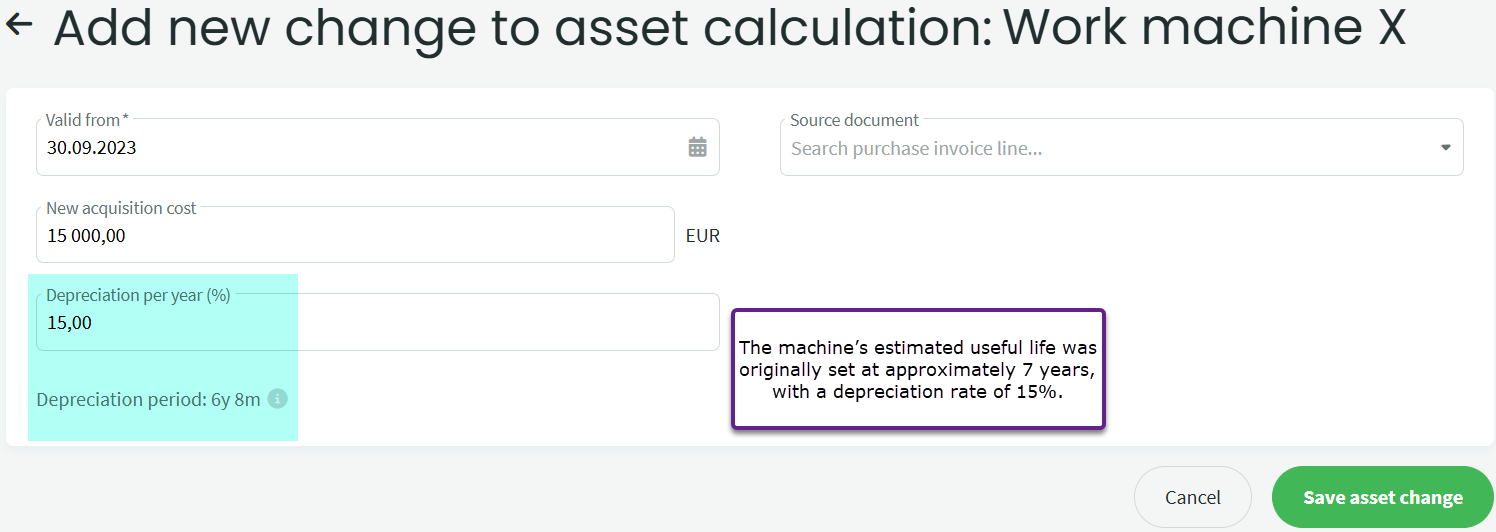

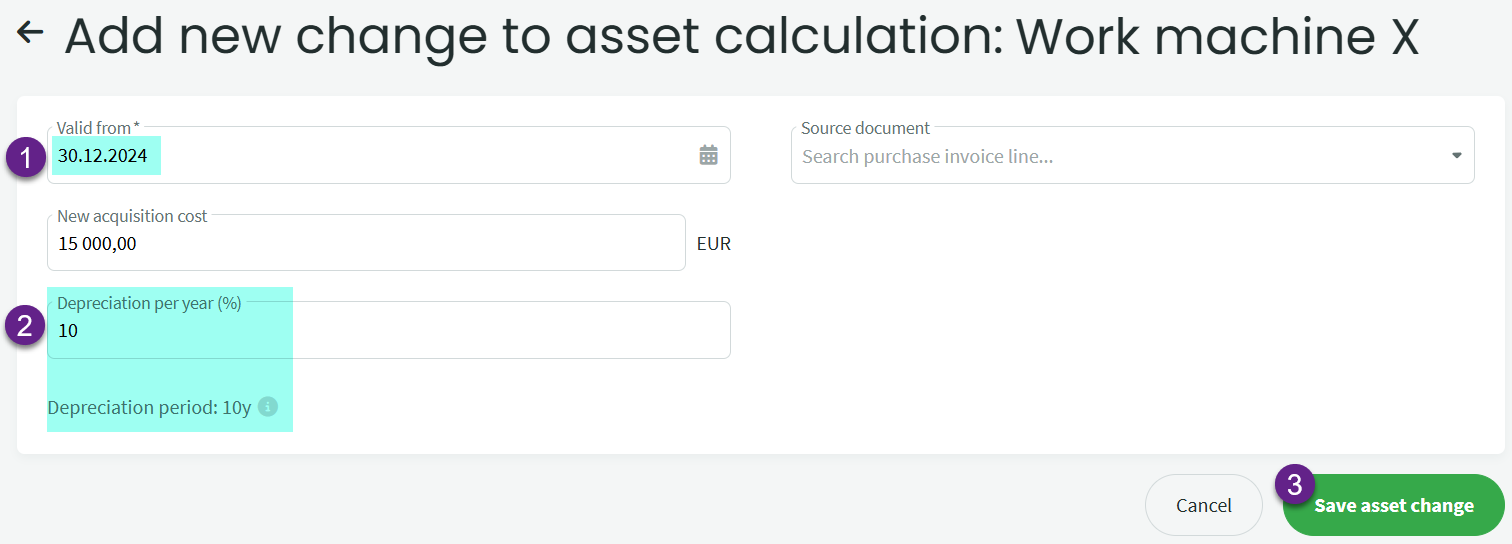

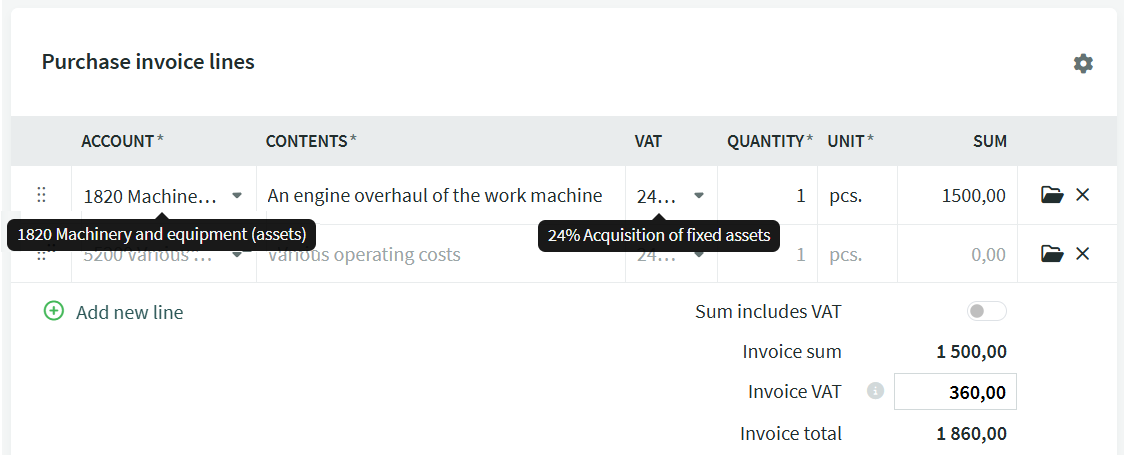

On the fixed asset card, you can, if necessary, change the depreciation rate, record an , or increase the value of the asset based on improvements made to it (using purchase invoices).

According to Estonian financial accounting rules, it is not allowed to increase the value of an asset through revaluation. More detailed information on fixed asset accounting is provided in the Accounting Standards Board guideline (ASBG) 5 Tangible and intangible fixed assets. All guidelines are available on the Ministry of Finance website.

To make a change, go to the fixed asset card: Accounting -> Assets and open the fixed asset card you wish to modify.

