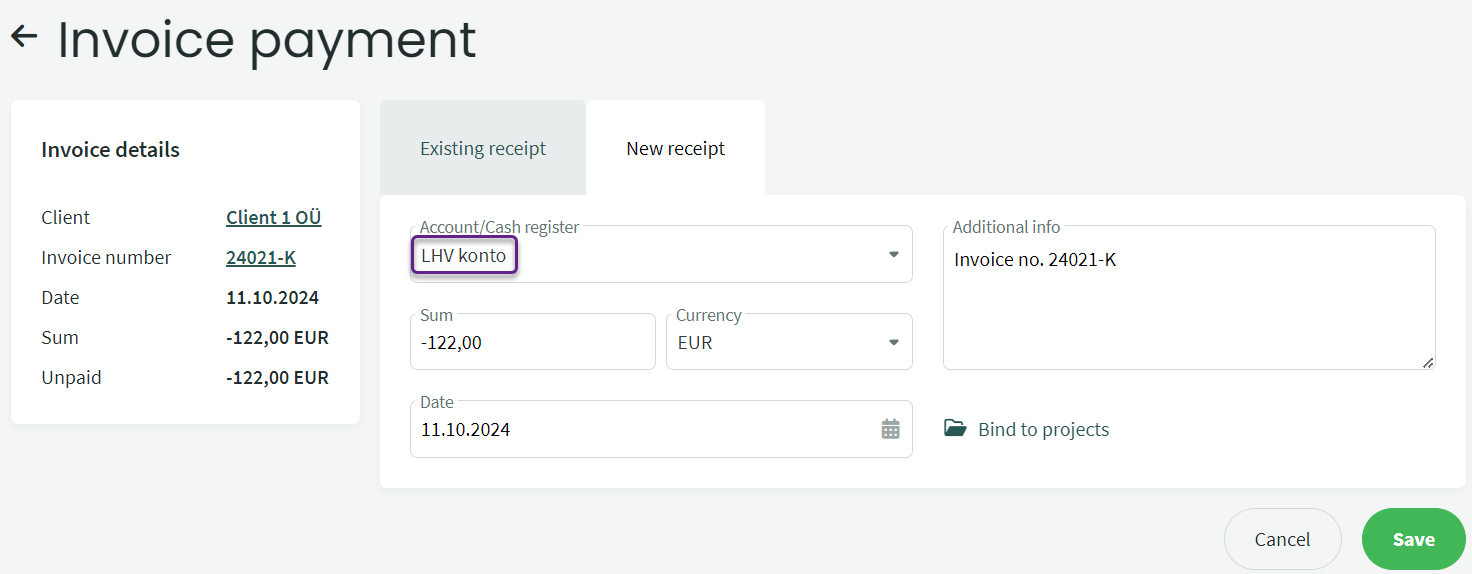

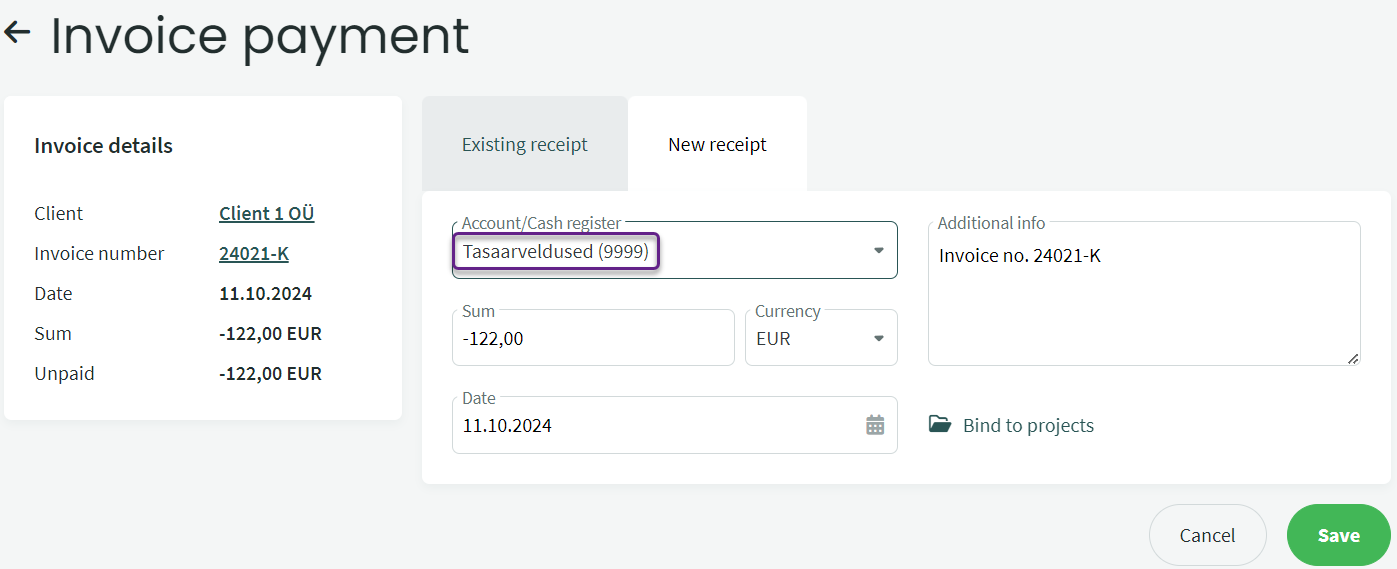

The guide describes the process of marking a credit invoice as paid using a sales invoice as an example, but the same principle applies when dealing with purchase invoices.

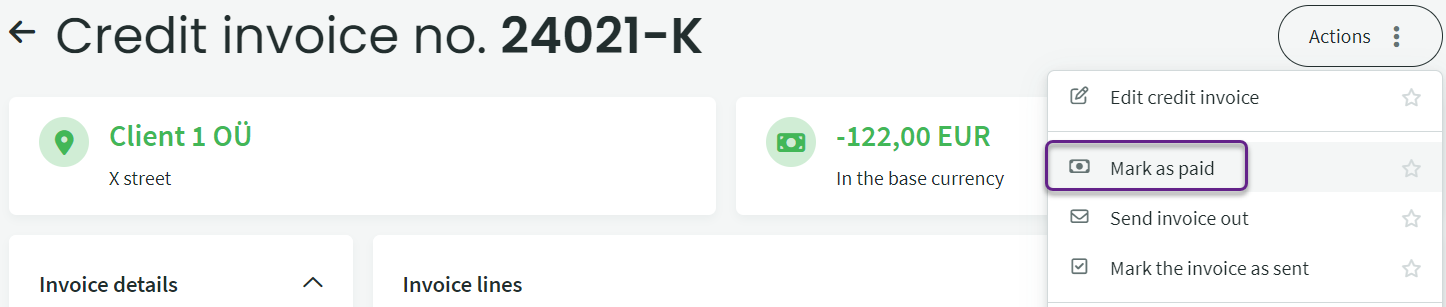

First, you need to find the credit invoice that is pending payment from the list of invoices.

You can do this in the sales invoices list: Operations -> Sales invoices and search, for example, by the customer’s name. Another option is to check the sales ledger: Reports -> Sales ledger -> select the customer. The advantage of viewing from the sales ledger is that you can immediately see the customer’s balance. By clicking on the invoice line in the report, the invoice view will open.

Advice If you create a credit note directly from the original (unpaid) invoice, the system will immediately offer to mark both the credit note and the original invoice as paid when saving. This applies to both partial and full credit notes (as of 10.04.2025).

Leave A Comment?