Travel report is intended to reflect the necessary expenses incurred by the employee during the visit (accommodation, transport, etc.) and the calculation of the daily allowance (business trip abroad). A business trip is considered to be working outside the area specified in the employment contract, it is usually determined by the city or rural municipality.

Travel reports are in the Operations menu under Expense and Travel Reports.

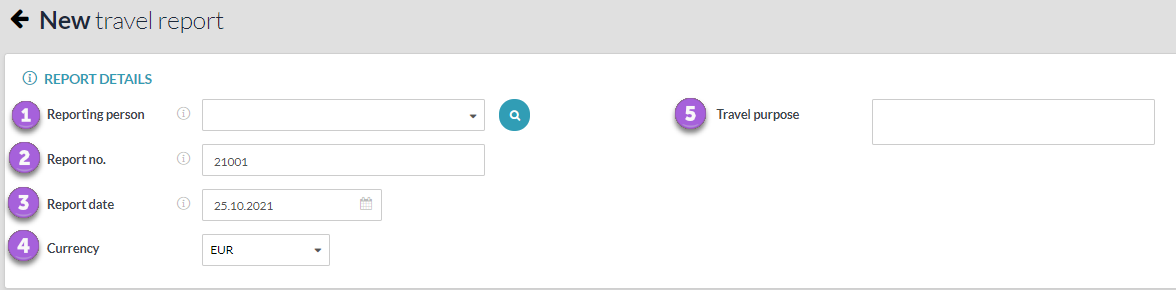

- Reporting person – person, who went on a business trip

- Report no. – the number is added automatically according to the number formula specified in the settings

- Report date – the date on which the travel expenses are entered in the accounts

- Currency – if expenses have been incurred in a currency other than the euro during the trip, these expense documents can be entered without recalculation. If daily allowance is required for the same travel, it must be entered as a separate report.

- Travel purpose – enter the purpose of the trip (meeting with the client, etc.)

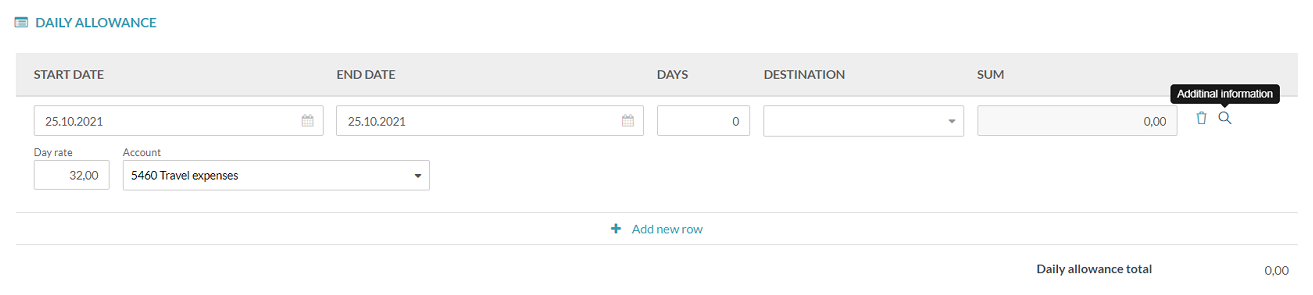

Here you must select the start and end dates of the travel and the destination with country accuracy (selectable from the drop-down menu). The amount of the daily allowance is calculated according to the number of days and the daily allowance rate. The default daily allowance rate is configurable in Settings -> Environment Settings -> Expense and Travel Reports. If necessary, you can also change the daily allowance rate on the report line. To do so, click on the magnifying glass icon (additional information) at the end of the line and overwrite the daily allowance rate.

If several daily subsistence rates have been used during one travel, they must be added to different lines (e.g. 50 €/ per day for the first 15 days and 32 €/ per day for the next 3 days).

Documents of expenses incurred by the business traveller can be attached here. Expense documents made from the company’s funds (bank card, transfer) are not reflected here. The cost documents are entered in the same way as in the cost statement. Read more about this in the guide ‘Expense reports (reporting person)’

The amounts for both the total cost documents and the total amount of the report are shown below.

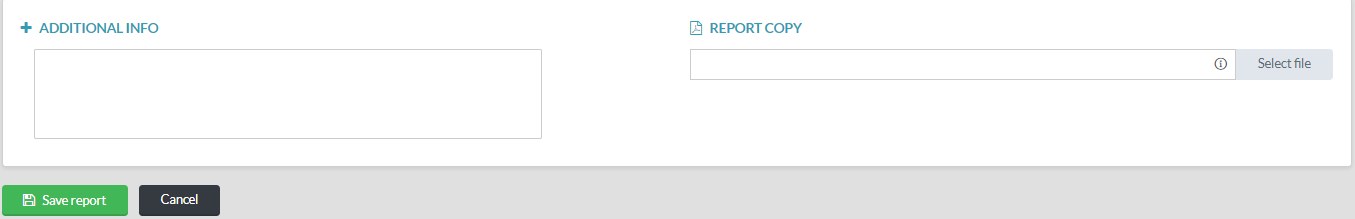

In the Additional information field, you can enter additional information, such as a reference to travel expenses that have been paid separately (airline tickets, ferry tickets, accommodation). The copy field of the report is normally left blank, and the system prepares a report in PDF format, which can be saved with the expense documents or printed out if desired.

If all the data is correct, save the report.

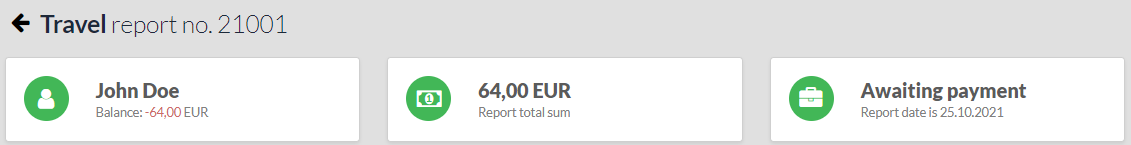

After saving your report, you’ll see the balance associated with the reporting person, the amount of this report, and the status of your report (pending or paid) in the header. If the same person has not been paid for the expense report and / or logbook, you will see the total amount due in the balance.

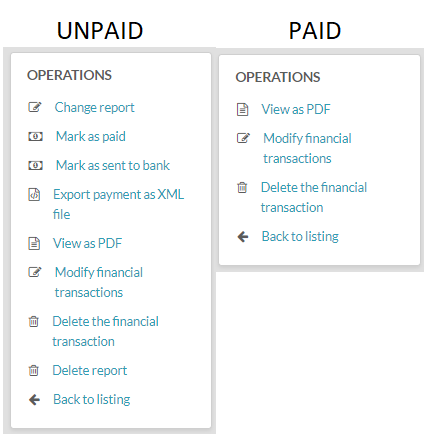

Operations menu options depend on whether the report is pending or in a paid status. To make a payment to the reporting person, you should create a payment file or send the payment directly to the bank (if the Swedbank or LHV banking interface is activated).

Where necessary, an advance payment can also be made to the reporting person. In this case, it must be saved under Operations -> Payments in the name of the reporting person and after entering the report, linking the report to the payment occurs.

If you have additional questions, feel free to contact us support@simplbooks.ee

Leave A Comment?