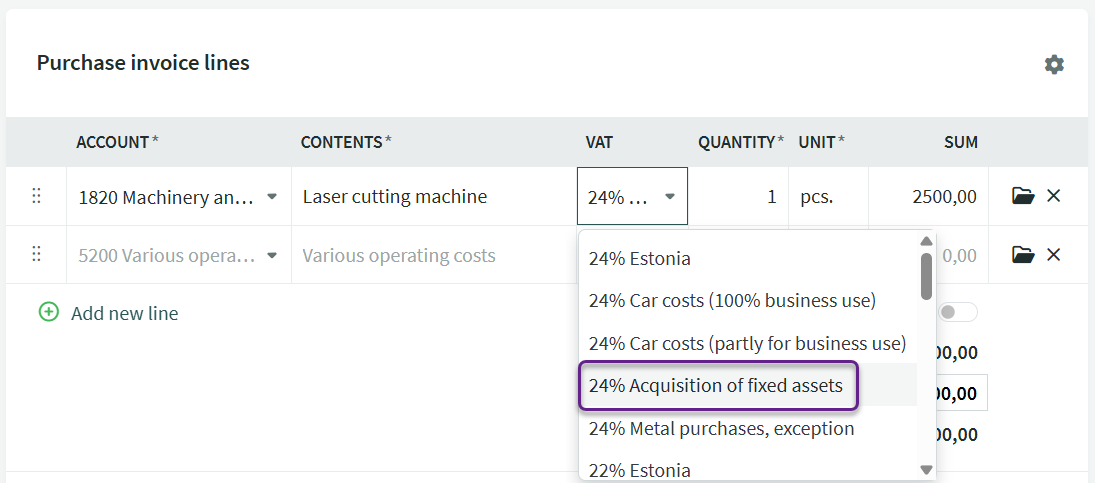

When purchasing fixed assets, the VAT type 24% Acquisition of Fixed Asset must be used.

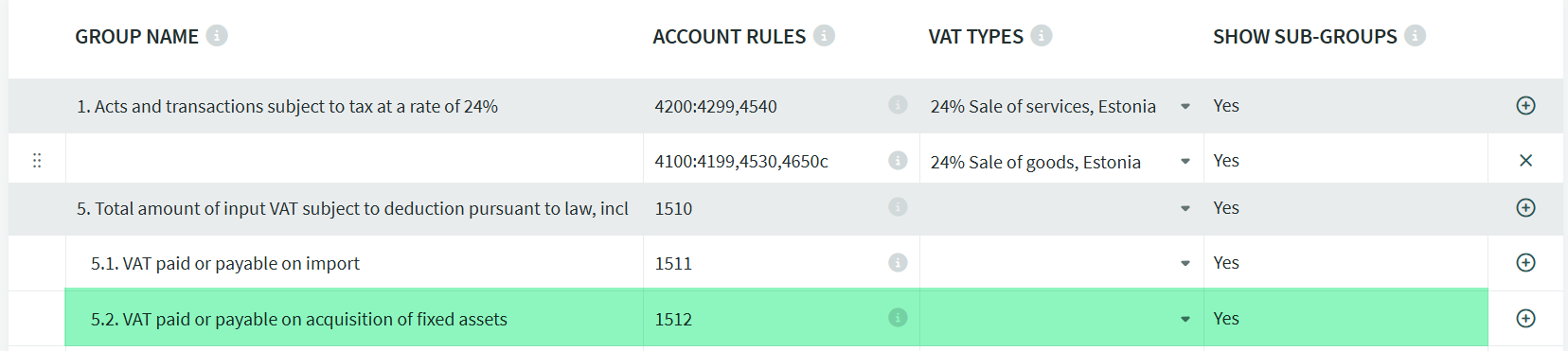

In the VAT report, line 5.2 shows the input VAT on fixed assets acquired for business purposes included in the amount on line 5.

