What to do if you have made an advance payment to the supplier, but it is partially or fully returned? Currently, there is no “one-click” solution for this, but here are some recommendations on how to proceed.

- When you make an advance payment to the supplier, record it under payments (Operations -> Payments). It doesn’t matter whether you add it manually or save it via bank import.

- The refund received from the supplier should also be added under payments. However, it cannot be saved through bank import; you need to add it manually. Select the supplier, the correct bank account (if you have multiple), the refund date, and enter the received amount with a minus sign.

Now you have positive and negative payments that need to be cleared from the ledger.

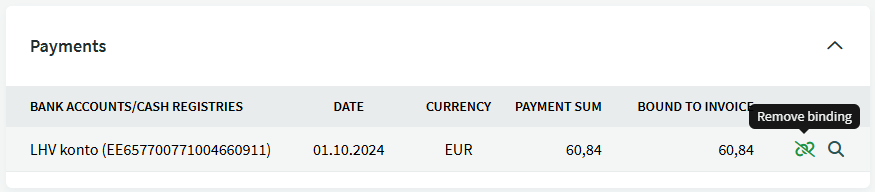

- If you’ve received an invoice from the supplier within the same financial year, you can link both payments to the most recent invoice. If the invoice has already been paid, remove the payment from the invoice. You can do this in the “Payments” section within the invoice view.

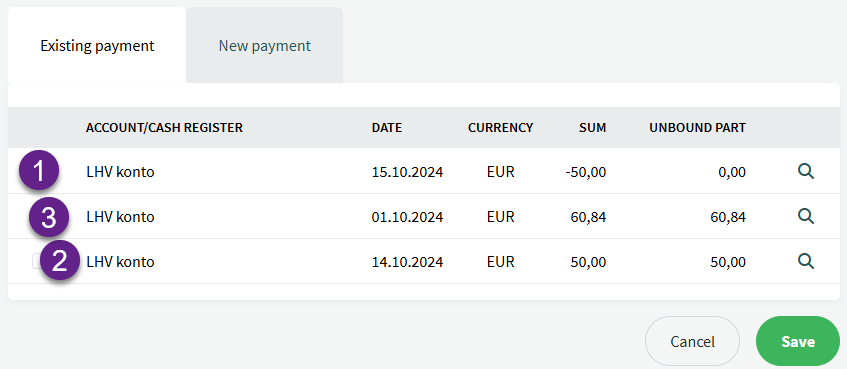

Once the original payment has been removed, you can re-add the payments by selecting Mark as paid from the Actions menu. This allows you to link the added negative (1) and positive (2) payments, along with the correct payment (3), to the invoice.

- If you receive a partial refund, it likely means you received an invoice for a portion of the amount, and you can then link the refund to this invoice. It’s important to remember to link the refund, i.e., the negative payment, first.

- If the supplier has not issued an invoice within the current year, we recommend creating a purchase invoice dated with the advance payment date and linking the payment to it. On the refund date, create a credit note for the added invoice and link the refund to the credit note.

If it’s not important for the cash flow to be traceable from the supplier card report (for a one-time purchase, not saving the supplier in the database), you can simply enter both the payment and the refund as financial transaction (manually in Accounting -> Transactions or during the bank import process).

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?