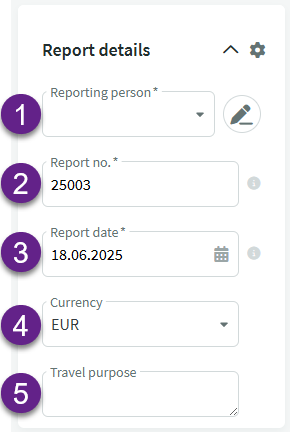

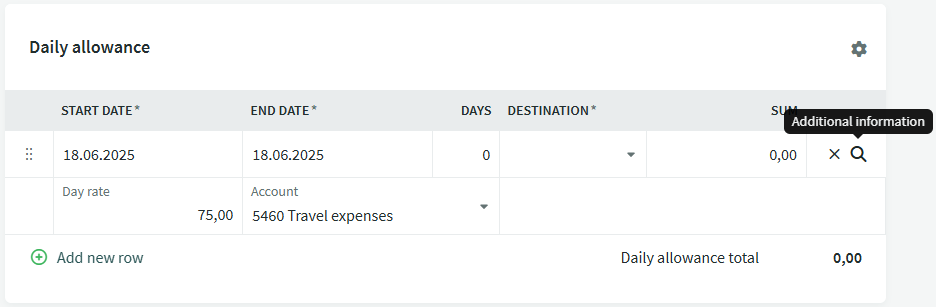

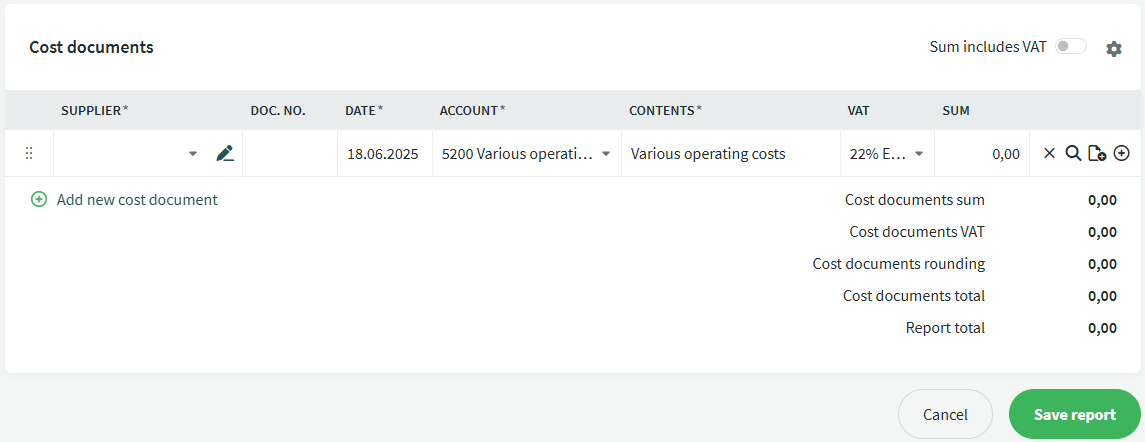

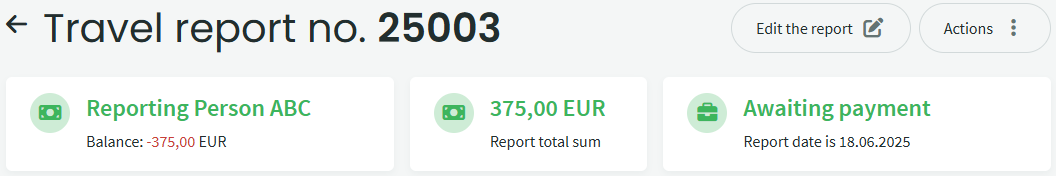

The travel report is used to record expenses paid by the employee during a business trip, such as accommodation, transport and other necessary costs, as well as the calculation of daily allowances (for foreign business trips).

A business trip means work performed outside the area specified in the employment contract, usually defined at the level of a city or municipality.

The rules on reimbursement of can be found on the official Riigi Teataja (State Gazette) website.

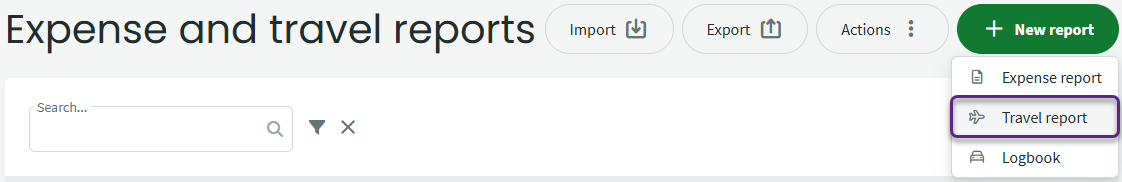

You can access the travel report from the Operations menu, under Expense and travel reports.

Operations -> Expense and travel reports -> New report -> Travel report

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?