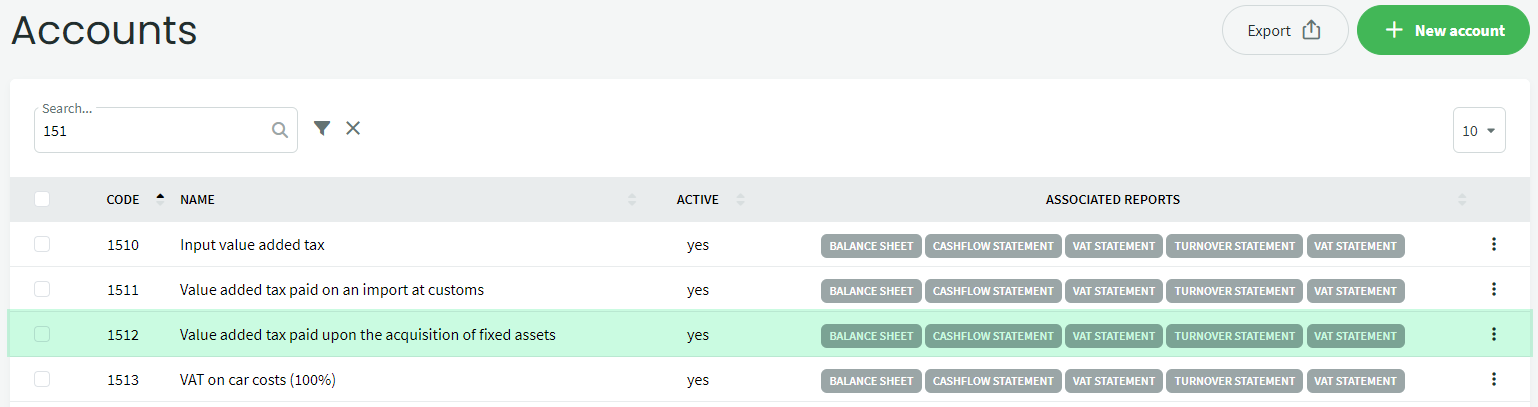

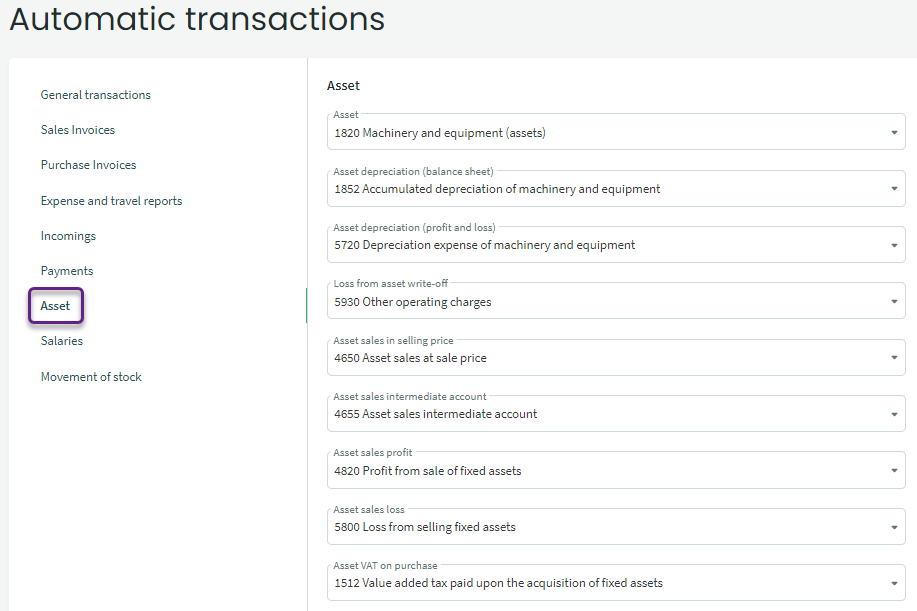

If the company’s environment was created before 2022, we recommend checking:

Leave A Comment?