The VAT declaration and Appendices INF A and INF B can be sent directly from the SimplBooks software to e-MTA when the interface is activated.

The declaration can still be submitted from the file, clicking on the “cloud center” icon will open the file download window. Read more here.

Before sending the declaration to e-MTA, check the accuracy of the data to avoid the need to make corrections.

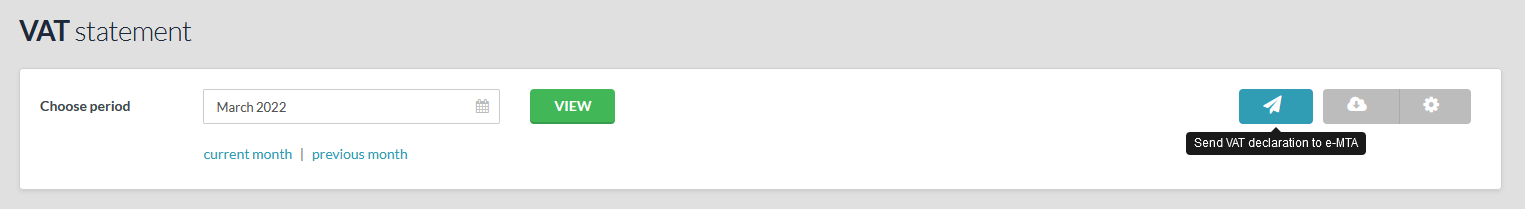

Click on the blue button “Send VAT declaration to e-MTA“.

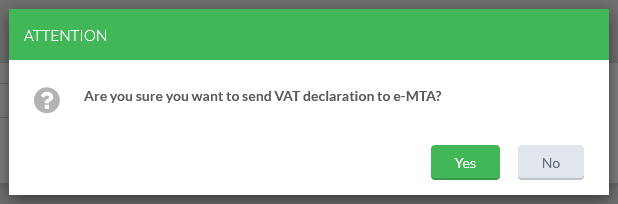

The confirmation window will appear to prevent the report from being sent accidentally. If you were not ready yet to send the report data, you can still stop it here or confirm that you want to send the data to the e-MTA.

If the declaration has been sent successfully, a confirmation will be displayed on the green background above the report: VAT declaration successfully sent.

Tip If the interface settings specify that the declaration is sent in an unverified form, you must log in to the e-MTA now and confirm the declaration.If sending in verified form is selected in the interface settings, there is nothing more you have to do with the data.

If the user has not previously sent data to the e-MTA via the interface, then for the first time the user needs to identify himself/herself with an ID card or mobile ID.

The Intra-Community Supply (VD) cannot be sent directly to the e-MTA, it must be submitted from a file.

If you have additional questions, write to us at support@simplbooks.ee

Leave A Comment?