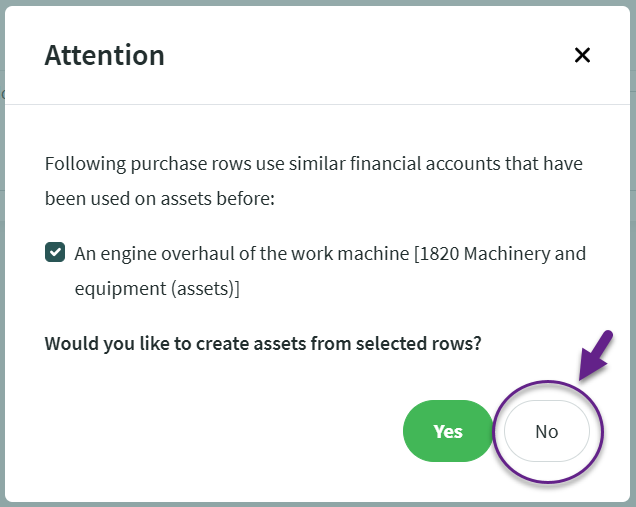

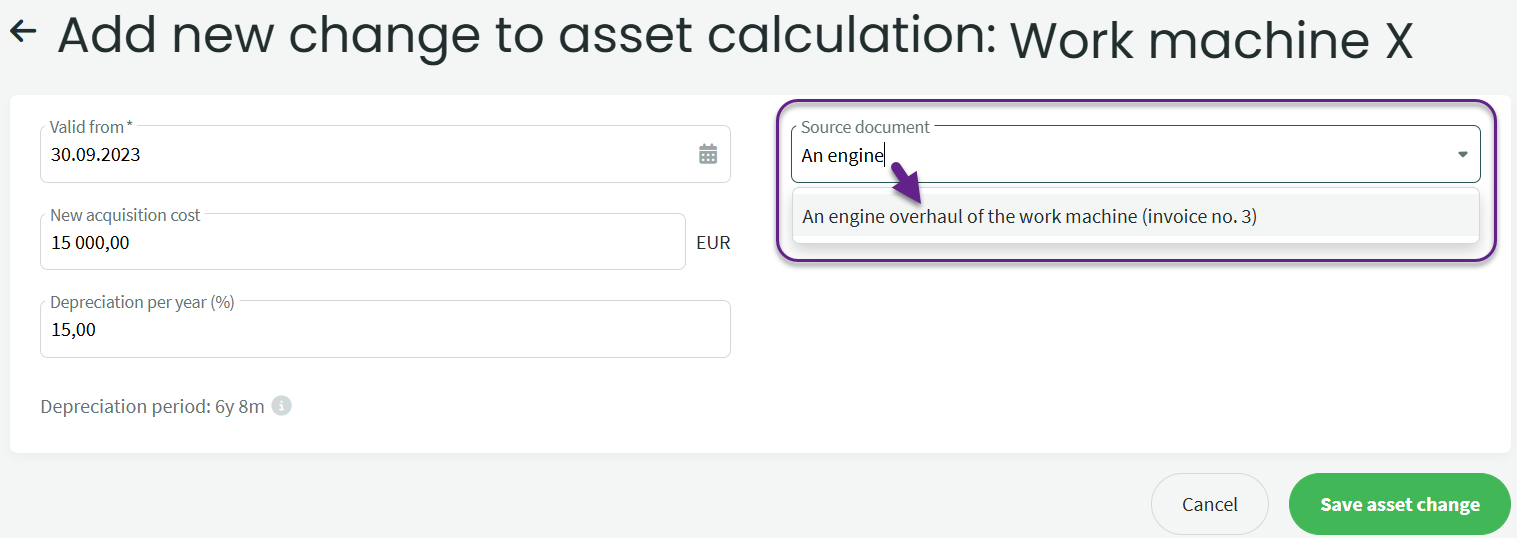

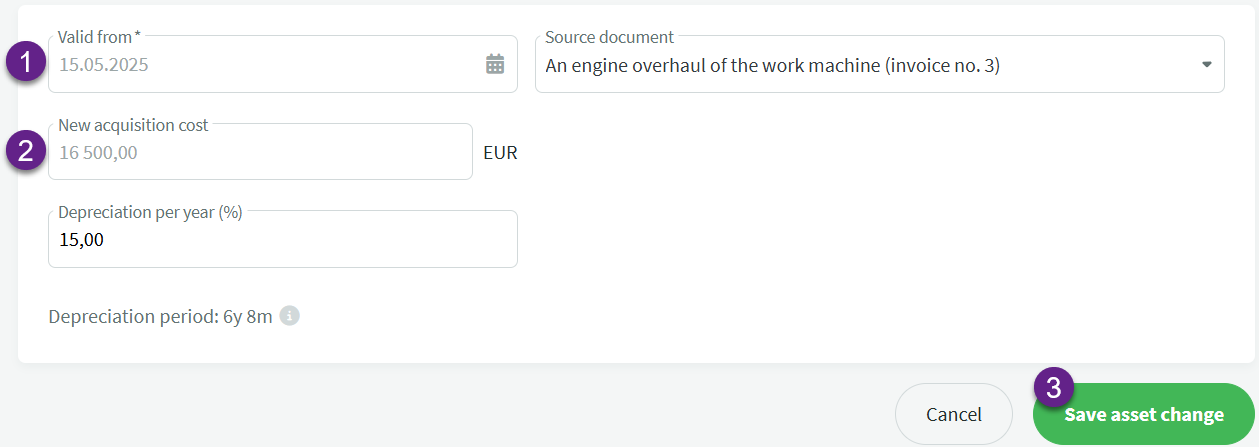

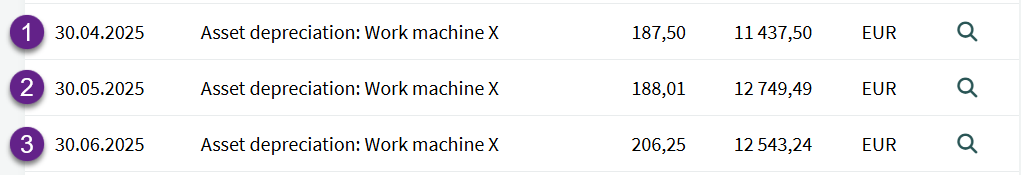

On the fixed asset card, you will see the panel “Alter asset depreciation plan”. To add a new change, click on “Add new change to asset”.

Below are the available options.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?