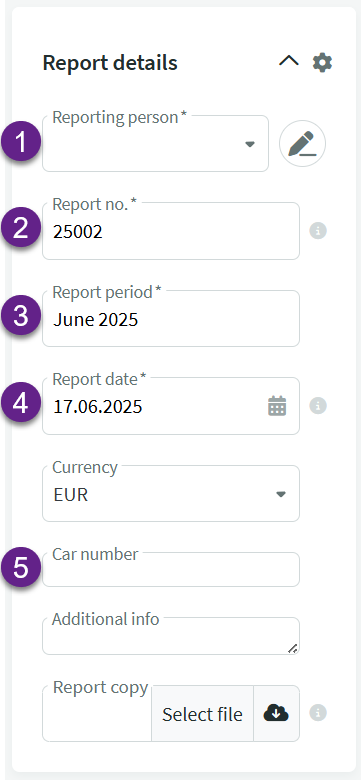

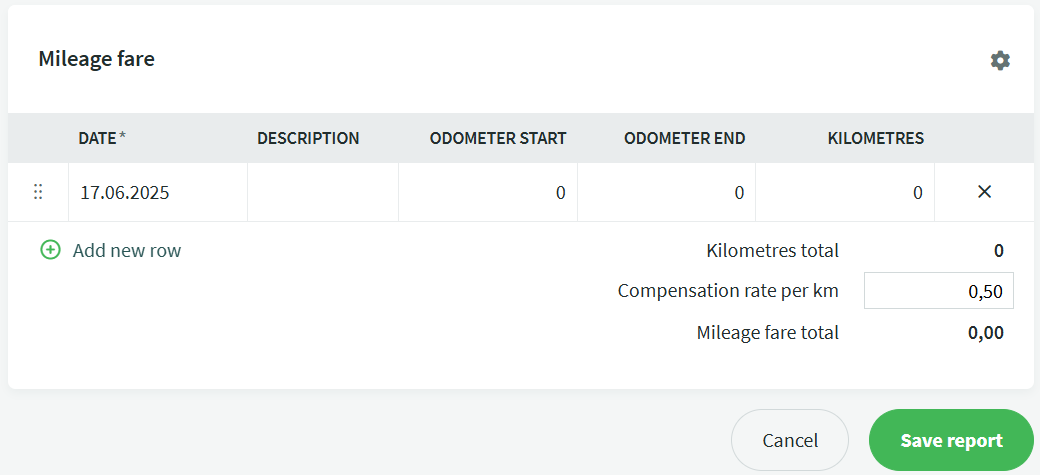

A logbook is required to record business trips made with a private car (categories M1 and M1G). Compensation can be paid for using a car that the employer does not own or possess. The car does not need to be owned by the user personally, but the right to use it must be proven, either documented on the vehicle registration certificate or provided in a power of attorney from the owner.

The text of the regulation can be found on the (in Estonian).

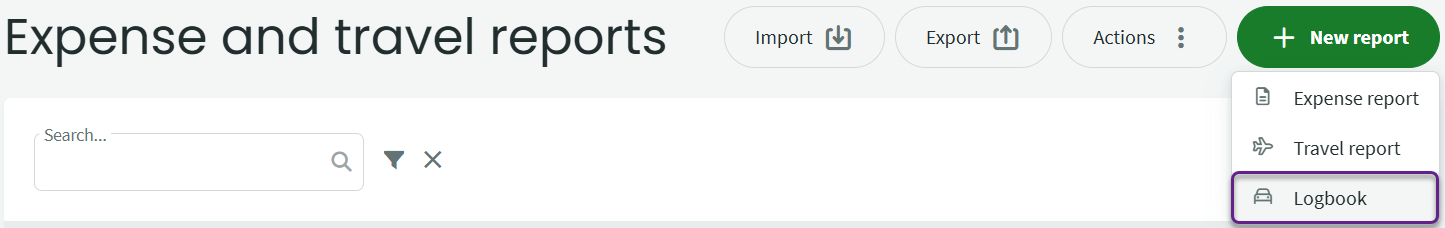

The logbook can be found under the Operations menu in the Expense and travel reports section.

Operations -> Expense and travel reports -> New report -> Logbook

Additionally, you can see all transactions related to the reporting person (such as payments and expense reports) by going to Partners -> Clients and suppliers, opening the reporting person’s card and selecting “View transaction statement” from the Actions menu. Choose the desired period and click “Generate”.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?