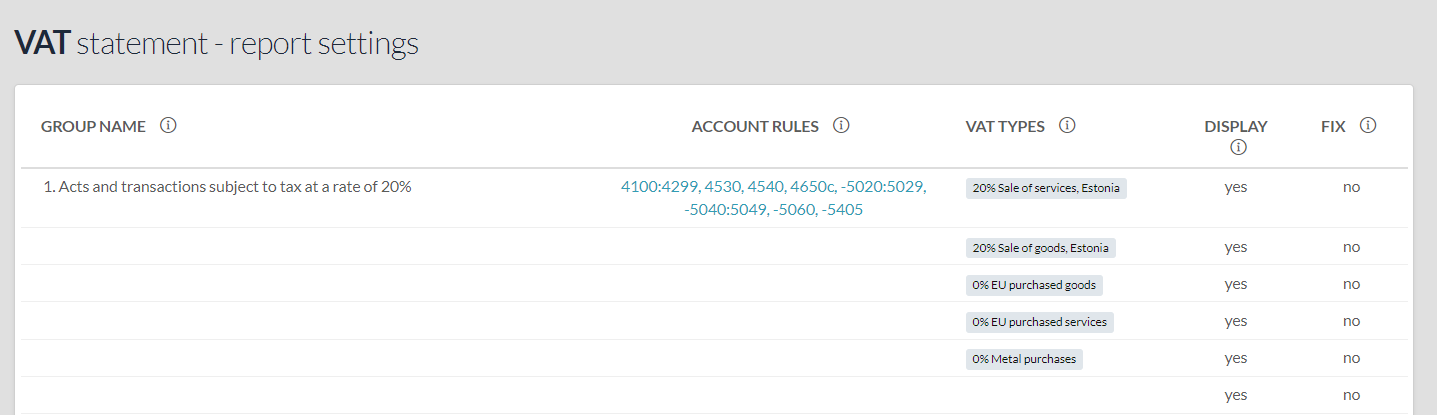

The report is prepared using an account (income accounts and, in the case of reverse charge goods and services, expense accounts) and VAT type.

The Account Rules column shows the account numbers included in the report, and the turnover reported in these accounts is reported according to the type of VAT described in the VAT Types column.

Example Line 1. Operations and transactions taxable at a rate of 20% include transactions in accounts 4200-4299 and 4540 for the VAT type “20% Sale of Services, Estonia”. If the transactions in these accounts include transactions of another type of VAT, they are excluded from the report.

For example, if you add the VAT type “20% Sales of Goods, Estonia” to the line 4200 in the report settings and use the account 4200 and the VAT type “20% Sales of Goods, Estonia” as the income account when preparing the invoice, the data will also appear correctly in the report.

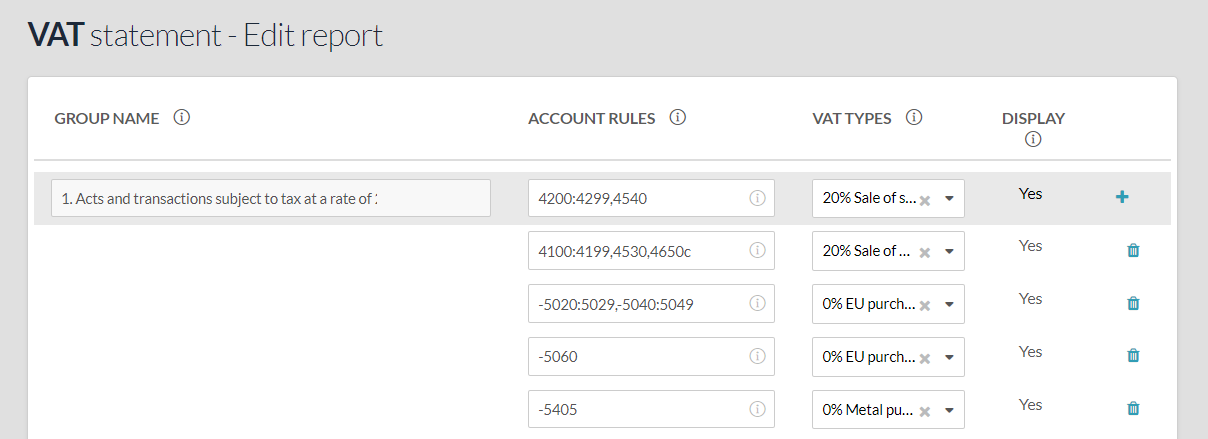

To change the report settings, select Edit report settings from the Operations menu.

- When adding a new account to your settings, be sure to add it to the right line according to VAT type.

- If you add an expense account for reverse chargeable goods or services, you’ll need to add a minus sign to your 1st line item’s settings. Lines 6, 6.1, 7 or 7.1 show the expense account without a minus sign.

- Input VAT accounts are not linked to the type of VAT, so the settings in rows 5 to 5.4 do not specify the type of VAT.

- Restore statement default settings – it replaces any changes made with the system to default settings.

- Restore previous settings – you can select which report settings you want to reset by date and time.

If you have additional questions, write to us at support@simplbooks.ee

Leave A Comment?