This user manual deals with all issues concerning purchase invoices. If you are interested in information concerning a specific field, then read more under the relevant step shown on the images.

Before creating the first purchase invoice it is advisable to check the settings.

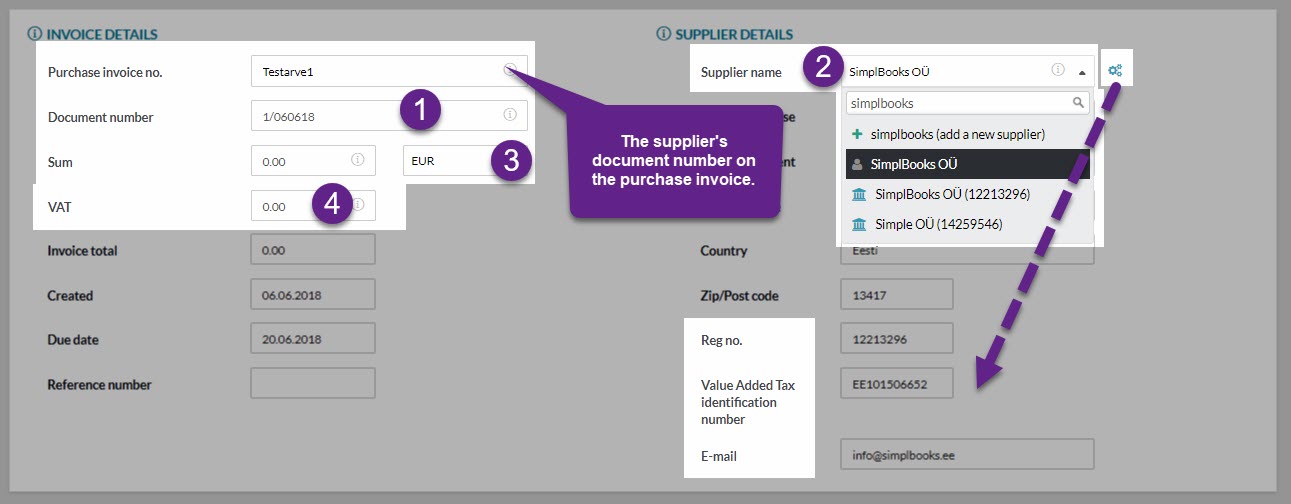

More details about the fields of a purchase invoice:

1. The invoice number counter can be pre-set, read more here: Setting the number counter formula.

2. The client name line allows you to select the client as follows:

– (plus icon) add a new client/supplier with information entered by you;

– (person icon) select a client from the SimplBooks client database;

– (museum icon) add a new client from the commercial register.

When you enter the details of a new client on a purchase invoice the client and their details are automatically saved with the invoice in the client list. When you change the client/supplier details on a purchase invoice (e.g. street and house), the details are not automatically renewed on the client/supplier information sheet. You can edit the client/supplier details on the client information sheet later. More details here: Operations on client information sheet.

![]() At the end of the client/supplier name line there is a gear wheel icon. Clicking on it opens additional lines (Delivery address).

At the end of the client/supplier name line there is a gear wheel icon. Clicking on it opens additional lines (Delivery address).

3. The Sum line is an informative field where you can only change the currency. You must enter the sums in the INVOICE LINES part (step 6).

4. The VAT line can be edited. N.B. You can only make corrections related to differences resulting from rounding off the VAT. No major differences can be corrected this way. Read more about adjusting the VAT sum here.

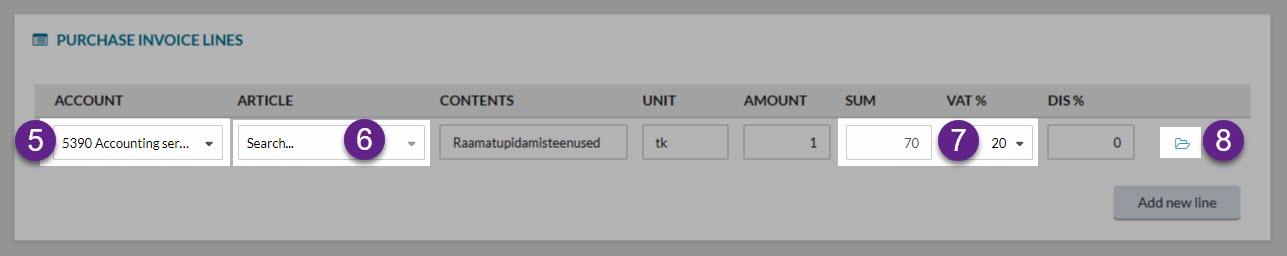

5. Editing the account.

6. It is not required to add an article (the field may be left blank).

7. The sum is displayed not including VAT. The VAT rate can be changed. If you cannot select the appropriate VAT rate from the drop-down menu, you must add it beforehand.

8. Project-based calculation.

9. You may add specifying details in the additional information box. E.g. Invoice paid in cash.

10. The file line is only intended for invoices in PDF format created elsewhere and sent to you by the supplier (no other files may be added there).

11. Save by clicking on “Save invoice”.

N.B. Purchase invoices often display differences in cents of the VAT; read instructions in the manual: Correcting (changing) VAT amount on purchase invoices.

12. If a purchase invoice needs to be credited, there is a manual for it: Creating credit invoices.

Leave A Comment?